Page 5 - AB

P. 5

4 LOCAL AWEMainta Diabierna, 27 Juni 2025

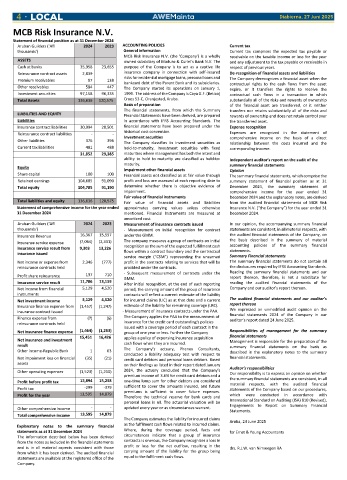

MCB Risk Insurance N.V.

Statement of financial position as at 31 December 2024

Aruban Guilders (‘Afl 2024 2023 ACCOUNTING POLICIES Current tax

thousands’) General information Current tax comprises the expected tax payable or

MCB Risk Insurance N.V. (the ‘Company’) is a wholly receivable on the taxable income or loss for the year

ASSETS owned subsidiary of Maduro & Curiel's Bank N.V. The and any adjustment to the tax payable or receivable in

Cash at banks 35,958 23,655 purpose of the Company is to act as a captive life respect of previous years.

Reinsurance contract assets 2,839 insurance company in connection with self-insured De-recognition of financial assets and liabilities

Premium receivables 97 138 risks for residential mortgage loans, personal loans and The Company derecognizes a financial asset when the

bankcard debt of the Parent Bank and its subsidiaries.

Other receivables 584 447 The Company started its operations on January 1, contractual rights to the cash flows from the asset

expire, or it transfers the rights to receive the

Investment securities 97,158 96,335 1999. The address of the Company is Caya G.F. (Betico) contractual cash flows in a transaction in which

Total Assets 136,636 120,575 Croes 53-C, Oranjestad, Aruba. substantially all of the risks and rewards of ownership

Basis of preparation of the financial asset are transferred, or it neither

The financial statements, from which the Summary

LIABILITIES AND EQUITY Financial Statements have been derived, are prepared transfers nor retains substantially all of the risks and

rewards of ownership and does not retain control over

Liabilities in accordance with IFRS Accounting Standards. The the transferred asset.

Insurance contract liabilities 30,994 28,501 financial statements have been prepared under the Expense recognition

Reinsurance contract liabilities - - historical cost convention. Expenses are recognized in the statement of

Investment securities

Other liabilities 376 396 The Company classifies its investment securities as comprehensive income on the basis of a direct

relationship between the costs incurred and the

Current tax liabilities 481 488 held-to-maturity. Investment securities with fixed corresponding income.

31,852 29,385 maturities where management has both the intent and

ability to hold to maturity are classified as held-to- Independent auditor’s report on the audit of the

maturity.

Equity Impairment other financial assets summary financial statements

Opinion

Share capital 100 100 Financial assets not classified as at fair value through The summary financial statements, which comprise the

Retained earnings 104,685 91,090 profit and loss are assessed at each reporting date to summary statement of financial position as at 31

Total equity 104,785 91,190 determine whether there is objective evidence of December 2024, the summary statement of

impairment. comprehensive income for the year ended 31

Fair value of financial instruments

December 2024 and the explanatory notes, are derived

Total liabilities and equity 136,636 120,575 Fair value of financial assets and liabilities from the audited financial statements of MCB Risk

Statement of comprehensive income for the year ended approximates carrying values unless otherwise Insurance N.V. (“the Company”) for the year ended 31

31 December 2024 mentioned. Financial Instruments are measured at December 2024.

amortized cost.

Aruban Guilders (‘Afl 2024 2023 Measurement of insurance contracts issued In our opinion, the accompanying summary financial

thousands’) - Measurement on initial recognition for contract statements are consistent, in all material respects, with

Insurance Revenue 16,367 15,557 under the GMM. the audited financial statements of the Company, on

Insurance service expense (7,064) (2,331) The company measures a group of contracts on initial the basis described in the summary of material

accounting policies of the summary financial

Insurance service result from 9,303 13,226 recognition as the sum of the expected fulfillment cash statements.

insurance issued flows within a contract boundary and the contractual

service margin (“CSM”) representing the unearned Summary Financial statements

Net income or expense from 2,346 (777) profit in the contracts relating to services that will be The summary financial statements do not contain all

reinsurance contracts held provided under the contracts. the disclosures required by IFRS Accounting Standards.

Profit share reinsurance 137 710 - Subsequent measurement of contracts under the Reading the summary financial statements and our

report thereon, therefore, is not a substitute for

GMM.

Insurance service result 11,786 13,159 After initial recognition, at the end of each reporting reading the audited financial statements of the

Net income from financial 5,129 4,520 period, the carrying amount of the group of insurance Company and our auditor’s report thereon.

instruments contracts will reflect a current estimate of the liability

Net investment income 5,129 4,520 for incurred claims (LIC) as at that date and a current The audited financial statements and our auditor’s

Insurance finance expense from (1,457) (1,247) estimate of the liability for remaining coverage (LRC). report thereon

insurance contract issued - Measurement of insurance contracts under the PAA. We expressed an unmodified audit opinion on the

financial statements 2024 of the Company in our

Finance expense from (7) (6) The Company applies the PAA to the measurement of auditor’s report dated 24 June 2025.

reinsurance contracts held insurance for the credit card outstanding's policies

issued with a coverage period of each contract in the

Net insurance finance expense (1,464) (1,253) group of one year or less. Further the Company Responsibilities of management for the summary

15,451 16,426 applies a policy of expensing insurance acquisition financial statements

Net insurance and investment Management is responsible for the preparation of the

result cash flows when they are incurred. summary financial statements on the basis as

Other income-Republic Bank 1 63 The Company’s actuary, Phenox Consultants, described in the explanatory notes to the summary

conducted a liability adequacy test with respect to

Net impairment loss on financial (35) (21) credit card debtors and personal loans debtors. Based financial statements.

assets on their findings as listed in their report dated January

Other operating expenses (1,523) (1,210) 2024, the actuary concluded that the Company’s Auditor’s responsibilities

Our responsibility is to express an opinion on whether

premium income of 3.6% for credit card debtors and a

Profit before profit tax 13,894 15,258 one-time lump sum for other debtors are considered the summary financial statements are consistent, in all

material respects, with the audited financial

Profit tax -299 -379 sufficient to cover the amounts insured, and future statements of the Company based on our procedures,

premiums is sufficient to cover future expenses.

Profit for the year 13,595 14,879 Therefore the technical reserve for bank cards and which were conducted in accordance with

personal loans is nil. The actuarial valuation will be International Standard on Auditing (ISA) 810 (Revised),

Other comprehensive income - - updated every year or as circumstances warrant. Engagements to Report on Summary Financial

Statements.

Total comprehensive income 13,595 14,879

The Company estimates the liability for incurred claims Aruba, 24 June 2025

Explanatory notes to the summary financial as the fulfilment cash flows related to incurred claims.

statements as at 31 December 2024 Where, during the coverage period, facts and for Ernst & Young Accountants

The information described below has been derived circumstances indicate that a group of insurance

from the notes as included in the financial statements contracts is onerous, the Company recognizes a loss in

and is in all material aspects consistent with those profit or loss for the net outflow, resulting in the drs. R.J.W. van Nimwegen RA

from which it has been derived. The audited financial carrying amount of the liability for the group being

statements are available at the registered office of the equal to the fulfilment cash flows.

Company.