Page 14 - AHATA

P. 14

Friday 17 February 2023 LOCAL

A10

The CBA raised the reserve requirement rate by 0.5 percentage

point as of January 1, 2023

In line with the Monetary higher utility prices, which

Policy Committee’s (MPC) affected the ‘housing’

task to evaluate, direct, component (2.9 percent-

and provide transparency age points contribution).

on the monetary policy ac- Moreover, gasoline prices

tions of the Central Bank of rose, mainly impacting the

Aruba (CBA), the CBA in- ‘transport’ component (1.6

forms the following. During percentage points contri-

its meeting on December bution) and the ‘food and

16, 2022, the MPC decided non-alcoholic beverages’

to increase the reserve re- component (1.4 percent-

quirement rate by 0.5 per- age points contribution).

centage point to 25.5 per-

cent as of January 1, 2023. The 12-month average in-

flation climbed from 4.3

Accordingly, commercial percent to 5.1 percent in

banks must hold a minimum October 2022. The CBA

balance at the CBA equal estimates elevated infla-

to 25.5 percent of their cli- tionary pressures for the

ents’ short-term deposits. remainder of 2022, due to

The decision to raise the the elevated oil price in in-

reserve requirement rate ternational markets, as well

by 0.5 percentage point as the recent hikes in utility

was based on the still am- tariffs. Furthermore, the ex-

ple level of excess liquidity pectation is that Aruba will

at the commercial banks, import much of the soaring

that persisted well above prices from its export part-

the pre-pandemic level, ners, particularly the United

and the diminished pace States and Europe.

of decline in excess liquid- In October 2022, end-of-

ity with preliminary data period core inflation (ex-

for November 2022 again cluding energy and food)

recording an uptick. The accelerated from 2.4 per-

0.5 percentage point rise cent to 2.7 percent on a

in the reserve requirement year-over-year basis. On a

aims to ensure a gradual twelve-month average ba-

decrease of excess liquid- sis, core inflation amounted

ity at all commercial banks, to 2.1 percent, up from 1.9

but the CBA is determined, precent, at end-October

dependent on the devel- 2022.

opments of excess liquid- 3,198.0 million, respectively. Current account payments (ARA) metric (Table 1).

ity in the coming months, consist of import payments, Commercial bank excess

to further increase the rate Maintaining reserve ad- interest payments made to Inflation liquidity

of increments, if deemed equacy is critical to keep- investors, and foreign trans- In October 2022, the con- Aggregated excess liquid-

necessary. ing the fixed exchange fers such as money remit- sumer price index (CPI) ity fell from Afl. 1,320.5 mil-

rate between the Aruban tances by foreign workers, jumped by 7.0 percent lion in December 2021 to

The MPC considered the florin and the US dollar. In amongst others. Official compared to the same Afl. 778.3 million in October

following information and this regard, the CBA an- reserves are forecasted to month of the previous year 2022 (Graph 3). This drop

analysis during its delibera- ticipates international re- stay within an adequate (Graph 2), unchanged was principally due to the

tions: serves to remain comfort- range when benchmarked from the end-of-period in- consecutive hikes in the

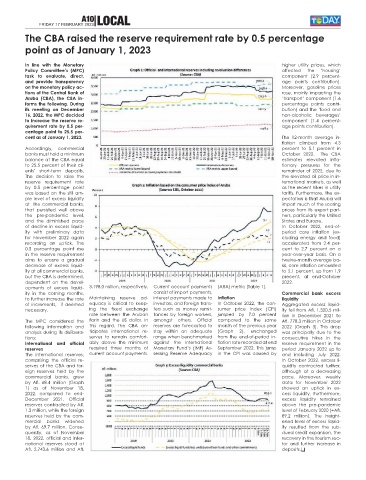

International and official ably above the minimum against the International flation rate recorded at end reserve requirement in the

reserves required three months of Monetary Fund’s (IMF) As- September 2022. This jump period January 2022 up to

The international reserves, current account payments. sessing Reserve Adequacy in the CPI was caused by and including July 2022.

comprising the official re- In October 2022, excess li-

serves of the CBA and for- quidity contracted further,

eign reserves held by the although at a decreasing

commercial banks, grew pace. Moreover, weekly

by Afl. 68.4 million (Graph data for November 2022

1) as of November 18, showed an uptick in ex-

2022, compared to end- cess liquidity. Furthermore,

December 2021. Official excess liquidity remained

reserves contracted by Afl. above the pre-pandemic

1.3 million, while the foreign level of February 2020 (+Afl.

reserves held by the com- 89.2 million). The height-

mercial banks widened ened level of excess liquid-

by Afl. 69.7 million. Conse- ity resulted from the sub-

quently, as of November dued credit expansion, the

18, 2022, official and inter- recovery in the tourism sec-

national reserves stood at tor and further increase in

Afl. 2,743.6 million and Afl. deposits.q