Page 17 - RosboroAR2017

P. 17

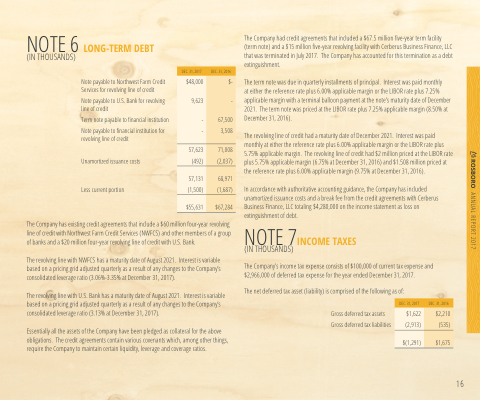

NOTE 6 LONG-TERM DEBT (IN THOUSANDS)

Note payable to Northwest Farm Credit Services for revolving line of credit

Note payable to U.S. Bank for revolving line of credit

Term note payable to nancial institution

Note payable to nancial institution for revolving line of credit

Unamortized issuance costs Less current portion

The Company has existing credit agreements that include a $60 million four-year revolving line of credit with Northwest Farm Credit Services (NWFCS) and other members of a group of banks and a $20 million four-year revolving line of credit with U.S. Bank.

The revolving line with NWFCS has a maturity date of August 2021. Interest is variable based on a pricing grid adjusted quarterly as a result of any changes to the Company’s consolidated leverage ratio (3.06%-3.35% at December 31, 2017).

The revolving line with U.S. Bank has a maturity date of August 2021. Interest is variable based on a pricing grid adjusted quarterly as a result of any changes to the Company’s consolidated leverage ratio (3.13% at December 31, 2017).

Essentially all the assets of the Company have been pledged as collateral for the above obligations. The credit agreements contain various covenants which, among other things, require the Company to maintain certain liquidity, leverage and coverage ratios.

The Company had credit agreements that included a $67.5 million ve-year term facility (term note) and a $15 million ve-year revolving facility with Cerberus Business Finance, LLC that was terminated in July 2017. The Company has accounted for this termination as a debt extinguishment.

The term note was due in quarterly installments of principal. Interest was paid monthly

at either the reference rate plus 6.00% applicable margin or the LIBOR rate plus 7.25% applicable margin with a terminal balloon payment at the note’s maturity date of December 2021. The term note was priced at the LIBOR rate plus 7.25% applicable margin (8.50% at December 31, 2016).

The revolving line of credit had a maturity date of December 2021. Interest was paid monthly at either the reference rate plus 6.00% applicable margin or the LIBOR rate plus 5.75% applicable margin. The revolving line of credit had $2 million priced at the LIBOR rate plus 5.75% applicable margin (6.75% at December 31, 2016) and $1.508 million priced at the reference rate plus 6.00% applicable margin (9.75% at December 31, 2016).

In accordance with authoritative accounting guidance, the Company has included unamortized issuance costs and a break fee from the credit agreements with Cerberus Business Finance, LLC totaling $4,280,000 on the income statement as loss on extinguishment of debt.

NOTE 7INCOME TAXES (IN THOUSANDS)

The Company’s income tax expense consists of $100,000 of current tax expense and $2,966,000 of deferred tax expense for the year ended December 31, 2017.

The net deferred tax asset (liability) is comprised of the following as of:

Gross deferred tax assets Gross deferred tax liabilities

DEC. 31, 2017

DEC. 31, 2016

$48,000

$-

9,623

-

-

67,500

-

3,508

57,623

71,008

(492)

(2,037)

57,131

68,971

(1,500)

(1,687)

$55,631

$67,284

DEC. 31, 2017

DEC. 31, 2016

$1,622

$2,210

(2,913)

(535)

$(1,291)

$1,675

16