Page 21 - RosboroAR2020

P. 21

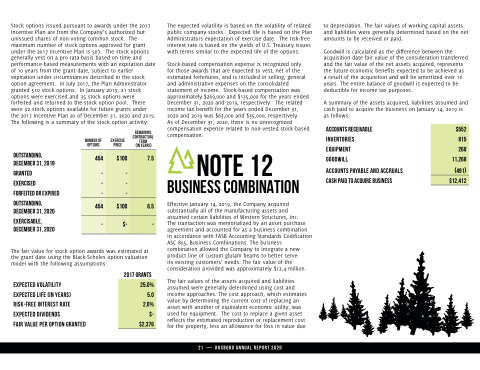

Stock options issued pursuant to awards under the 2017 Incentive Plan are from the Company’s authorized but unissued shares of non-voting common stock. The maximum number of stock options approved for grant under the 2017 Incentive Plan is 567. The stock options generally vest on a pro rata basis based on time and performance-based measurements with an expiration date of 10 years from the grant date, subject to earlier expiration under circumstances described in the stock option agreement. In July 2017, the Plan Administrator granted 510 stock options. In January 2019, 21 stock options were exercised and 35 stock options were forfeited and returned to the stock option pool. There were 92 stock options available for future grants under the 2017 Incentive Plan as of December 31, 2020 and 2019. The following is a summary of the stock option activity:

The expected volatility is based on the volatility of related public company stocks. Expected life is based on the Plan Administrators expectation of exercise date. The risk-free interest rate is based on the yields of U.S. Treasury issues with terms similar to the expected life of the options.

Stock-based compensation expense is recognized only for those awards that are expected to vest, net of the estimated forfeitures, and is included in selling, general and administrative expenses on the consolidated statement of income. Stock-based compensation was approximately $269,000 and $135,000 for the years ended December 31, 2020 and 2019, respectively. The related income tax bene t for the years ended December 31, 2020 and 2019 was $63,000 and $35,000, respectively.

As of December 31, 2020, there is no unrecognized compensation expense related to non-vested stock-based compensation.

NOTE 12 BUSINESS COMBINATION

Effective January 14, 2019, the Company acquired substantially all of the manufacturing assets and

assumed certain liabilities of Western Structures, Inc.

The transaction was memorialized by an asset purchase agreement and accounted for as a business combination in accordance with FASB Accounting Standards Codi cation ASC 805, Business Combinations. The business combination allowed the Company to integrate a new product line of custom glulam beams to better serve

its existing customers’ needs. The fair value of the consideration provided was approximately $12.4 million.

The fair values of the assets acquired and liabilities assumed were generally determined using cost and income approaches. The cost approach, which estimates value by determining the current cost of replacing an asset with another of equivalent economic utility, was used for equipment. The cost to replace a given asset re ects the estimated reproduction or replacement cost for the property, less an allowance for loss in value due

to depreciation. The fair values of working capital assets and liabilities were generally determined based on the net amounts to be received or paid.

Goodwill is calculated as the difference between the acquisition date fair value of the consideration transferred and the fair value of the net assets acquired, represents the future economic bene ts expected to be achieved as a result of the acquisition and will be amortized over 10 years. The entire balance of goodwill is expected to be deductible for income tax purposes.

A summary of the assets acquired, liabilities assumed and cash paid to acquire the business on January 14, 2019 is as follows:

Accounts Receivable Inventories Equipment Goodwill

Accounts payable and accruals Cash paid to acquire business

$552

815

268

11,268

(491)

$12,412

NUMBER OF OPTIONS

EXERCISE PRICE

REMAINING CONTRACTUAL TERM

(IN YEARS)

454

$100

7.5

-

-

-

-

-

-

454

$100

6.5

-

$-

-

Outstanding, December 31, 2019

Granted

Exercised

Forfeited or expired

Outstanding, December 31, 2020

Exercisable, December 31, 2020

The fair value for stock option awards was estimated at the grant date using the Black-Scholes option valuation model with the following assumptions:

2017 Grants

25.0%

5.0

2.0%

$-

$2,376

Expected volatility

Expected life (in years) Risk-free interest rate Expected dividends

Fair value per option granted

21 — ROSBORO ANNUAL REPORT 2020