Page 218 - Thailand Post Annual Report 2024

P. 218

Part 1

Overview of the Organization

Part 2

Business Trends

Part 3

Business Model

Part 4

Strategies and Resource Allocation

Part 5

Risk

Part 6

Corporate Governance

Part 7

Operating Results

Part 8

Other Information

As of 31 December 2024 and 2023, the subsidiary has paid 87.19 million baht and 70.97 million baht, respectively (see Note 12) to deposit collateral for reduced tax payments to await a verdict from the Central Tax Court for value added tax assessments of 2016 – 2017. The aforementioned sum is shown in other current assets in the statements of consolidated financial position.

3rd Notice – Notice of Value Added Tax Assessment for the Year 2021 – September 2022

On 9 April 2024, the subsidiary received a notice of value added tax assessment for 2021 and September 2022 with taxes and fines for a total of 80.87 million baht from officials of Bangkok Revenue Office Area 9.

On 7 May 2024, the subsidiary filed an appeal with the Appeal Consideration Committee in objection to taxes.

On 21 October 2024, the subsidiary sent a letter to the Revenue Department regarding a request for support and fairness to expedite consideration of the value added tax assessment in 2018 – 2020 and the value added tax assessment in 2021 – 2022 by the Appeal Consideration Committee.

28.5 As at 31 December 2024 and 2023, the Company has bank guarantor’s letters for use as collateral with banks in issuing guarantor’s letters and providing contract transport services for moving coins, in the amount of 23.79 million baht and 20.00 million baht, respectively (see Note 9).

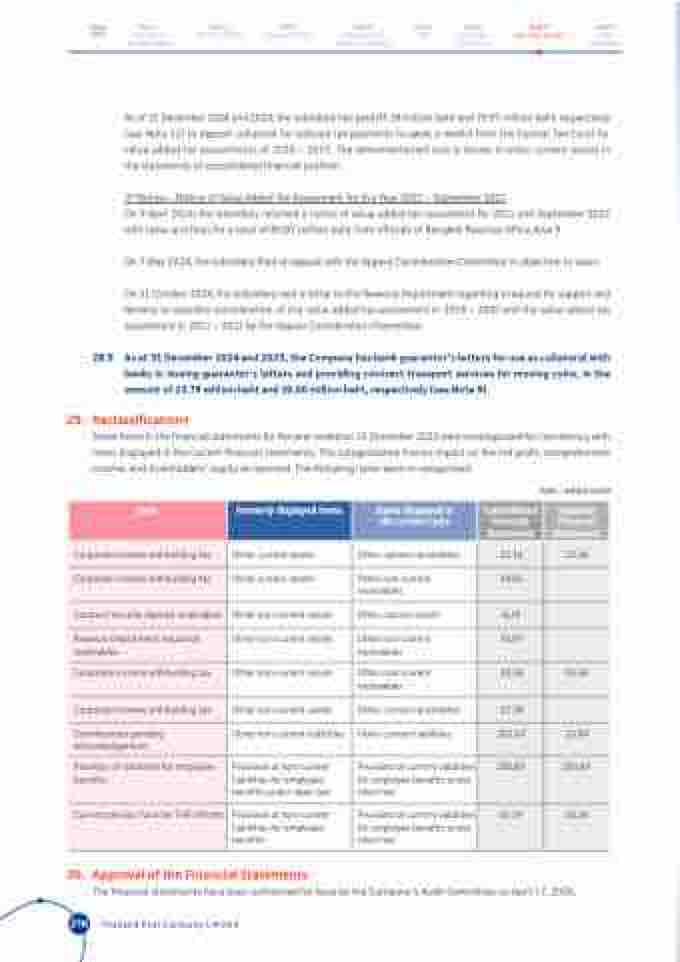

29. Reclassifications

Some items in the financial statements for the year ended on 31 December 2023 were recategorized for consistency with items displayed in the current financial statements. The categorization has no impact on the net profit, comprehensive income, and shareholders’ equity as reported. The following items were re-categorized :

(Unit : million baht)

Item

Formerly displayed items

Items displayed in the current cycle

Consolidated Financial Statements

Separate

Financial Statements

Corporate income withholding tax

Other current assets

Other current receivables

22.16

22.16

Corporate income withholding tax

Other current assets

Other non-current receivables

19.81

-

Contract security deposit receivables

Other non-current assets

Other current assets

6.29

-

Revenue Department insurance receivables

Other non-current assets

Other non-current receivables

70.97

-

Corporate income withholding tax

Other non-current assets

Other non-current receivables

43.26

43.26

Corporate income withholding tax

Other non-current assets

Other current receivables

27.39

-

Contributions pending acknowledgement

Other non-current liabilities

Other current liabilities

201.67

23.94

Provision of liabilities for employee benefits

Provision of non-current liabilities for employee benefits under labor law

Provision of current liabilities for employee benefits under labor law

250.87

250.87

Current pension fund for THP officers

Provision of non-current liabilities for employee benefits

Provision of current liabilities for employee benefits under labor law

10.19

10.19

30. Approval of the Financial Statements

The financial statements have been authorized for issue by the Company 's Audit Committee on April 17, 2025.

216 Thailand Post Company Limited