Page 10 - RosboroAR2018

P. 10

A Job Package Program, giving our wholesale distributors a means to e ciently secure large multi-family and commercial bid work by providing cut-to-length orders directly from the mill

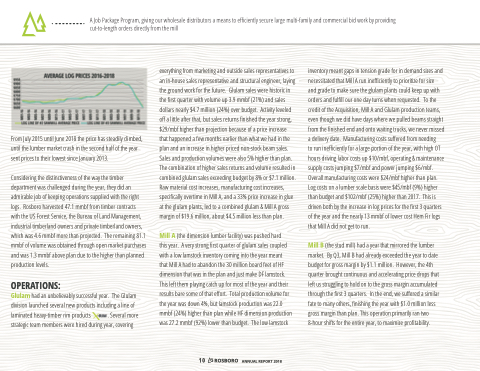

From July 2015 until June 2018 the price has steadily climbed, until the lumber market crash in the second half of the year sent prices to their lowest since January 2013.

Considering the distinctiveness of the way the timber department was challenged during the year, they did an admirable job of keeping operations supplied with the right logs. Rosboro harvested 47.1 mmbf from timber contracts with the US Forest Service, the Bureau of Land Management, industrial timberland owners and private timberland owners, which was 4.6 mmbf more than projected. The remaining 81.1 mmbf of volume was obtained through open market purchases and was 1.3 mmbf above plan due to the higher than planned production levels.

OPERATIONS:

Glulam had an unbelievably successful year. The Glulam division launched several new products including a line of laminated heavy-timber rim products . Several more strategic team members were hired during year, covering

everything from marketing and outside sales representatives to an in-house sales representative and structural engineer, laying the ground work for the future. Glulam sales were historic in the rst quarter with volume up 3.9 mmbf (21%) and sales dollars nearly $4.7 million (24%) over budget. Activity leveled o a little after that, but sales returns nished the year strong, $29/mbf higher than projection because of a price increase that happened a few months earlier than what we had in the plan and an increase in higher priced non-stock beam sales. Sales and production volumes were also 5% higher than plan. The combination of higher sales returns and volume resulted in combined glulam sales exceeding budget by 8% or $7.1 million. Raw material cost increases, manufacturing cost increases, speci cally overtime in Mill A, and a 33% price increase in glue at the glulam plants, led to a combined glulam & Mill A gross margin of $19.6 million, about $4.5 million less than plan.

Mill A (the dimension lumber facility) was pushed hard

this year. A very strong rst quarter of glulam sales coupled with a low lamstock inventory coming into the year meant that Mill A had to abandon the 30 million board feet of HF dimension that was in the plan and just make DF lamstock. This left them playing catch up for most of the year and their results bare some of that e ort. Total production volume for the year was down 4%, but lamstock production was 22.0 mmbf (24%) higher than plan while HF dimension production was 27.2 mmbf (92%) lower than budget. The low lamstock

inventory meant gaps in tension grade for in demand sizes and necessitated that Mill A run ine ciently to prioritize for size

and grade to make sure the glulam plants could keep up with orders and ful ll our one day turns when requested. To the credit of the Acquisition, Mill A and Glulam production teams, even though we did have days where we pulled beams straight from the nished end and onto waiting trucks, we never missed a delivery date. Manufacturing costs su ered from needing

to run ine ciently for a large portion of the year, with high OT hours driving labor costs up $10/mbf, operating & maintenance supply costs jumping $7/mbf and power jumping $6/mbf. Overall manufacturing costs were $24/mbf higher than plan. Log costs on a lumber scale basis were $45/mbf (9%) higher than budget and $102/mbf (25%) higher than 2017. This is driven both by the increase in log prices for the rst 3 quarters of the year and the nearly 13 mmbf of lower cost Hem Fir logs that Mill A did not get to run.

Mill B (the stud mill) had a year that mirrored the lumber market. By Q3, Mill B had already exceeded the year to date budget for gross margin by $1.1 million. However, the 4th quarter brought continuous and accelerating price drops that left us struggling to hold on to the gross margin accumulated through the rst 3 quarters. In the end, we su ered a similar fate to many others, nishing the year with $1.0 million less gross margin than plan. This operation primarily ran two 8-hour shifts for the entire year, to maximize pro tability.

10 ANNUAL REPORT 2018