Page 5 - ANTILL DGB

P. 5

Antilliaans Dagblad Maandag 6 augustus 2018 ADVERTENTIE 5

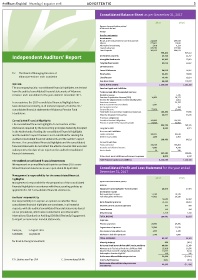

Consolidated Balance Sheet as per December 31, 2017

2017 2016

(figures in thousands Antillean guilders)

All risks are for the fund

Assets

Non Current assets:

Investments:

Bonds and Foreign Fixed Income Instruments 212,238 205,519

Shares 277,421 225,80

Alternative investments 3,678 4,124

Loans & advances 339,253 324,908

Time Deposits 163,532 204,532

996,122 964,563

Independent Auditors’ Report Investment property 35,728 32,707

Intangible fixed assets 13,343 12,881

Tangible fixed assets 12,015 11,687

Current assets:

Loans & Advances 64,013 76,297

To: The Board of Managing Directors of Receivables 18,131 18,604

Vidanova Pension Fund Foundation Liquid assets 76,787 53,654

Due from Banks 86,960 115,787

Opinion TOTAL FUND ASSETS 1,303,099 1,286,180

The accompanying 2017 consolidated financial highlights are derived Pension Captal and Liabilities

from the audited consolidated financial statements of Vidanova Technical and other designated reserves:

Pension Fund Foundation for the year ended 31 December 2017. Disability reserve - 7,336

Premium Equalisation Reserve (PER) 18,859 18,177

Reserve for adjustment to recent mortality tables - 2,861

In our opinion, the 2017 consolidated financial highlights have Investment reserve - 31,744

Return Guarantee Reserve (RGR) 3,361 -

been derived consistently, in all material respects, from the 2017

Re-insurance reserve - 394

consolidated financial statements of Vidanova Pension Fund General Reserve 77,976 17,044

Total technical and other designated reserves: 100,196 77,556

Foundation.

Minority interest third parties 20,077 31,415

Provision obligations

Consolidated Financial Highlights Provision Pension Obligations 741,061 715,223

Pension Capital DC Plan (Spaarkapitaal) 64,724 53,952

The consolidated financial highlights do not contain all the 805,785 769,175

disclosures required by the Accounting principles Generally Accepted Long term debt 4,850 6,971

in the Netherlands. Reading the consolidated financial highlights Non-current Liabilities:

and the auditor’s report thereon is not a substitute for reading the Funds entrusted 108,135 92,678

Deferred tax liability 1,298 1,953

audited consolidated financial statements and the auditor’s report 109,433 94,631

thereon. The consolidated financial highlights and the consolidated Current Liabilities:

Funds entrusted 249,105 295,494

financial statements do not reflect the effects of events that occurred

Accruals and deferred income 4,563 4,375

subsequent to the date of our report on the audited consolidated Due to banks 15 126

financial statements. 253,683 299,995

Other short term liabilities and accrued expenses 9,075 6,437

The audited consolidated financial statements Total Pension Capital and Liabilities 1,303,099 1,286,180

We expressed an unmodified audit opinion on these 2017 con so-

lidated financial statements in our report dated 24 April 2018. Consolidated Profit and Loss Statement for the year ended

December 31, 2017

Management’s responsibility for the consolidated financial

2017 2016

highlights

(figures in thousands Antillean guilders)

Management is responsible for the preparation of the consolidated

Income

financial highlights in accordance with the accounting policies as

Employers’ and employees’ Contributions 32,546 27,494

applied in the 2017 consolidated financial statements.

Investment income

Net investment income 11,169 15,249

Auditors’ responsibility Fair value gains and losses 47,023 16,220

58,192 31,469

Our responsibility is to express an opinion on whether these

Bank Operating Income 21,531 20,991

consolidated financial highlights are consistent, in all material

Interest current accounts sponsors 577 360

respects, with the audited consolidated financial statements based Lease Income 116 159

on our procedures, which were conducted in accordance with Other income 1,719 1,130

International Standard on Auditing (ISA) 810 (Revised), Engagement TOTAL INCOME 114,681 81,603

to Report on Summary Financial Statements. Expenses

Pension payments 25,996 24,256

Organizational expenses 25,548 22,979

Curaçao, 2 August 2018 Amortization Intangible Assets 1,444 1,148

61306086 112/22138 Addition to bad debt provision 2,249 1,000

TOTAL EXPENSES 55,237 49,383

for Ernst & Young Accountants

Minority interest 250 (831)

Net operational income before additions to provisions 59,694 31,389

Movements in Technical Provisions (VPV) and VAS 25,838 33,076

Movements in Accrued Savings (Spaarkapitaal) 10,772 8,314

Redemption Pension Right DC 140 346

Net income after additions to provisions 22,944 (10,347)

E.R. Statius van Eps CPA C. Smorenburg RA AA Income Tax Expenses (301) (813)

Net income after additions to provisions

and after tax 22,643 (11,160)