Page 7 - HOH

P. 7

Saturday 18 June 2022 locAl

A10

The reserve requirement was raised by two percentage points as

of the 1st of May 2022

in order to further mop up commercial banks’ excess liquidity

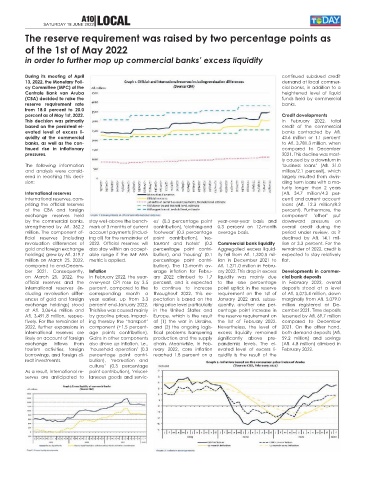

During its meeting of April continued subdued credit

13, 2022, the Monetary Poli- demand at local commer-

cy Committee (MPC) of the cial banks, in addition to a

Centrale Bank van Aruba heightened level of liquid

(CBA) decided to raise the funds held by commercial

reserve requirement rate banks.

from 18.0 percent to 20.0

percent as of May 1st, 2022. Credit developments

This decision was primarily In February 2022, total

based on the persistent el- credit of the commercial

evated level of excess li- banks contracted by Afl.

quidity at the commercial 43.6 million or 1.1 percent

banks, as well as the con- to Afl. 3,781.3 million, when

tinued rise in inflationary compared to December

pressures. 2021. This decline was most-

ly caused by a downturn in

The following information ‘business loans’ (Afl. 31.0

and analysis were consid- million/2.1 percent), which

ered in reaching this deci- largely resulted from dwin-

sion: dling term loans with a ma-

turity longer than 2 years

International reserves (Afl. 34.7 million/4.2 per-

International reserves, com- cent) and current account

prising the official reserves loans (Afl. 12.3 million/8.2

of the CBA and foreign percent). Furthermore, the

exchange reserves held component ‘other’ put

by the commercial banks, stay well-above the bench- es’ (0.3 percentage point year-over-year basis and downward pressure on

strengthened by Afl. 362.2 mark of 3 months of current contribution), ‘clothing and 0.3 percent on 12-month overall credit during the

million. The component of- account payments (includ- footwear’ (0.2 percentage average basis. period under review, as it

ficial reserves (including ing oil) for the remainder of point contribution), ‘res- declined by Afl. 14.1 mil-

revaluation differences of 2022. Official reserves will taurant and hotels’ (0.2 Commercial bank liquidity lion or 3.3 percent. For the

gold and foreign exchange also stay within an accept- percentage point contri- Aggregated excess liquid- remainder of 2022, credit is

holdings) grew by Afl. 319.7 able range if the IMF ARA bution), and ‘housing’ (0.1 ity fell from Afl. 1,320.5 mil- expected to stay relatively

million on March 25, 2022, metric is applied. percentage point contri- lion in December 2021 to flat.

compared to end-Decem- bution). The 12-month av- Afl. 1,271.0 million in Febru-

ber 2021. Consequently, Inflation erage inflation for Febru- ary 2022. This drop in excess Developments in commer-

on March 25, 2022, the In February 2022, the year- ary 2022 climbed to 1.7 liquidity was mainly due cial bank deposits

official reserves and the over-year CPI rose by 3.5 percent, and is expected to the one percentage In February 2022, overall

international reserves (in- percent, compared to the to continue to increase point uptick in the reserve deposits stood at a level

cluding revaluation differ- corresponding month a throughout 2022. This ex- requirement on the 1st of of Afl. 5,073.4 million, down

ences of gold and foreign year earlier, up from 3.3 pectation is based on the January 2022 and, subse- marginally from Afl. 5,079.0

exchange holdings) stood percent end-January 2022. rising price level particularly quently, another one per- million registered at De-

at Afl. 3,064.6 million and This hike was caused mainly in the United States and centage point increase in cember 2021. Time deposits

Afl. 3,491.8 million, respec- by gasoline prices, impact- Europe, which is the result the reserve requirement on lessened by Afl. 69.7 million

tively. For the remainder of ing thereby the ‘transport’ of (1) the war in Ukraine, the 1st of February 2022. compared to December

2022, further expansions in component (+1.5 percent- and (2) the ongoing logis- Nevertheless, the level of 2021. On the other hand,

international reserves are age points contribution). tical problems hampering excess liquidity remained both demand deposits (Afl.

likely on account of foreign Gains in other components production and the supply significantly above pre- 59.2 million) and savings

exchange inflows from also drove up inflation, i.e., chain. Meanwhile, in Feb- pandemic levels. The el- (Afl. 4.8 million) climbed in

tourism activities, foreign ‘household operation’ (0.3 ruary 2022, core inflation evated level of excess li- February 2022.

borrowings, and foreign di- percentage point contri- reached 1.8 percent on a quidity is the result of the

rect investments. bution), ‘recreation and

culture’ (0.3 percentage

As a result, international re- point contribution), ‘miscel-

serves are anticipated to laneous goods and servic-