Page 49 - IRS Employer Tax Guide

P. 49

9:19 - 23-Dec-2019

Page 48 of 48

Fileid: … ations/P15/2020/A/XML/Cycle07/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

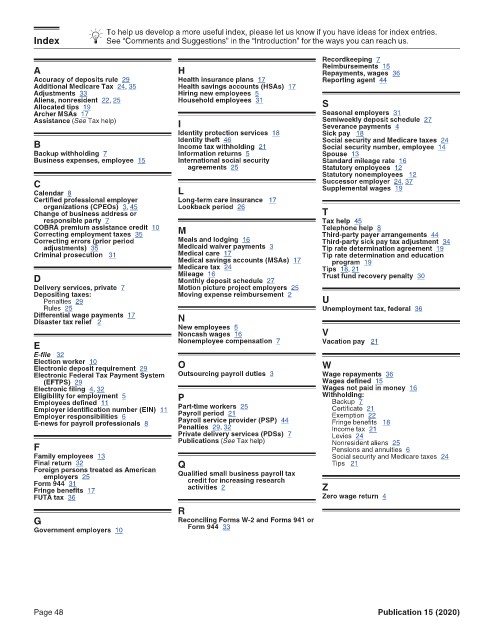

To help us develop a more useful index, please let us know if you have ideas for index entries.

Index See “Comments and Suggestions” in the “Introduction” for the ways you can reach us.

Recordkeeping 7

A H Reimbursements 15

Repayments, wages 36

Accuracy of deposits rule 29 Health insurance plans 17 Reporting agent 44

Additional Medicare Tax 24, 35 Health savings accounts (HSAs) 17

Adjustments 33 Hiring new employees 5

Aliens, nonresident 22, 25 Household employees 31 S

Allocated tips 19

Archer MSAs 17 Seasonal employers 31

Assistance (See Tax help) I Semiweekly deposit schedule 27

Severance payments 4

Identity protection services 18 Sick pay 18

B Identity theft 46 Social security and Medicare taxes 24

Income tax withholding 21

Social security number, employee 14

Backup withholding 7 Information returns 5 Spouse 13

Business expenses, employee 15 International social security Standard mileage rate 16

agreements 25 Statutory employees 12

Statutory nonemployees 12

C Successor employer 24, 37

Supplemental wages 19

Calendar 8 L

Certified professional employer Long-term care insurance 17

organizations (CPEOs) 3, 45 Lookback period 26

Change of business address or T

responsible party 7 Tax help 45

COBRA premium assistance credit 10 M Telephone help 8

Correcting employment taxes 35 Third-party payer arrangements 44

Correcting errors (prior period Meals and lodging 16 Third-party sick pay tax adjustment 34

adjustments) 35 Medicaid waiver payments 3 Tip rate determination agreement 19

Criminal prosecution 31 Medical care 17 Tip rate determination and education

Medical savings accounts (MSAs) 17 program 19

Medicare tax 24 Tips 18, 21

D Mileage 16 Trust fund recovery penalty 30

Monthly deposit schedule 27

Delivery services, private 7 Motion picture project employers 25

Depositing taxes: Moving expense reimbursement 2

Penalties 29 U

Rules 25 Unemployment tax, federal 36

Differential wage payments 17 N

Disaster tax relief 2

New employees 5

Noncash wages 16 V

E Nonemployee compensation 7 Vacation pay 21

E-file 32

Election worker 10 O W

Electronic deposit requirement 29

Electronic Federal Tax Payment System Outsourcing payroll duties 3 Wage repayments 36

(EFTPS) 29 Wages defined 15

Electronic filing 4, 32 Wages not paid in money 16

Eligibility for employment 5 P Withholding:

Employees defined 11 Backup 7

Employer identification number (EIN) 11 Part-time workers 25 Certificate 21

Payroll period 21

Employer responsibilities 6 Exemption 22

E-news for payroll professionals 8 Payroll service provider (PSP) 44 Fringe benefits 18

Penalties 29, 32

Private delivery services (PDSs) 7 Income tax 21

Levies 24

F Publications (See Tax help) Nonresident aliens 25

Pensions and annuities 6

Family employees 13 Social security and Medicare taxes 24

Final return 32 Q Tips 21

Foreign persons treated as American

employers 25 Qualified small business payroll tax

Form 944 31 credit for increasing research Z

Fringe benefits 17 activities 2

FUTA tax 36 Zero wage return 4

R

G Reconciling Forms W-2 and Forms 941 or

Government employers 10 Form 944 33

Page 48 Publication 15 (2020)