Page 20 - RosboroAR2018

P. 20

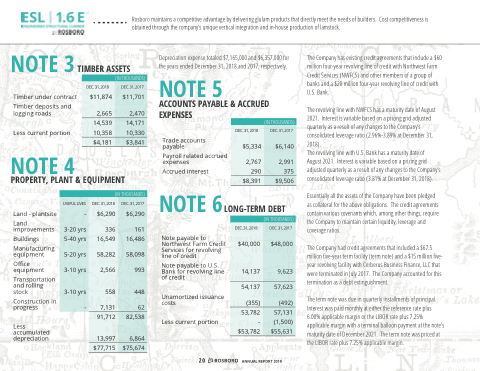

Rosboro maintains a competitive advantage by delivering glulam products that directly meet the needs of builders. Cost competitiveness is obtained through the company’s unique vertical integration and in-house production of lamstock.

NOTE 3

Timber under contract

Timber deposits and logging roads

Less current portion

NOTE 4

PROPERTY, PLANT & EQUIPMENT

Depreciation expense totaled $7,165,000 and $6,357,000 for the years ended December 31, 2018 and 2017, respectively.

NOTE 5

ACCOUNTS PAYABLE & ACCRUED EXPENSES

Trade accounts payable

Payroll related accrued expenses

The Company has existing credit agreements that include a $60 million four-year revolving line of credit with Northwest Farm Credit Services (NWFCS) and other members of a group of banks and a $20 million four-year revolving line of credit with U.S. Bank.

The revolving line with NWFCS has a maturity date of August 2021. Interest is variable based on a pricing grid adjusted quarterly as a result of any changes to the Company’s consolidated leverage ratio (2.96%-3.89% at December 31, 2018).

The revolving line with U.S. Bank has a maturity date of August 2021. Interest is variable based on a pricing grid adjusted quarterly as a result of any changes to the Company’s consolidated leverage ratio (3.81% at December 31, 2018).

Essentially all the assets of the Company have been pledged as collateral for the above obligations. The credit agreements contain various covenants which, among other things, require the Company to maintain certain liquidity, leverage and coverage ratios.

The Company had credit agreements that included a $67.5 million ve-year term facility (term note) and a $15 million ve- year revolving facility with Cerberus Business Finance, LLC that were terminated in July 2017. The Company accounted for this termination as a debt extinguishment.

The term note was due in quarterly installments of principal. Interest was paid monthly at either the reference rate plus 6.00% applicable margin or the LIBOR rate plus 7.25% applicable margin with a terminal balloon payment at the note’s maturity date of December 2021. The term note was priced at the LIBOR rate plus 7.25% applicable margin.

TIMBER ASSETS

(IN THOUSANDS)

DEC. 31, 2018

$11,874 2,665

DEC. 31, 2017

$11,701 2,470

14,539 10,358

14,171 10,330

$4,181

$3,841

(IN THOUSANDS)

DEC. 31, 2018

$5,334

2,767 290

DEC. 31, 2017

$6,140

2,991 375

$8,391

$9,506

(IN THOUSANDS)

Land - plantsite

Land improvements

Buildings

Manufacturing equipment

O ce equipment

Transportation and rolling stock

Construction in progress

Less accumulated depreciation

NOTE 6

LONG-TERM DEBT

USEFUL LIVES

-

3-20 yrs 5-40 yrs

5-20 yrs 3-10 yrs

3-10 yrs -

DEC. 31, 2018

$6,290

336 16,549

58,282 2,566

558 7,131

DEC. 31, 2017

$6,290

161 16,486

58,098 993

448 62

Accrued interest

(IN THOUSANDS)

DEC. 31, 2018

$40,000 14,137

DEC. 31, 2017

$48,000 9,623

54,137 (355)

57,623 (492)

53,782 - $53,782

57,131

(1,500) $55,631

Note payable to Northwest Farm Credit Services for revolving line of credit

Note payable to U.S. Bank for revolving line of credit

Unamortized issuance costs

Less current portion

91,712 13,997

82,538 6,864

$77,715

$75,674

20

ANNUAL REPORT 2018