Page 19 - RosboroAR2018

P. 19

X-Beam is Rosboro’s agship glulam product. As the industry’s only full-framing-width stock glulam in architectural appearance, it gives our distributors a unique competitive edge.

nancial statement and tax basis of assets and liabilities at the applicable enacted tax rates. A valuation allowance is provided when it is more likely than not that some portion or all of the deferred tax assets will not be realized.

The Company has adopted authoritative guidance that clari es the accounting for uncertain income tax positions by prescribing a minimum probability threshold that a tax position must

meet before a nancial statement bene t is recognized. The minimum threshold is de ned by the guidance as a tax position that is more likely than not to be sustained upon examination by the applicable taxing authority, including resolution of any related appeals or litigation processes, based on the technical merits of the position. The tax bene t to be recognized is measured as the largest amount of bene t that is greater than 50% likely of being realized upon ultimate settlement. The Company has evaluated its tax positions, and no signi cant uncertain amounts have been recorded for income taxes in the accompanying consolidated nancial statements.

FAIR VALUE OF FINANCIAL INSTRUMENTS - The carrying amounts of cash and

cash equivalents, accounts receivable, accounts payable, notes payable, and long-term debt approximated fair value as of December 31, 2018 and 2017. Fair values of the Company’s nancial instruments are generally considered to approximate their carrying amounts either because the expected collection or payment period is relatively short or because the terms are similar to market terms.

The Company has adopted Financial Accounting Standards Board (“FASB”) authoritative guidance that de nes fair value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements. This guidance

is currently incorporated in FASB Accounting Standards Codi cation Section 820 (“ASC 820”).

ASC 820 de nes fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC 820 also establishes a fair value hierarchy which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The guidance describes three levels of inputs that may be used to measure fair value:

Level 1 - Quoted prices in active markets for identical assets or liabilities.

Level 2 - Observable inputs other than Level 1 prices, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3 - Unobservable inputs that are supported by little or no market activity and that are signi cant to the fair value of the assets or liabilities.

The fair values of the Company’s nancial instruments have generally been determined to fall within Level 2 of the valuation hierarchy.

SUBSEQUENT EVENTS - Subsequent events are events or transactions that occur after the balance sheet date but before nancial statements are available to be issued. The Company recognizes in the consolidated nancial statements the e ects of all subsequent events that provide

additional evidence about conditions that existed at the date of the balance sheet, including the estimates inherent in the process of preparing the consolidated nancial statements. The Company’s consolidated nancial statements do not recognize subsequent events that provide evidence about conditions that did not exist at the date of the balance sheet but arose after the balance sheet date and before the consolidated nancial statements are available to be issued.

The Company has evaluated subsequent events through ____________, 2019 which is the date the consolidated nancial statements were available to be issued. See Note 12 for disclosure of a subsequent business combination that was completed in January 2019.

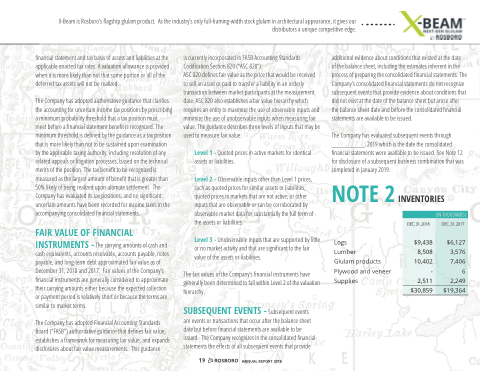

NOTE 2

Logs

Lumber

Glulam products Plywood and veneer Supplies

INVENTORIES

(IN THOUSANDS)

DEC. 31, 2018

$9,438 8,508 10,402 - 2,511

DEC. 31, 2017

$6,127 3,576 7,406

6 2,249

$30,859

$19,364

19 ANNUAL REPORT 2018