Page 3 - Kensington Bi-Fold Brochure

P. 3

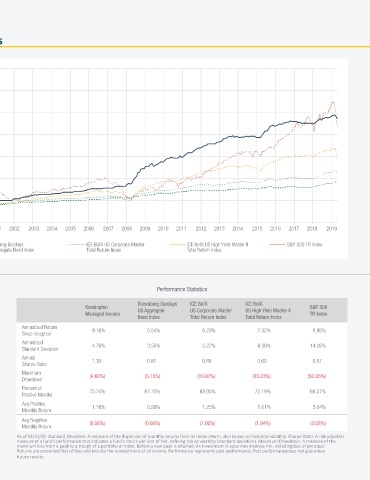

Kensington Managed Income Strategy Returns

INVESTMENT OBJECTIVE

The Kensington Managed Income Strategy $1,750,000

$1,750,000

strives to provide investors with the

potential to generate stable, above

average total returns, with low drawdown. $1,500,000

$1,500,000

ABOUT THE STRATEGY

Kensington Analytics uses a proprietary

$1,250,000

trend-following model to identify and $1,250,000

act on prevailing market sentiment. The

model provides daily signals to guide the

$1,000,000

Strategy’s allocation. Managed Income $1,000,000

rotates between two investment modes:

Risk-On: When markets are generally

$750,000

trending upward, Managed Income $750,000

allocates to higher yielding fixed income

securities across the high-yield and

multisector bond categories. This allows $500,000

$500,000

the Strategy to reap the highest level of

yield when confidence in the market is high.

Risk-Off: When the overall trend is one $250,000

$250,000

of decline or high volatility, Managed

Income shifts into shorter duration

instruments, including Treasuries or $0 $0

cash equivalents. This helps protect 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

principal and mitigate drawdowns.

Returns are Net

Kensington Managed Income US Aggregate Bond US Corporate Bond US High Yield Bond S&P 500

S&P 500 TR Index

ICE BofA US Corporate Master

ICE BofA US High Yield Master II

Bloomberg Barclays

Kensington Managed Income

MORNINGSTAR® CLASSIFICATION US Aggregate Bond Index Total Return Index Total Return Index

Nontraditional Bond

MORNINGSTAR® RATING*

* The Kensington Managed Income Strategy received a 14%

5-Star Overall Morningstar® Rating as of December 31, Risk/Return (Since 1992) Performance Statistics

2019. The Strategy was rated against the following

numbers of Morningstar® rated composites over the

12%

following time periods: 37 nontraditional composites in 12% Bloomberg Barclays ICE BofA ICE BofA

the last 3 years, 34 nontraditional composites in the last Kensington S&P 500

5 years, and 19 nontraditional composites in the last 10 Managed Income US Aggregate US Corporate Master US High Yield Master II TR Index

years. With respect to these nontraditional composites, Bond Index Total Return Index Total Return Index

the Kensington Managed Income Strategy received a 10%

10%

5-Star rating overall, a 4-Star rating for 3 years, a 5-Star Annualized Return

rating for 5 years and a 5-Star rating for 10 years. Past Kensington Managed Income 9.16% 5.54% 6.23% 7.32% 8.88%

performance does not guarantee future results. S&P 500 TR Index Since Inception

Annualized

8%

INCEPTION DATE 8% ICE BofA US High Yield Master II Total Return Index Standard Deviation 4.76% 3.55% 5.27% 8.30% 14.26%

December 31, 1991 Annual 1.39 0.87 0.80 0.69 0.57

The Kensington Managed Income Strategy Annualized Return Since Inception 6% ICE BofA US Corporate Master Total Return Index Sharpe Ratio

6%

is managed by Advisors Preferred, LLC dba Bloomberg Barclays US Aggregate Bond Index Maximum

Kensington Analytics LLC. Additional Drawdown (4.60%) (5.15%) (16.07%) (33.23%) (50.95%)

information about the Strategy and 4% Percent of

4%

the adviser can be obtained by viewing Positive Months 75.74% 67.75% 68.05% 72.19% 66.57%

company disclosure documents available

upon request. Past Performance does not 2% Avg Positive 1.16% 0.99% 1.25% 1.61% 3.04%

guarantee future results. 2% Monthly Return

Avg Negative

To Receive a GIPS® Compliant Monthly Return (0.56%) (0.66%) (1.05%) (1.94%) (3.68%)

0%

Presentation Please Contact 0% 0% 5% 10% 15% 20%

info@kensingtonanalytics.com 0% 5% 10% 15% 20% 25% As of 03/31/20. Standard Deviation: A measure of the dispersion of monthly returns from its mean return, also known as historical volatility. Sharpe Ratio: A risk-adjusted

measure of a fund’s performance that indicates a fund’s return per unit of risk, defining risk as volatility (standard deviation). Maximum Drawdown: A measure of the

KensingtonAnalytics.com Standard Deviation maximum loss from a peak to a trough of a portfolio or index, before a new peak is attained. An investment in securities involves risk, including loss of principal.

877.891.1222 Returns are presented Net of fees and include the reinvestment of all income. Performance represents past performance. Past performancedoes not guarantee

future results.