Page 83 - ONLINE LEARNING LIBRARY

P. 83

5 The borrowing process

3 years (36 months) 30.65 1103.40

5 years (60 months) 19.56 1173.60

Consequently, price, flexibility and length of term are all important factors in choosing a

debt product. This is all significant information needed in any financial planning process

about the taking out of debt. However, the notion of choice itself is influenced by the social

and economic circumstances of individuals such as Philip. As we saw in Section 2.1, low-

income groups have only limited access to mainstream finance: in fact, this is one of the

characteristics of financial exclusion. People who do not own their own home, for

instance, will not have the same access to secured lending as homeowners. This narrows

their ability to access the kind of low interest debt which is associated with secured

lending. Such individuals might, of course, choose not to borrow to fund a music system

purchase, but any borrowing they do undertake would most likely involve more expensive

forms of debt than homeowners can access.

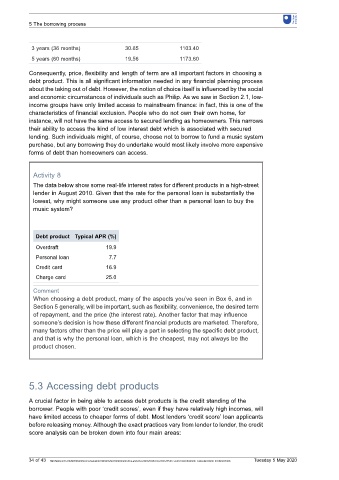

Activity 8

The data below show some real-life interest rates for different products in a high-street

lender in August 2010. Given that the rate for the personal loan is substantially the

lowest, why might someone use any product other than a personal loan to buy the

music system?

Debt product Typical APR (%)

Overdraft 19.9

Personal loan 7.7

Credit card 16.9

Charge card 25.0

Comment

When choosing a debt product, many of the aspects you’ve seen in Box 6, and in

Section 5 generally, will be important, such as flexibility, convenience, the desired term

of repayment, and the price (the interest rate). Another factor that may influence

someone’s decision is how these different financial products are marketed. Therefore,

many factors other than the price will play a part in selecting the specific debt product,

and that is why the personal loan, which is the cheapest, may not always be the

product chosen.

5.3 Accessing debt products

A crucial factor in being able to access debt products is the credit standing of the

borrower. People with poor ‘credit scores’, even if they have relatively high incomes, will

have limited access to cheaper forms of debt. Most lenders ‘credit score’ loan applicants

before releasing money. Although the exact practices vary from lender to lender, the credit

score analysis can be broken down into four main areas:

34 of 43 http://www.open.edu/openlearn/money-management/money/personal-finance/you-and-your-money/content-section-0?utm_source=openlearnutm_campaign=olutm_medium=ebook Tuesday 5 May 2020