Page 9 - RosboroAR2017

P. 9

latest survey of its members showed the second highest percentage of members reporting labor shortages in the last 20 years at 63%. This survey also had 63% of its respondents claim that buildable lot supply was either low or very low in 2017, consistent with what they thought in 2016 as well. According to the APA’s 2018-2022 Market Outlook, publically traded builders pretax pro t margins have likely decreased over the last few years because of rising labor costs, buildable lot costs and rising material costs. This could help explain why single-family construction has been slower to increase relative to what a number of analysts had expected.

Outside of the above mentioned constraints, a rising concern recently for the housing industry is the path of interest rates and what it means for a ordability. Interest rates have risen sharply in the rst month of 2018, and are approaching 4.5%. This trend will likely continue throughout the year. However, according to a late 2017 Red n commissioned survey, only 6% of homebuyers who plan to buy a home in the next 12 months said they would cancel their plans to buy if mortgage rates surpassed 5%.

The company plans to signi cantly increase its lumber production in 2018. Stud sales are expected to rise from 112 mmbf to 135 mmbf while dimension lumber production is planned to rise from 87 mmbf to 123 mmbf.

The Glulam side of the business is also expected to see a signi cant increase in sales and production volumes in 2018 with the innovative products of

, and all continuing to

gain acceptance as replacements for other EWP, in addition to the standard glulam product line. With housing starts projected to improve 7% over

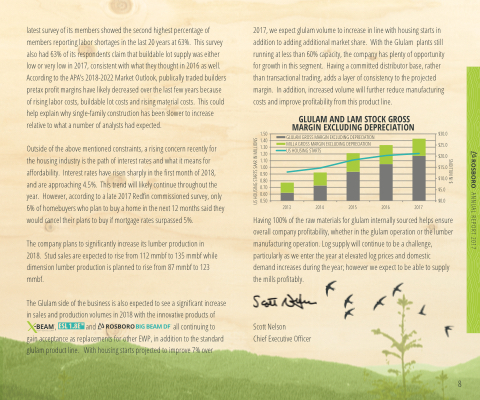

2017, we expect glulam volume to increase in line with housing starts in addition to adding additional market share. With the Glulam plants still running at less than 60% capacity, the company has plenty of opportunity for growth in this segment. Having a committed distributor base, rather than transactional trading, adds a layer of consistency to the projected margin. In addition, increased volume will further reduce manufacturing costs and improve pro tability from this product line.

Having 100% of the raw materials for glulam internally sourced helps ensure overall company pro tability, whether in the glulam operation or the lumber manufacturing operation. Log supply will continue to be a challenge, particularly as we enter the year at elevated log prices and domestic demand increases during the year; however we expect to be able to supply the mills pro tably.

Scott Nelson

Chief Executive O cer

8