Page 7 - ANTILL DGB

P. 7

Antilliaans Dagblad Donderdag 29 juni 2017 ADVERTENTIE 7

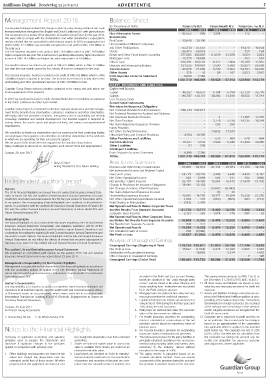

Management Report 2016 Balance Sheet

(In Thousands of ANG) Fatum Life N.V. Fatum Health N.V. Fatum Gen. Ins. N.V.

The Guardian Holdings Limited (GHL) Group consists of a very strong portfolio of non-bank ASSETS 2016 2015 2016 2015 2016 2015

fi nancial institutions th roughout th e English and Dutch Caribbean. It is with great pleasure Non-Admissable Assets 95,552 908 1,284 - 172 -

th at we present you a review of th e operations of Guardian Group Fatum for th e year 2016.

We were able to comply with th e shareholder’s and wider stakeholder’s expectations Investments:

and are satisfi ed th at we succeeded in achieving our targets. In 2016 an aggregated net Real Estate 32,648 30,190 - - -

profi t of ANG 32.1 Million was recorded compared to a net profi t of ANG 14.9 Million in Unconsolidated Affi liated Companies

th e prior year. and Oth er Participations 63,314 57,557 - - 19,470 16,504

The Life business recorded a net profi t of ANG 18.8 Million which is ANG 19.9 Million Stocks 86,473 69,519 - - 727 734

higher compared to last year. This result has been positively infl uenced by higher investment Bonds and Oth er Fixed Income Securities 377,583 382,687 51,039 51,078 3,024 3,023

income of ANG 14.5 Million and higher fair value adjustments of 9.8 Million. Mortgage Loans 25,770 28,680 - 453 554

Oth er Loans 106,391 189,553 8,317 7,664 16,789 12,987

The Health business recorded a net profi t of ANG 6.5 Million which is ANG 6.1 Million Deposits with Financial Institutions 121,235 109,981 3,500 3,500 25,821 25,699

less th an last year mainly caused by less release of reserves compared to last year. Current Assets 85,476 71,605 5,730 5,563 54,701 52,636

Oth er Assets 378 43 58 107 2,823 3,042

The General Insurance business recorded a net profi t of ANG 6.8 Million which is ANG From Separate Accounts Statement 6,890 7,366 -

3.4 Million higher compared to last year. The increase in net result is mainly due to less TOTAL 1,001,710 948,089 69,928 67,912 123,980 115,179

underwriting and oth er operational expenses of ANG 3.8 Million in total.

EQUITY, PROVISIONS AND LIABILITIES

Guardian Group Fatum solvency position continued to be strong and well above th e Capital and Surplus

local requirements of th e regulator. Capital 46,637 46,637 6,194 6,194 32,730 32,730

Surplus 146,787 130,337 38,286 31,810 18,556 11,744

In 2016 we continued to invest in multi-channel distribution to consolidate our presence Less Treasury Stock - -

in th e Dutch Caribbean and th e Dutch market. Subordinated Instruments - -

Provisions for Insurance Obligations

Guardian Group Fatum is committed to eff ective corporate governance and risk manage- Net Technical Provision for Life Insurances 786,314 747,671 -

ment for th e benefi t of our shareholders, customers, employees and oth er stakeholders. Net Technical Provision for Accident and Sickness - -

We highly value th e principles of fairness, transparency and accountability and actively Net Unearned Premium Provision - 4 - 11,487 12,476

encourage individual and societal development. Our fi nancial support is targeted at, Net Claim Provision - 3,778 5,214 19,235 18,269

among oth ers, th e youth , sports and physical activity, and various non-governmental

organizations. Net Claim Adjustment Expense Provision - 292 298 -

Funds Provision - - - -

Net Oth er Technical Provisions - 14,892 17,539 -

We would like to th ank our shareholders and our customers for th eir continuing loyalty,

our employees, th e regulators and auth orities and all oth er stakeholders in th e territories Oth er Net Policy and Contract Provisions 4,704 10,305 -

in which we are operating, for th eir ever present support. Oth er Provisions and Liabilities - 533 609 528 464

We are proud of th e future we have mapped out for Guardian Group Fatum. Current Liabilities 10,327 5,533 5,949 6,248 41,444 39,496

Many challenges lie ahead of us, and togeth er we’ll convert th em into opportunities! Oth er Liabilities 51 240 - -

Contingent Liabilities - -

Curaçao, 28 June 2017 From Separate Accounts Statement 6,890 7,366 - - -

TOTAL 1,001,710 948,089 69,928 67,912 123,980 115,179

Diego Fränkel Profi t & Loss Statement 2016 2015 2016 2015 2016 2015

Acting President & CEO Fatum Holding Premium and Oth er Policy Considerations 57,807 64,619 27,144 27,973 41,189 42,492

Net Investment Income and Realized Capital

Gains and Losses 54,729 40,259 3,446 3,448 4,400 4,182

Net Oth er Operational Income 683 2,099 595 617 185 (898)

Independent auditor’s report Net Benefi ts / Claims Incurred 36,127 48,420 15,264 16,442 21,640 21,702

Change In Provisions for Insurance Obligations 38,449 33,122 - -

Opinion Net Changes In Various Oth er Provisions - (2,647) (6,943) -

The 2016 Financial Highlights are derived from th e audited Life Insurance Annual State- Net Claim Adjustment Expenses Incurred - (6) 38 -

ment of Fatum Life N.V, th e audited General Insurance Annual Statements of Fatum Underwriting Expenses Incurred 16,081 14,795 10,377 10,354 16,228 21,276

Health N.V. and Fatum General Insurance N.V. for th e year ended 31 December 2016. Net Oth er Operational Expenditures Incurred 1,093 447 (253) (559) 504 (714)

In our opinion, th e accompanying Financial Highlights are consistent, in all material re- Profi t Sharing to Policyholders (261) 1,476 - -

spects, in accordance with th e audited Life Insurance Annual Statement of Fatum Life Net Operational Results Before Corporate Taxes

N.V and th e audited General Insurance Annual Statements of Fatum Health N.V. and and Net Results From Separate Accounts 21,730 8,717 8,450 12,706 7,402 3,512

Fatum General Insurance N.V. Corporate Taxes Incurred 3,121 362 1,974 178 597 62

Net Operational Results Aft er Corporate Taxes

Financial highlights and Before Net Results From Separate Accounts 18,609 8,355 6,476 12,528 6,805 3,450

The fi nancial highlights do not contain all th e disclosures required by th e Life and General Net Results from Separate Accounts (14) 177 - - - -

Insurance Annual Statement Composition and Valuation Guidelines (2015) of th e Net Operational Results 18,595 8,532 6,476 12,528 6,805 3,450

Bank. Reading th e fi nancial highlights and th e auditor’s report th ereon, th erefore, is not Net Unrealized Gains or Losses 232 (9,586) - - - -

a substitute for reading th e audited Life and General Insurance Annual Statements and Net Profi t or Loss 18,827 (1,054) 6,476 12,528 6,805 3,450

th e auditor’s report th ereon. The Financial Highlights and th e Life and General Insurance

Annual Statements do not refl ect th e eff ects of events th at occurred subsequent to Analysis of Unassigned Earnings

th e date of our report on th e audited Life and General Insurance Annual Statements.

Unassigned Earnings (Beginning of Year) 119,734 139,671 31,810 24,796 11,744 9,618

The audited Life and General Insurance Annual Statements Net Profi t or Loss 18,827 (1,054) 6,476 12,528 6,805 3,450

We expressed an unmodifi ed audit opinion on th e audited 2016 Life and General Distribution of Accumulated Earnings 18,883 5,514 1,452

Insurance Annual Statements in our report dated 23 June 2017. Oth er Changes In Unassigned Earnings - - - 7 128

Unassigned Earnings (End of Year) 138,561 119,734 38,286 31,810 18,556 11,744

Management’s Responsibility for th e Financial Highlights

Management is responsible for th e preparation of th e fi nancial highlights in accordance

with th e accounting policies as applied in th e Life Insurance Annual Statement of

Fatum Life N.V. and th e general Insurance Statements of Fatum Health N.V. and Fatum

General Insurance N.V. recorded in th e Profi t and Loss account. Foreign The ageing reserve amounts to ANG 13,613 as

bonds are classifi ed as “fair value th rough profi t per December 31, 2016 (2015: ANG 16,451).

Auditor’s Responsibility or loss” and are stated at fair value. All gains and 11. All oth er assets and liabilities are shown at face

Our responsibility is to express an opinion on wheth er th ese Financial Highlights are losses resulting from revaluation are accounted value less any necessary provisions for credit risk

consistent, in all material respects, with th e audited Life and General Insurance Annu- for in th e Profi t and Loss account. exposure.

al Statements based on our procedures, which were conducted in accordance with 4. Mortgage loans are stated at face value less any 12. Assets and liabilities in foreign currencies are ex-

necessary provision for credit risk exposure. pressed in Neth erlands Antillean guilders at rates

International Standard on Auditing (ISA) 810 (Revised), Engagements to Report on

5. Capitalized interest rate rebates are amortized at prevailing at th e balance sheet date. Transactions

Summary Financial Statements.

annual rate of 15% during th e fi rst four years and denominated in foreign currencies are recorded

Curaçao, 28 June 2017 10% during th e next four years. at th e average rate of exchange of th e previous

for Ernst & Young Accountants 6. Policy loans are stated at face value. The surrender month . All gains and losses are recognized in th e

value of th e loan serves as collateral. Profi t & Loss account.

C. Smorenburg RA AA F. de Windt-Ferreira CPA 7. For Health Insurance provision for outstanding 13. Corporate tax is expensed to profi t and loss on

claims is calculated as a percentage of th e net an accrual basis. The accrued profi t tax charge is

premium earned based on experience ratios of based on an approximation of th e corporation

previous years.

Notes to th e Financial Highlights 8. For General Insurance provision for outstanding rate applicable which is applied on th e reported

profi t before tax. The corporate tax rate is 22%

claims are stated at estimated cost per event. (2015: 25%). The eff ective tax rate diff ers from

Summary of signifi cant accounting and valuation less straight line depreciation over th eir estimated 9. The (reinsured) provision for life policy liabilities is th e corporate tax taking into account any tax

principles used to prepare th e statements and useful lives. principally calculated according to th e net reserve credits, non-deductible tax expenses and prior

disclosure if signifi cant changes in th e principles 2. Shares are stated at market value. In case no fair meth od using mortality tables and interest rates year adjustment, where applicable.

applied, in comparison with previous year: value is available th ese shares are stated at an customary in th e industry, almost with out

estimated realizable value. exception in th e range of 3-4%.

1. Offi ce buildings and properties are stated at fair 3. Local bonds are classifi ed as “held to maturity” 10. The aging reserve is calculated based on an

values less straight line depreciation over th e and are stated at amortized cost. The amortization actuarial calculation meth od. There are several

estimated useful lives of th ese assets. All oth er of premium and accretion of discount are com- assessments of th e provision during th e year and

property, plant and equipment are stated at cost puted over th e remaining time of maturity and th e provision is adjusted based on th e outcome.