Page 14 - Parameter D_BPA AREA VI

P. 14

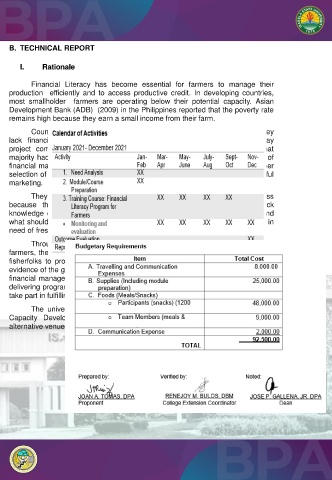

B. TECHNICAL REPORT

I. Rationale

Financial Literacy has become essential for farmers to manage their

production efficiently and to access productive credit. In developing countries,

most smallholder farmers are operating below their potential capacity. Asian

Development Bank (ADB) (2009) in the Philippines reported that the poverty rate

remains high because they earn a small income from their farm.

Countless farmers still experience financial hardship partly because they

lack financial education. Similar situation can be found in the adopt-a-barangay

project community of the Isabela State University. Initial assessment shows that

majority had basic education only as their foundation. They are unconscious of

financial matters such as cost and profit analysis, increasing income by proper

selection of crops, and applying optimum conditions that end up with successful

marketing.

They are skilled in crop production, but they cannot grow their business

because they do not know much about the financial side of farming. They lack

knowledge on how to budget or differentiate between disposable income and

what should be plowed back to production. Because of this, they are always in

need of fresh funds and become victims of predatory lending.

Through its various agencies responsible for ensuring better living for

farmers, the government has crafted financial literacy programs for farmers and

fisherfolks to provide efficient budgetary management for the industry. This is

evidence of the government's commitment to teaching farmers what they need in

financial management. The Isabela State University being a leading partner in

delivering programs for growth and development in the community, would like to

take part in fulfilling the race.

The university's FLT program aims to address such needs through the

Capacity Development Workshop on Financial Literacy and the provision of an

alternative venue for farmers to access financial assistance.