Page 37 - UK

P. 37

Administering an Estate You will need to provide the death certificate and identification confirming that you are the

Executor. There should also be a certificate of deposit for the Will, but if you cannot find it you

will need to write to the Principle Record Keeper in the first instance.

When someone passes away, there are certain steps that must be taken when dealing with the Applying for Probate

Estate they leave behind. The estate is everything that the deceased person has left behind. Depending on the type and value of assets in the Estate, you may need to obtain a Grant of

These possessions need to be distributed to those who are entitled to receive it. This might not Representation. This is often referred to as a Grant of Probate, and the type of grant that is issued

necessarily include bricks and mortar property; it can often just consist of bank accounts, personal to you will depend on your circumstances. So:

possessions, stocks and shares. However, whether or not a property is involved, it may take a If you are named executor in a Will – you will need a Grant of Probate

while to sort out who gets what, especially if there is no Will or a Will is contested. If you are the next-of-kin and there is no Will – you will need letters of administration

If you are the next person entitled in a Will where there is no valid appointment of an

What is Probate and When is it Needed? executor – you will need letters of administration (with Will).

Probate is the word that many people use to describe the formal authority provided by the court You may not need a grant of representation if the Estate is very small, but be prepared to

to facilitate the administration of the Estate. If a Will has been drawn up then the person may apply for one if a bank or other institution requests it.

have specified a particular individual or individuals, known as ‘executors’ to carry out that process. You can apply for a Grant of Probate or Letters of Administration by contacting the local

It is advisable to have more than one executor, especially if the Estate is particularly large or Probate Registry and completing Probate Application form PA1.

complex. Where there is no Will this situation known as Intestacy, Probate is normally granted to

the closest next-of-kin, who will be called the Administrators of the Estate. If you are an executor Contacting HMRC

under a will or administrator on intestacy, you may need to apply for probate. Once probate has As early as possible you will also need to contact HMRC to discuss any potential income tax

been granted, you will be able to proceed with administering the Estate, to ensure that close outstanding, or inheritance tax that may be due.

family members and friends achieve the closure they need, as soon as possible.

How Long Does Probate Take?

Who Can be an Executor? On average it takes between nine to twelve months to complete the distribution of the Estate

An executor is named in the will, and has usually been notified of their role beforehand. An through Probate, but if the Estate is complicated or there are any legal challenges brought by

executor does not have to be a solicitor or legal representative - but can rather be a family family members or dependants then it could take much longer. If you are concerned that there

member or trusted friend. If no executor is named in the will or the deceased has not left a will at may be issues then it is important to bring in the services of a solicitor or professional expert who

all, then probate will usually be granted to one of the beneficiaries in the will, or the next-of-kin specialises in Probate law.

on intestacy.

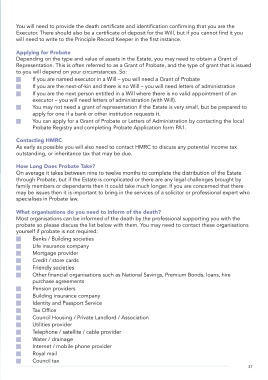

What organisations do you need to inform of the death?

What Does an Executor Do? Most organisations can be informed of the death by the professional supporting you with the

The Court will issue a document called a Grant of Representation to the Executor or probate so please discuss the list below with them. You may need to contact these organisations

administrator, as part of the probate process. Those individuals will be responsible for matters yourself if probate is not required:

such as cashing bank accounts, transferring or selling property or shares, paying inheritance tax Banks / Building societies

that may be due on the Estate, paying any outstanding debts (such as utilities bills, credit card

payments etc) and distributing the Estate according to the will or the laws governing intestacy. Life insurance company

Mortgage provider

What if You Can’t Find a Will? Credit / store cards

It is estimated that only about a third of people in the UK have made a Will. So there is more than Friendly societies

a 60% chance that the deceased will have died intestate. However, it is important that you double Other financial organisations such as National Savings, Premium Bonds, loans, hire

check all paperwork just in case there is a Will that hasn’t been discovered yet, either among the purchase agreements

deceased’s paperwork, or left with a Solicitor or the bank. There are also dedicated Will storage Pension providers

service provider that may have the Will. Alternatively you can check with the Principal Registry of Building insurance company

the Family Division by calling 020 794 7022 or write to: Identity and Passport Service

Tax Office

The Principal Registry of the Family Division

Record Keeper’s Department Council Housing / Private Landlord / Association

First Avenue House Utilities provider

42-49 High Holborn Telephone / satellite / cable provider

London Water / drainage

WC1V 6NP Internet / mobile phone provider

Royal mail

Council tax

36

36 37