Page 8 - RosboroAR2017

P. 8

7

smaller diameter log is also favorable for us as we expect to lower our log costs on a log scale basis downward by $50/mbf.

Strategic capital improvements made in 2017 have all contributed to the success we realized this year and are paving the way for us to push ourselves further in the future.

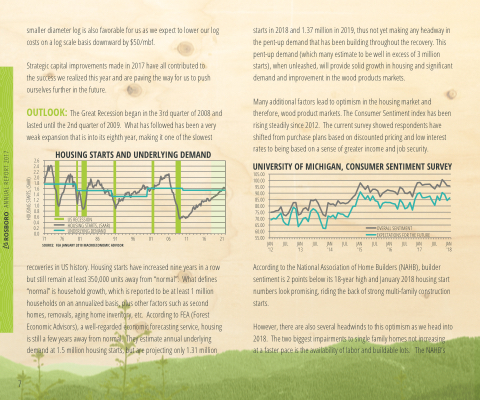

OUTLOOK: The Great Recession began in the 3rd quarter of 2008 and lasted until the 2nd quarter of 2009. What has followed has been a very weak expansion that is into its eighth year, making it one of the slowest

starts in 2018 and 1.37 million in 2019, thus not yet making any headway in the pent-up demand that has been building throughout the recovery. This pent-up demand (which many estimate to be well in excess of 3 million starts), when unleashed, will provide solid growth in housing and signi cant demand and improvement in the wood products markets.

Many additional factors lead to optimism in the housing market and therefore, wood product markets. The Consumer Sentiment index has been rising steadily since 2012. The current survey showed respondents have shifted from purchase plans based on discounted pricing and low interest rates to being based on a sense of greater income and job security.

recoveries in US history. Housing starts have increased nine years in a row but still remain at least 350,000 units away from “normal”. What de nes “normal” is household growth, which is reported to be at least 1 million households on an annualized basis, plus other factors such as second homes, removals, aging home inventory, etc. According to FEA (Forest Economic Advisors), a well-regarded economic forecasting service, housing is still a few years away from normal. They estimate annual underlying demand at 1.5 million housing starts, but are projecting only 1.31 million

According to the National Association of Home Builders (NAHB), builder sentiment is 2 points below its 18-year high and January 2018 housing start numbers look promising, riding the back of strong multi-family construction starts.

However, there are also several headwinds to this optimism as we head into 2018. The two biggest impairments to single family homes not increasing

at a faster pace is the availability of labor and buildable lots. The NAHB’s