Page 48 - Ruland Funeral Home

P. 48

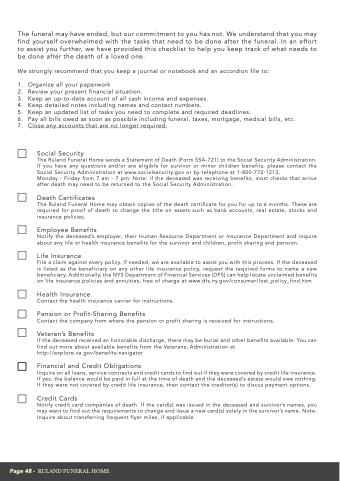

The funeral may have ended, but our commitment to you has not. We understand that you may find yourself overwhelmed with the tasks that need to be done after the funeral. In an effort to assist you further, we have provided this checklist to help you keep track of what needs to be done after the death of a loved one.

We strongly recommend that you keep a journal or notebook and an accordion file to:

1. Organize all your paperwork

2. Review your present financial situation.

3. Keep an up-to-date account of all cash income and expenses.

4. Keep detailed notes including names and contact numbers.

5. Keep an updated list of tasks you need to complete and required deadlines.

6. Pay all bills owed as soon as possible including funeral, taxes, mortgage, medical bills, etc. 7. Close any accounts that are no longer required.

Social Security

The Ruland Funeral Home sends a Statement of Death (Form SSA-721) to the Social Security Administration. If you have any questions and/or are eligible for survivor or minor children benefits, please contact the Social Security Administration at www.socialsecurity.gov or by telephone at 1-800-772-1213,

Monday - Friday from 7 am - 7 pm. Note: if the deceased was receiving benefits, most checks that arrive after death may need to be returned to the Social Security Administration.

Death Certificates

The Ruland Funeral Home may obtain copies of the death certificate for you for up to 6 months. These are required for proof of death to change the title on assets such as bank accounts, real estate, stocks and insurance policies.

Employee Benefits

Notify the deceased’s employer, their Human Resource Department or Insurance Department and inquire about any life or health insurance benefits for the survivor and children, profit sharing and pension.

Life Insurance

File a claim against every policy. If needed, we are available to assist you with this process. If the deceased is listed as the beneficiary on any other life insurance policy, request the required forms to name a new beneficiary. Additionally, the NYS Department of Financial Services (DFS) can help locate unclaimed benefits on life insurance policies and annuities, free of charge at www.dfs.ny.gov/consumer/lost_policy_find.htm

Health Insurance

Contact the health insurance carrier for instructions.

Pension or Profit-Sharing Benefits

Contact the company from where the pension or profit sharing is received for instructions.

Veteran’s Benefits

If the deceased received an honorable discharge, there may be burial and other benefits available. You can find out more about available benefits from the Veterans; Administration at http://explore.va.gov/benefits-navigator

Financial and Credit Obligations

Inquire on all loans, service contracts and credit cards to find out if they were covered by credit life insurance. If yes, the balance would be paid in full at the time of death and the deceased’s estate would owe nothing. If they were not covered by credit life insurance, then contact the creditor(s) to discus payment options.

Credit Cards

Notify credit card companies of death. If the card(s) was issued in the deceased and survivor’s names, you may want to find out the requirements to change and issue a new card(s) solely in the survivor’s name. Note: Inquire about transferring frequent flyer miles, if applicable.

Page 48 - RULAND FUNERAL HOME