Page 2 - Pearl Spot Bank Documents

P. 2

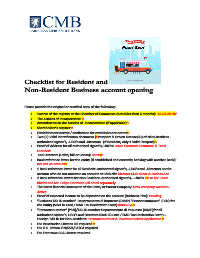

Checklist for Resident and

Non-Resident Business account opening

Please provide the original or certified copy of the following:

• Excerpt of the registry at the Chamber of Commerce (not older than 6 months): 13-03-2018√

• The Articles of Incorporation: √

• Amendments in the Articles of Incorporation (If applicable) √

• Shareholder’s register √

• Establishment permit / application for establishment permit√

• Two (2) Valid Identification document (√Passport & Driven License/ID) of NON-Resident -

authorized signee’s, -UBO’s and -Directors (If Resident, only 1 Valid Passport) √

• Proof of Address for all authorized signee’s, UBO’s: Lease Contracts Diamante & Tanki

Leendert

• and Directors (Utility bill or Censo): Censo√

• Bank reference letter for the entity (If established and currently banking with another bank):

nvt has no account√

• 1 Bank reference letter for all Resident -authorized signee’s, -UBO’s and -Directors on the

account who do not maintain an account at CMB NV: Director CMB client & Savings Acc

• 2 Bank reference letters for Non Resident -authorized signee’s, - UBO’s : √For Mr. Jesus

Rivero and Mr. Felipe Gonzalez will email separately

• The latest financial statement of the Entity or Parent Company: New company was Non-

Active

• Proof of expected income to be deposited on the account (Business Plan): Pending

• “Business TAX ID number” Departamento di Impuesto (DIMP) “Persoonsnummer” (PSN) for

the entity (SIAD ID Card / SIAD Tax Declaration Form)10005264 √

• “Persoonsnummer” (PSN)/TAX ID number Departamento di Impuesto (DIMP)for all

authorized signee’s, UBO’s and Directors (SIAD ID Card / SIAD Tax Declaration Form) –

Foreign TAX ID for Non-Resident: Persoonsnummer & Investors Permit Application √

• For Venezuelan Citizens RIF required √

• For U.S. Citizen TIN/SSN/FATCA required

• For Free zone CBA License required