Page 49 - Ruland Funeral Home

P. 49

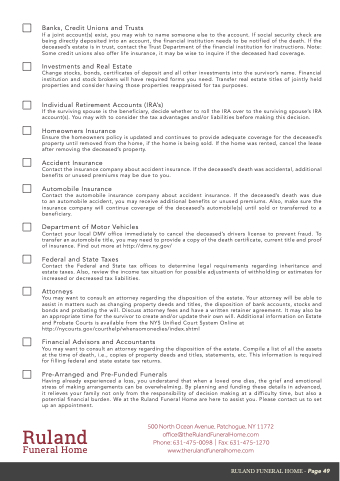

Banks, Credit Unions and Trusts

If a joint account(s) exist, you may wish to name someone else to the account. If social security check are being directly deposited into an account, the financial institution needs to be notified of the death. If the deceased’s estate is in trust, contact the Trust Department of the financial institution for instructions. Note: Some credit unions also offer life insurance, it may be wise to inquire if the deceased had coverage.

Investments and Real Estate

Change stocks, bonds, certificates of deposit and all other investments into the survivor’s name. Financial institution and stock brokers will have required forms you need. Transfer real estate titles of jointly held properties and consider having those properties reappraised for tax purposes.

Individual Retirement Accounts (IRA’s)

If the surviving spouse is the beneficiary, decide whether to roll the IRA over to the surviving spouse’s IRA account(s). You may with to consider the tax advantages and/or liabilities before making this decision.

Homeowners Insurance

Ensure the homeowners policy is updated and continues to provide adequate coverage for the deceased’s property until removed from the home, if the home is being sold. If the home was rented, cancel the lease after removing the deceased’s property.

Accident Insurance

Contact the insurance company about accident insurance. If the deceased’s death was accidental, additional benefits or unused premiums may be due to you.

Automobile Insurance

Contact the automobile insurance company about accident insurance. If the deceased’s death was due to an automobile accident, you may receive additional benefits or unused premiums. Also, make sure the insurance company will continue coverage of the deceased’s automobile(s) until sold or transferred to a beneficiary.

Department of Motor Vehicles

Contact your local DMV office immediately to cancel the deceased’s drivers license to prevent fraud. To transfer an automobile title, you may need to provide a copy of the death certificate, current title and proof of insurance. Find out more at http://dmv.ny.gov/

Federal and State Taxes

Contact the Federal and State tax offices to determine legal requirements regarding inheritance and estate taxes. Also, review the income tax situation for possible adjustments of withholding or estimates for increased or decreased tax liabilities.

Attorneys

You may want to consult an attorney regarding the disposition of the estate. Your attorney will be able to assist in matters such as changing property deeds and titles, the disposition of bank accounts, stocks and bonds and probating the will. Discuss attorney fees and have a written retainer agreement. It may also be an appropriate time for the survivor to create and/or update their own will. Additional information on Estate and Probate Courts is available from the NYS Unified Court System Online at http://nycourts.gov/courthelp/whensomonedies/index.shtml

Financial Advisors and Accountants

You may want to consult an attorney regarding the disposition of the estate. Compile a list of all the assets at the time of death, i.e., copies of property deeds and titles, statements, etc. This information is required for filling federal and state estate tax returns.

Pre-Arranged and Pre-Funded Funerals

Having already experienced a loss, you understand that when a loved one dies, the grief and emotional stress of making arrangements can be overwhelming. By planning and funding these details in advanced, it relieves your family not only from the responsibility of decision making at a difficulty time, but also a potential financial burden. We at the Ruland Funeral Home are here to assist you. Please contact us to set up an appointment.

Ruland Funeral Home

500 North Ocean Avenue, Patchogue, NY 11772 office@theRulandFuneralHome.com Phone: 631-475-0098 | Fax: 631-475-1270 www.therulandfuneralhome.com

RULAND FUNERAL HOME - Page 49