Page 19 - RosboroAR2017

P. 19

The Company has 5,049 Series A Preferred Stock shares issued and outstanding at December 31, 2017 and 2016. Series A Preferred Stock shares shall accrue cumulatively

at the rate of 10% per annum, compounding quarterly. Such dividends shall accrue and accumulate whether or not they have been declared and whether or not there are pro ts, surplus or other funds of the Company legally available for the payment of dividends. Such dividends shall be payable when and as declared by the Board out of any assets or funds legally available therefor and upon the occurrence of a liquidation event or an extraordinary transaction. Accrued and undeclared dividends totaled approximately $5,623,000 at December 31, 2017.

E ective April 7, 2017, the amended and restated stockholders agreement included a provision to allow new stockholders to purchase shares from the existing stockholders in the same percentage of voting common stock and Series A Preferred Stock that the existing stockholders have. All new stockholders are entitled to the same rights and privileges of the existing stockholders in addition to speci c redemption rules in the case of a termination of employment.

NOTE 11 STOCK-BASED COMPENSATION

In connection with the amended and restated stockholders agreement, the Company adopted the Rosboro Holdings, Inc. 2017 Equity Incentive Plan (2017 Incentive Plan). The 2017 Incentive Plan provides for grants of stock options, stock appreciation rights, stock awards, restricted stock, stock units and other stock or cash-based awards. These awards are at the discretion of the board of directors (Plan Administrator) and they vest and expire in accordance with terms established at the time of grant.

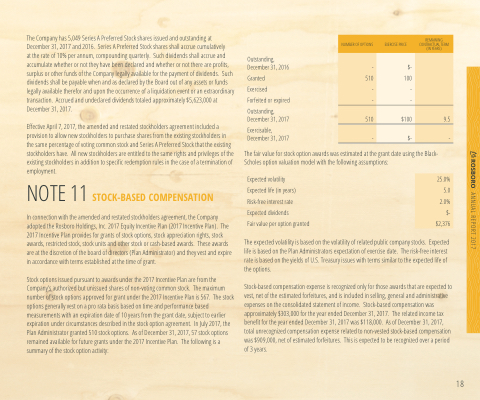

Stock options issued pursuant to awards under the 2017 Incentive Plan are from the Company’s authorized but unissued shares of non-voting common stock. The maximum number of stock options approved for grant under the 2017 Incentive Plan is 567. The stock options generally vest on a pro rata basis based on time and performance based measurements with an expiration date of 10 years from the grant date, subject to earlier expiration under circumstances described in the stock option agreement. In July 2017, the Plan Administrator granted 510 stock options. As of December 31, 2017, 57 stock options remained available for future grants under the 2017 Incentive Plan. The following is a summary of the stock option activity:

Outstanding, December 31, 2016

Granted

Exercised

Forfeited or expired

Outstanding, December 31, 2017

Exercisable, December 31, 2017

The fair value for stock option awards was estimated at the grant date using the Black- Scholes option valuation model with the following assumptions:

Expected volatility

Expected life (in years) Risk-free interest rate Expected dividends

Fair value per option granted

The expected volatility is based on the volatility of related public company stocks. Expected life is based on the Plan Administrators expectation of exercise date. The risk-free interest rate is based on the yields of U.S. Treasury issues with terms similar to the expected life of the options.

Stock-based compensation expense is recognized only for those awards that are expected to vest, net of the estimated forfeitures, and is included in selling, general and administrative expenses on the consolidated statement of income. Stock-based compensation was approximately $303,000 for the year ended December 31, 2017. The related income tax bene t for the year ended December 31, 2017 was $118,000. As of December 31, 2017, total unrecognized compensation expense related to non-vested stock-based compensation was $909,000, net of estimated forfeitures. This is expected to be recognized over a period of 3 years.

NUMBER OF OPTIONS

EXERCISE PRICE

REMAINING CONTRACTUAL TERM (IN YEARS)

-

$-

510

100

-

-

-

-

510

$100

9.5

-

$-

-

25.0%

5.0

2.0%

$-

$2,376

18