Page 7 - ANTILL DGB

P. 7

Antilliaans Dagblad Donderdag 28 juni 2018 ADVERTENTIE 7

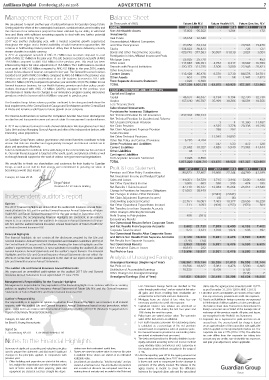

Management Report 2017 Balance Sheet

(In Thousands of ANG)

ASSETS 2017 2016 2017 2016 2017 2016

Non-Admissable Assets 17,803 95,552 - 1,284 - 172

Investments:

Real Estate 38,654 32,648 - -

70,056 63,314 - - 20,583 19,470

continue to hold leading market positions in all key lines of business delivering a steady Stocks 134,823 86,473 - - 728 727

stream of profi ts in a stable currency. 429,745 377,583 50,997 51,039 3,024 3,024

In 2017 an aggregated net profi t of ANG 31.2 Million was recorded compared to a net - - - -

Mortgage Loans 25,025 25,770 - - - 453

117,884 106,391 2,784 8,317 19,582 16,789

120,173 121,235 3,500 3,500 22,945 25,821

- - - - - -

caused by less release of reserves compared to last year. The General Insurance business

Current Assets 115,428 85,476 6,570 5,730 88,578 54,701

601 378 19 58 1,947 2,823

From Separate Accounts Statement 7,028 6,890 -

ANG 23.1 Million (39.9%) compared to previous year and ANG 3.6 (8.7%) Million for our

TOTAL 0 , 1 7 2 , 7 2 0 , 1 0 0 7 , 1 1 0 6 8 , 3 7 0 6 9 , 9 2 1 8 5 3 , 7 8 1 7 2 9 , 3 8 0

EQUITY, PROVISIONS AND LIABILITIES

The decrease is mainly due to changes in our reinsurance program causing reinsurance

Capital and Surplus

Capital 46,637 46,637 6,194 6,194 32,730 32,730

Surplus 157,640 146,787 35,499 38,286 18,504 18,556

Less Treasury Stock - - - - - -

Subordinated Instruments - - - - - -

Provisions for Insurance Obligations

Net Technical Provision for Life Insurances 837,903 786,314 - - - -

an objective and transparent manner and are not subject to management’s undue infl uence. Net Technical Provision for Accident and Sickness - - - - - -

Net Unearned Premium Provision - - 3 4 11,360 11,487

Net Claim Provision - - 4,535 3,778 20,338 19,235

Net Claim Adjustment Expense Provision - - 288 292 - -

interesting value propositions. Funds Provision - - - - - -

- - 11,949 14,892 - -

At Guardian Group Fatum, various governance and control functions coordinate to help 6,285 4,704 - - - -

- - 547 533 472 528

place and operating eff ectively. Current Liabilities 21,683 10,327 4,855 5,949 73,983 41,444

44 51 - - - -

Contingent Liabilities - - - - - -

From Separate Accounts Statement 7,028 6,890 - - - -

TOTAL 0 , 1 7 2 , 7 2 0 , 1 0 0 7 , 1 1 6 0 8 , 3 7 0 6 9 , 9 2 1 8 5 3 , 7 8 1 7 2 9 , 3 8 0

Profi t & Loss Statement 2017 2016 2017 2016 2017 2016

becoming a world-class insurer.

80,873 57,807 19,860 27,144 44,789 41,189

Net Investment Income and Realized Capital

Curaçao, 22 June 2018

Gains and Losses 44,051 54,729 3,715 3,446 5,600 4,400

Diego Fränkel 1,680 683 580 595 474 185

President & CEO Fatum Holding Net Benefi ts / Claims Incurred 47,719 36,127 12,084 15,264 25,051 21,640

Change In Provisions for Insurance Obligations 51,603 38,449 - - - -

Independent auditor’s report Net Claim Adjustment Expenses Incurred - - (2.943) (2.647) - -

(4)

-

-

(6)

-

-

Underwriting Expenses Incurred 22,761 16,081 7,463 10,377 20,656 16,228

Opinion

311 1,093 (404) (253) (970) 504

Net Transfers to or from Separate Accounts - - - - - -

- - - - - -

Profi t Sharing to Policyholders 408 (261) - - - -

Extraordinary Results - - - - - -

Net Operational Results Before Corporate Taxes

and Net Results From Separate Accounts 3,802 21,730 7,959 8,450 6,126 7,402

and Fatum General Insurance N.V.

Corporate Taxes Incurred 673 3,121 1,978 1,974 536 597

Financial highlights

and Before Net Results From Separate Accounts 3,129 18,609 5,981 6,476 5,590 6,805

General Insurance Annual Statement Composition and Valuation Guidelines (2015) of Net Results from Separate Accounts (176) (14) - - - -

Net Operational Results 2,953 18,595 5,981 6,476 5,590 6,805

Net Unrealized Gains or Losses 16,643 232 - - - -

Net Profi t or Loss 19,596 18,827 5,981 6,476 5,590 6,805

Analysis of Unassigned Earnings

Life and General Insurance Annual Statements. Unassigned Earnings (Beginning of Year) 138,561 119,734 38,286 31,810 18,556 11,744

Net Profi t or Loss 19,596 18,827 5,981 6,476 5,590 6,805

The audited Life and General Insurance Annual Statements

Distribution of Accumulated Earnings 10,326 - 8,768 - 5,128 -

- - - - (514) 7

Insurance Annual Statements in our report dated 22 June 2018.

Unassigned Earnings (End of Year) 147,831 138,561 35,499 38,286 18,504 18,556

e t a t S s s o L m e g i e r o F . t n b n o n e fi i s s a l c e r a s d r i a f “ s a d claims ratio. The ageing reserve amounts to ANG 10,775

as per December 31, 2017 (2016: ANG 13,613).

All gains and losses resulting from revaluation are

less any necessary provisions for credit risk exposure.

Auditor’s Responsibility 4. Mortgage loans are stated at face value less any 12. Assets and liabilities in foreign currencies are expressed

necessary provision for credit risk exposure.

5. Capitalized interest rate rebates are amortized at

Engagements to

Report on Summary Financial Statements.

6. Policy loans are stated at face value. The surrender

Curaçao, 22 June 2018 13. Corporate tax is expensed to profi t and loss on an

for Ernst & Young Accountants accrual basis. The accrued profi t tax charge is based

Signed by earned based on experience ratios of previous years.

C. Smorenburg RA AA F. de Windt-Ferreira CPA 8. For General Insurance provision for outstanding claims corporate tax rate is 22% (2016: 22%). The eff ective

are stated at estimated cost per event.

N 9. The (reinsured) provision for life policy liabilities is prin- account any tax credits, non-deductible tax expenses

and prior year adjustment, where applicable.

using mortality tables and interest rates customary in

Summary of signifi cant accounting and valuation principles

2. Shares are stated at market value. In case no fair value 3-4%.

previous year: realizable value.

3. Local bonds are classifi ed as “held to maturity” and are

stated at amortized cost. The amortization of premium

equipment are stated at cost less straight line depre-