Page 207 - Thailand Post Annual Report 2024

P. 207

Part 1

Overview of the Organization

Part 2

Business Trends

Part 3

Business Model

Part 4

Strategies and Resource Allocation

Part 5

Risk

Part 6

Corporate Governance

Part 7

Operating Results

Part 8

Other Information

(Unit : million baht)

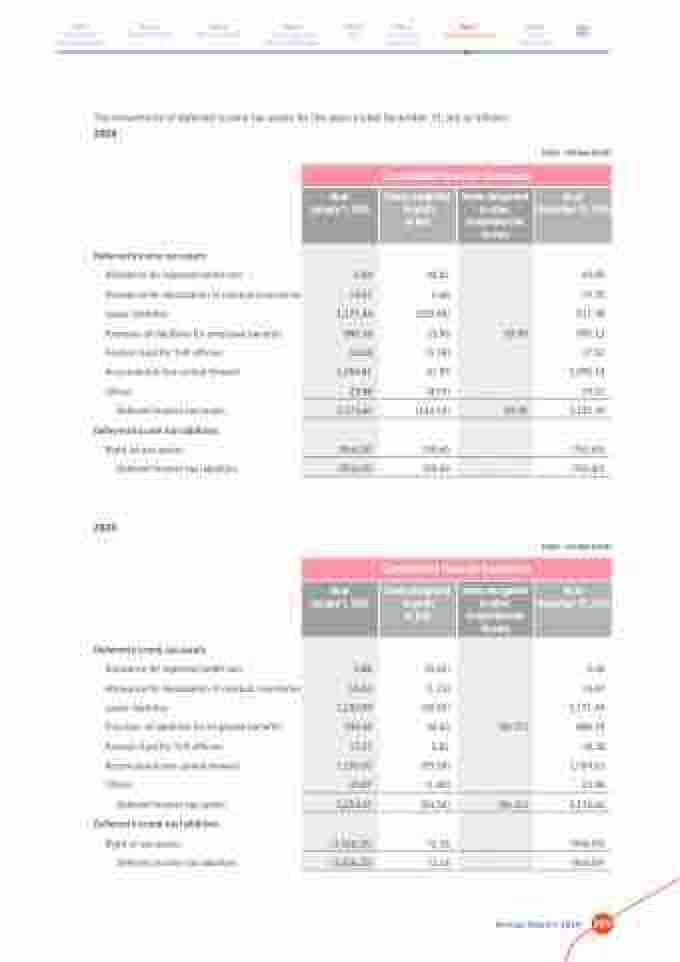

The movements of deferred income tax assets for the years ended December 31, are as follows :

2024

Deferred income tax assets

Allowance for expected credit loss

Allowance for devaluation of residual inventories Lease liabilities

Provision of liabilities for employee benefits Pension fund for THP officers

Accumulated loss carried forward

Others

Deferred income tax assets

Deferred income tax liabilities

Right-of-use assets

Deferred income tax liabilities

2023

Deferred income tax assets

Allowance for expected credit loss

Allowance for devaluation of residual inventories Lease liabilities

Provision of liabilities for employee benefits Pension fund for THP officers

Accumulated loss carried forward

Others

Deferred income tax assets

Deferred income tax liabilities

Right of use assets

Deferred income tax liabilities

(Unit : million baht)

Consolidated Financial Statements

As at January 1, 2024

Items recognized in profit

or loss

Items recognized in other comprehensive income

As at December 31, 2024

44.41 0.68 (259.46) 33.96 (0.76) 41.55 (4.57)

49.85

15.35 911.98 990.12

17.52 1,096.16 19.41

5.44

-

14.67

-

1,171.44

-

886.18

69.98

18.28

-

1,054.61

-

23.98

-

3,174.60

(144.19)

69.98

3,100.39

190.69

(763.40)

(954.09)

-

(954.09)

190.69

-

(763.40)

Consolidated Financial Statements

As at January 1, 2023

Items recognized in profit

or loss

Items recognized in other comprehensive income

As at December 31, 2023

(0.42)

(1.15) (29.55) 44.03 0.81 (95.39) (1.89)

5.44 14.67 1,171.44 886.18 18.28 1,054.61 23.98

5.86

-

15.82

-

1,200.99

-

938.46

(96.31)

17.47

-

1,150.00

-

25.87

-

3,354.47

(83.56)

(96.31)

3,174.60

72.16

(954.09)

(1,026.25)

-

(1,026.25)

72.16

-

(954.09)

Annual Report 2024 205