Page 209 - Thailand Post Annual Report 2024

P. 209

Part 1

Overview of the Organization

Part 2

Business Trends

Part 3

Business Model

Part 4

Strategies and Resource Allocation

Part 5

Risk

Part 6

Corporate Governance

Part 7

Operating Results

Part 8

Other Information

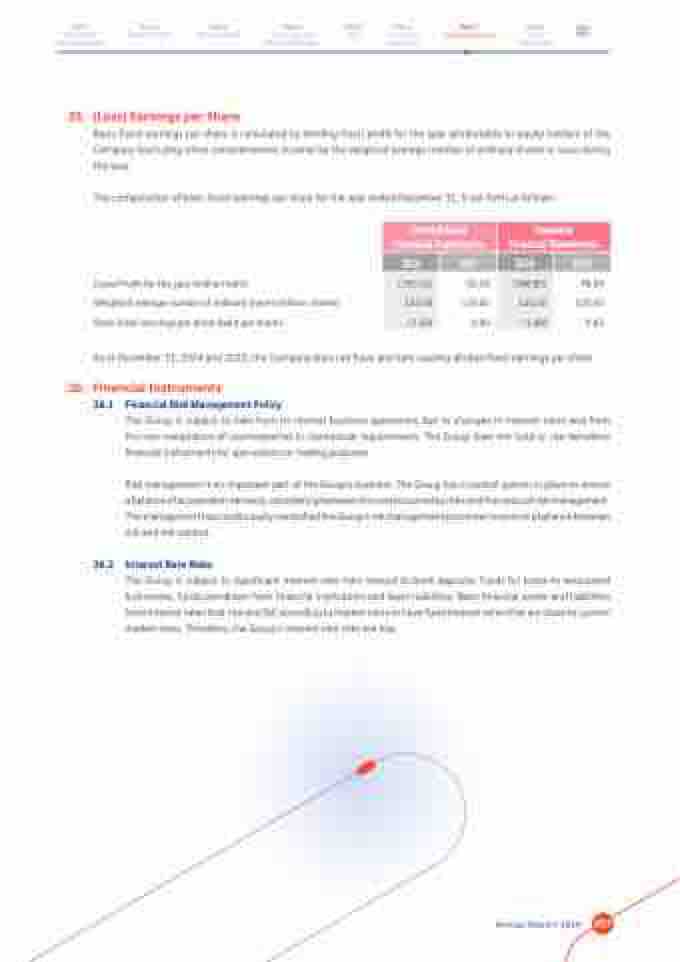

25. (Loss) Earnings per Share

Basic (loss) earnings per share is calculated by dividing (loss) profit for the year attributable to equity holders of the Company (excluding other comprehensive income) by the weighted average number of ordinary shares in issue during the year.

The computation of basic (loss) earnings per share for the year ended December 31, is set forth as follows :

Consolidated Financial Statements

Separate Financial Statements

2024

2023

2024

2023

(Loss) Profit for the year (million baht)

Weighted average number of ordinary shares (million shares) Basic (loss) earnings per share (baht per share)

50.04 125.00 0.40

78.54 125.00 0.63

(150.16)

(186.85)

125.00

125.00

(1.20)

(1.49)

As at December 31, 2024 and 2023, the Company does not have any item causing diluted (loss) earnings per share.

26. Financial Instruments

26.1 Financial Risk Management Policy

The Group is subject to risks from its normal business operations due to changes in interest rates and from the non-compliance of counterparties in contractual requirements. The Group does not hold or use derivative financial instruments for speculation or trading purposes.

Risk management is an important part of the Group's business. The Group has a control system in place to ensure a balance of acceptable risk levels, considering between the costs incurred by risks and the costs of risk management. The management has continuously controlled the Group's risk management processes to ensure a balance between risk and risk control.

26.2 Interest Rate Risks

The Group is subject to significant interest rate risks related to bank deposits, funds for loans to associated businesses, funds overdrawn from financial institutions and lease liabilities. Most financial assets and liabilities have interest rates that rise and fall according to market rates or have fixed interest rates that are close to current market rates. Therefore, the Group's interest rate risks are low.

Annual Report 2024 207