Page 16 - FY 2021-2022 Budget_Neat 2

P. 16

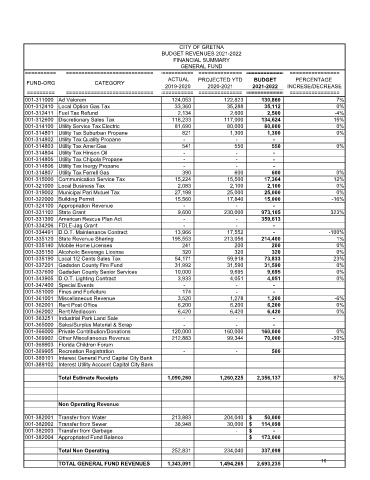

CITY OF GRETNA

BUDGET REVENUES 2021-2022

FINANCIAL SUMMARY

GENERAL FUND

========== ============================ =========== ============== ============= ================

ACTUAL PROJECTED YTD BUDGET PERCENTAGE

FUND-ORG CATEGORY

2019-2020 2020-2021 2021-2022 INCRESE/DECREASE

========= ============================ =========== ============== ============= ================

001-311000 Ad Valorem 124,053 122,823 130,860 7%

001-312410 Local Option Gas Tax 33,360 35,288 35,112 0%

001-312411 Fuel Tax Refund 2,134 2,600 2,500 -4%

001-312600 Discretionary Sales Tax 118,233 117,000 134,624 15%

001-314100 Utility Service Tax Electric 81,690 80,000 80,000 0%

001-314801 Utility Tax Suburban Propane 821 1,300 1,300 0%

001-314802 Utility Tax Quality Propane - - -

001-314803 Utility Tax AmeriGas 541 550 550 0%

001-314804 Utility Tax Hinson Oil - - -

001-314805 Utility Tax Chipola Propane - - -

001-314806 Utility Tax Inergy Propane - - -

001-314807 Utility Tax Ferrell Gas 390 600 600 0%

001-315000 Communication Service Tax 15,224 15,500 17,364 12%

001-321000 Local Business Tax 2,083 2,100 2,100 0%

001-319002 Municipal Pari Mutuel Tax 27,198 25,000 25,000 0%

001-322000 Building Permit 15,560 17,840 15,000 -16%

001-324100 Appropriation Revenue - - -

001-331102 State Grant 9,600 230,000 973,105 323%

001-331390 American Rescue Plan Act - - 359,613

001-334206 FDLE-Jag Grant - - -

001-334491 D.O.T. Maintenance Contract 13,966 17,552 - -100%

001-335120 State Revenue Sharing 195,553 213,056 214,400 1%

001-335140 Mobile Home Licenses 241 200 200 0%

001-335150 Alcoholic Beverage License 320 320 320 0%

001-335190 Local 1/2 Cents Sales Tax 54,171 59,918 73,833 23%

001-337201 Gadsden County Fire Fund 31,992 31,590 31,590 0%

001-337600 Gadsden County Senior Services 10,000 9,695 9,695 0%

001-343905 D.O.T. Lighting Contract 3,933 4,051 4,051 0%

001-347400 Special Events - - -

001-351000 Fines and Forfeiture 174 - -

001-361001 Miscellaneous Revenue 3,520 1,278 1,200 -6%

001-362001 Rent Post Office 6,200 6,200 6,200 0%

001-362002 Rent Mediacom 6,420 6,420 6,420 0%

001-363251 Industrial Park Land Sale - - -

001-365000 Sales/Surplus Material & Scrap - - -

001-366000 Private Contribution/Donations 120,000 160,000 160,000 0%

001-369902 Other Miscellaneous Revenue 212,883 99,344 70,000 -30%

001-369903 Florida Children Forum

001-369905 Recreation Registration - - 500

001-389101 Interest General Fund Capital City Bank

001-389102 Interest Utility Account Capital City Bank

Total Estimate Receipts 1,090,260 1,260,225 2,356,137 87%

Non Operating Revenue

001-382001 Transfer from Water 213,883 204,040 $ 50,000

001-382002 Transfer from Sewer 38,948 30,000 $ 114,098

001-382003 Transfer from Garbage - $ -

001-382004 Appropriated Fund Balance $ 173,000

Total Non Operating 252,831 234,040 337,098

TOTAL GENERAL FUND REVENUES 1,343,091 1,494,265 2,693,235 16