Page 23 - RosboroAR2018

P. 23

Rosboro maximizes value at each step of the conversion process through vertical integration of core operations – from the log – to lumber and lamstock – through nished stock and custom glulam products.

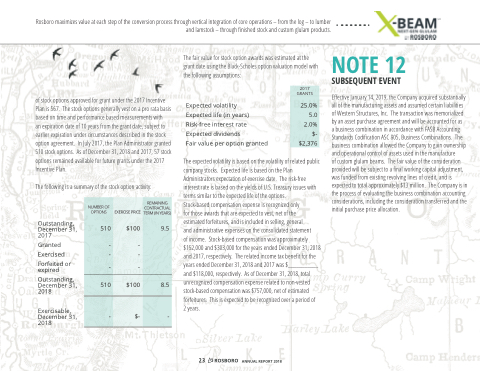

of stock options approved for grant under the 2017 Incentive Plan is 567. The stock options generally vest on a pro rata basis based on time and performance based measurements with

an expiration date of 10 years from the grant date, subject to earlier expiration under circumstances described in the stock option agreement. In July 2017, the Plan Administrator granted 510 stock options. As of December 31, 2018 and 2017, 57 stock options remained available for future grants under the 2017 Incentive Plan.

The following is a summary of the stock option activity:

Outstanding, December 31, 2017

Granted Exercised

Forfeited or expired

Outstanding, December 31, 2018

Exercisable, December 31, 2018

The fair value for stock option awards was estimated at the grant date using the Black-Scholes option valuation model with the following assumptions:

Expected volatility

Expected life (in years) Risk-free interest rate Expected dividends

Fair value per option granted

The expected volatility is based on the volatility of related public company stocks. Expected life is based on the Plan Administrators expectation of exercise date. The risk-free interest rate is based on the yields of U.S. Treasury issues with terms similar to the expected life of the options.

Stock-based compensation expense is recognized only

for those awards that are expected to vest, net of the

estimated forfeitures, and is included in selling, general

and administrative expenses on the consolidated statement

of income. Stock-based compensation was approximately $152,000 and $303,000 for the years ended December 31, 2018 and 2017, respectively. The related income tax bene t for the years ended December 31, 2018 and 2017 was $___________ and $118,000, respectively. As of December 31, 2018, total unrecognized compensation expense related to non-vested stock-based compensation was $757,000, net of estimated forfeitures. This is expected to be recognized over a period of

2 years.

NOTE 12

SUBSEQUENT EVENT

E ective January 14, 2019, the Company acquired substantially all of the manufacturing assets and assumed certain liabilities of Western Structures, Inc. The transaction was memorialized by an asset purchase agreement and will be accounted for as a business combination in accordance with FASB Accounting Standards Codi cation ASC 805, Business Combinations. The business combination allowed the Company to gain ownership and operational control of assets used in the manufacture

of custom glulam beams. The fair value of the consideration provided will be subject to a nal working capital adjustment, was funded from existing revolving lines of credit, and is expected to total approximately $13 million. The Company is in the process of evaluating the business combination accounting considerations, including the consideration transferred and the initial purchase price allocation.

2017 GRANTS

25.0% 5.0 2.0% $- $2,376

NUMBER OF OPTIONS

510

- -

-

EXERCISE PRICE

$100

- -

-

REMAINING CONTRACTUAL TERM (IN YEARS)

9.5

510

$100

8.5

-

$-

-

23 ANNUAL REPORT 2018