Page 17 - ANTILLIAANSE DGB

P. 17

17

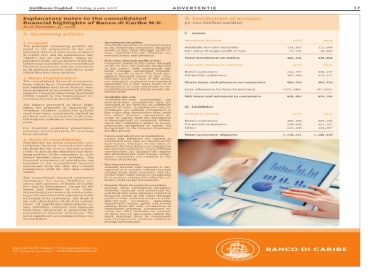

2015 111,994 36,824 148,818 2015 490,197 473,527 963,724 (87,931) 875,793 2015 463,434 822,335 104,057 1,389,826

2016 114,810 49,531 164,341 2016 513,797 467,946 981,743 (103,286) 878,457 2016 469,298 838,648 121,165 1,429,111

B. Specification of accounts (in ‘000 Antillean Guilders) Available-for-sale securities Fair value through profi t or loss Total investment securities Loans and advances to customers Gross loans and advances to customers Less: allowance for loan impairment Net loans and advances to customer

ADVERTENTIE I. Assets Investment securities as- Retail customers Corporate customers II. Liabilities Customers’ deposits Retail customers Corporate customers Other

Vrijdag 9 juni 2017 Explanatory notes to the consolidated financial highlights of Banco di Caribe N.V . Investment securities • The Bank classifi es its fi nancial assets in the following categories: fi nancial assets at fair value through profi t or loss; available-for-sale fi nancial sets and

Antilliaans Dagblad As at December 31, 2016 A. Accounting policies 1. General The principal accounting policies ad- opted in the preparation of the con- solidated fi nancial statements of Banco di Caribe N. V . and its subsidiaries (the “Bank”) are set out below. These ex- planatory notes are

Vrijdag 9 juni 2017 nancial position 2015 2016 428,175 461,763 148,818 164,341 108,721 109,967 875,793 878,457 78,341 82,162 17,078 17,078 8,167 40,797 69,473 71,497 1,734,566 1,826,062 1,389,826 1,429,111 2,829 - 8,167 40,797 7,820 7,835 2,343 2,223 14,849 17,777 1,892 2,288

Antilliaans Dagblad Consolidated statement of profit or loss For the year ended December 31, 2016 (in ‘000 Antillean Guilders)

Consolidated statement of fi As at December 31, 2016 (in ‘000 Antillean Guilders) Cash and due from banks Investment securities Investment property Loans and advances to customers Bank premises and equipment Deferred tax assets Customers’ liability under acceptances Liabilities and Shareholder

ADVERTENTIE Assets Other assets Total assets Liabilities Provisions Management’s responsibility for the con- Management is responsible for the prepa- ration of the consolidated fi nancial high- dated fi nancial statements in accordance Domestic Banking Institutions, issued by Our r

nancial highlights Independent auditor’s report on the solidated fi nancial highlights lights derived from the audited consoli- with the Provision for the Disclosure of Consolidated Financial Highlights of the CBCS. Auditor’s responsibility on whether the consolida

consolidated fi Opinion The consolidated fi nancial highlights, which comprise the consolidated balance sheet as at December 31, 2016, the con- solidated statement of profi t and loss for the year then ended, and related notes, are derived from the audited consolidated

16