Page 41 - IRS Employer Tax Guide

P. 41

9:19 - 23-Dec-2019

Page 40 of 48

Fileid: … ations/P15/2020/A/XML/Cycle07/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

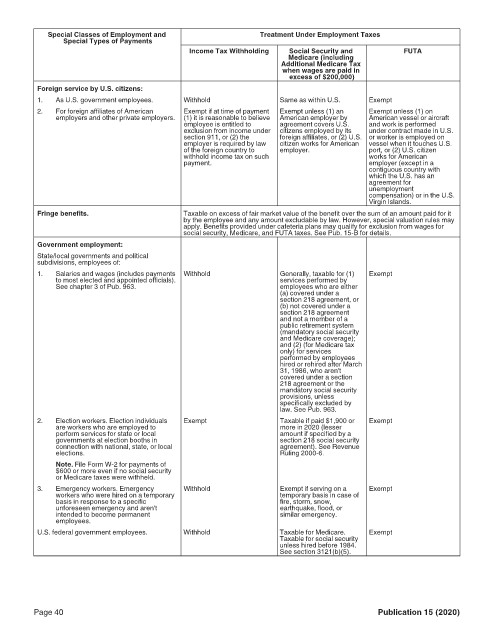

Special Classes of Employment and Treatment Under Employment Taxes

Special Types of Payments

Social Security and

Income Tax Withholding Medicare (including FUTA

Additional Medicare Tax

when wages are paid in

excess of $200,000)

Foreign service by U.S. citizens:

1. As U.S. government employees. Withhold Same as within U.S. Exempt

2. For foreign affiliates of American Exempt if at time of payment Exempt unless (1) an Exempt unless (1) on

employers and other private employers. (1) it is reasonable to believe American employer by American vessel or aircraft

employee is entitled to agreement covers U.S. and work is performed

exclusion from income under citizens employed by its under contract made in U.S.

section 911, or (2) the foreign affiliates, or (2) U.S. or worker is employed on

employer is required by law citizen works for American vessel when it touches U.S.

of the foreign country to employer. port, or (2) U.S. citizen

withhold income tax on such works for American

payment. employer (except in a

contiguous country with

which the U.S. has an

agreement for

unemployment

compensation) or in the U.S.

Virgin Islands.

Fringe benefits. Taxable on excess of fair market value of the benefit over the sum of an amount paid for it

by the employee and any amount excludable by law. However, special valuation rules may

apply. Benefits provided under cafeteria plans may qualify for exclusion from wages for

social security, Medicare, and FUTA taxes. See Pub. 15-B for details.

Government employment:

State/local governments and political

subdivisions, employees of:

1. Salaries and wages (includes payments Withhold Generally, taxable for (1) Exempt

to most elected and appointed officials). services performed by

See chapter 3 of Pub. 963. employees who are either

(a) covered under a

section 218 agreement, or

(b) not covered under a

section 218 agreement

and not a member of a

public retirement system

(mandatory social security

and Medicare coverage);

and (2) (for Medicare tax

only) for services

performed by employees

hired or rehired after March

31, 1986, who aren't

covered under a section

218 agreement or the

mandatory social security

provisions, unless

specifically excluded by

law. See Pub. 963.

2. Election workers. Election individuals Exempt Taxable if paid $1,900 or Exempt

are workers who are employed to more in 2020 (lesser

perform services for state or local amount if specified by a

governments at election booths in section 218 social security

connection with national, state, or local agreement). See Revenue

elections. Ruling 2000-6.

Note. File Form W-2 for payments of

$600 or more even if no social security

or Medicare taxes were withheld.

3. Emergency workers. Emergency Withhold Exempt if serving on a Exempt

workers who were hired on a temporary temporary basis in case of

basis in response to a specific fire, storm, snow,

unforeseen emergency and aren't earthquake, flood, or

intended to become permanent similar emergency.

employees.

U.S. federal government employees. Withhold Taxable for Medicare. Exempt

Taxable for social security

unless hired before 1984.

See section 3121(b)(5).

Page 40 Publication 15 (2020)