Page 9 - RosboroAR2018

P. 9

Rosboro Laminated Timber (RLT), a glulam substitute for traditional solid-sawn timbers that solves the problems of excessive warping, twisting, and checking

Despite the challenges posed by the lumber markets during the last two quarters, the company was able to increase market share across its glulam product lines in 2018 leading to an increase in net sales of 25% year over year.

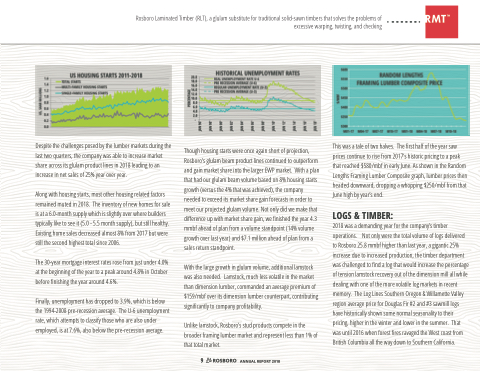

Along with housing starts, most other housing related factors remained muted in 2018. The inventory of new homes for sale is at a 6.0-month supply which is slightly over where builders typically like to see it (5.0 - 5.5 month supply), but still healthy. Existing home sales decreased almost 8% from 2017 but were still the second highest total since 2006.

The 30-year mortgage interest rates rose from just under 4.0% at the beginning of the year to a peak around 4.8% in October before nishing the year around 4.6%.

Finally, unemployment has dropped to 3.9%, which is below the 1994-2008 pre-recession average. The U-6 unemployment rate, which attempts to classify those who are also under employed, is at 7.6%, also below the pre-recession average.

Though housing starts were once again short of projection, Rosboro’s glulam beam product lines continued to outperform and gain market share into the larger EWP market. With a plan that had our glulam beam volume based on 8% housing starts growth (versus the 4% that was achieved), the company needed to exceed its market share gain forecasts in order to meet our projected glulam volume. Not only did we make that di erence up with market share gain, we nished the year 4.3 mmbf ahead of plan from a volume standpoint (14% volume growth over last year) and $7.1 million ahead of plan from a sales return standpoint.

With the large growth in glulam volume, additional lamstock was also needed. Lamstock, much less volatile in the market than dimension lumber, commanded an average premium of $159/mbf over its dimension lumber counterpart, contributing signi cantly to company pro tability.

Unlike lamstock, Rosboro’s stud products compete in the broader framing lumber market and represent less than 1% of that total market.

This was a tale of two halves. The rst half of the year saw prices continue to rise from 2017’s historic pricing to a peak that reached $580/mbf in early June. As shown in the Random Lengths Framing Lumber Composite graph, lumber prices then headed downward, dropping a whopping $250/mbf from that June high by year’s end.

LOGS & TIMBER:

2018 was a demanding year for the company’s timber operations. Not only were the total volume of logs delivered to Rosboro 25.8 mmbf higher than last year, a gigantic 25% increase due to increased production, the timber department was challenged to nd a log that would increase the percentage of tension lamstock recovery out of the dimension mill all while dealing with one of the more volatile log markets in recent memory. The Log Lines Southern Oregon & Willamette Valley region average price for Douglas Fir #2 and #3 sawmill logs have historically shown some normal seasonality to their pricing, higher in the winter and lower in the summer. That was until 2016 when forest res ravaged the West coast from British Columbia all the way down to Southern California.

9 ANNUAL REPORT 2018