Page 111 - IRS Business Tax Credits Guide

P. 111

Page 32 of 38

Fileid: … ns/i8933/202212/a/xml/cycle06/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

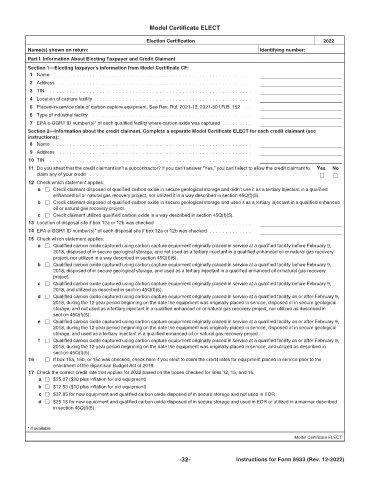

Model Certificate ELECT 12:51 - 5-Jan-2023

Election Certification 2022

Name(s) shown on return: Identifying number:

Part I. Information About Electing Taxpayer and Credit Claimant

Section 1—Electing taxpayer's information from Model Certificate CF:

1 Name . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 TIN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Location of capture facility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Placed-in-service date of carbon capture equipment. See Rev. Rul. 2021-13, 2021-30 I.R.B. 152 . .

6 Type of industrial facility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 EPA e-GGRT ID number(s)* of each qualified facility where carbon oxide was captured . . . . . . . . .

Section 2—Information about the credit claimant. Complete a separate Model Certificate ELECT for each credit claimant (see

instructions):

8 Name . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 Address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 TIN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 Do you attest that the credit claimant isn’t a subcontractor? If you can’t answer “Yes,” you can’t elect to allow the credit claimant to Yes No

claim any of your credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 Check which statement applies:

a Credit claimant disposed of qualified carbon oxide in secure geological storage and didn’t use it as a tertiary injectant in a qualified

enhanced oil or natural gas recovery project, nor utilized it in a way described in section 45Q(f)(5).

b Credit claimant disposed of qualified carbon oxide in secure geological storage and used it as a tertiary injectant in a qualified enhanced

oil or natural gas recovery project.

c Credit claimant utilized qualified carbon oxide in a way described in section 45Q(f)(5).

13 Location of disposal site if box 12a or 12b was checked . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14 EPA e-GGRT ID number(s)* of each disposal site if box 12a or 12b was checked . . . . . . . . . . . . .

15 Check which statement applies:

a Qualified carbon oxide captured using carbon capture equipment originally placed in service at a qualified facility before February 9,

2018, disposed of in secure geological storage, and not used as a tertiary injectant in a qualified enhanced oil or natural gas recovery

project, nor utilized in a way described in section 45Q(f)(5).

b Qualified carbon oxide captured using carbon capture equipment originally placed in service at a qualified facility before February 9,

2018, disposed of in secure geological storage, and used as a tertiary injectant in a qualified enhanced oil or natural gas recovery

project.

c Qualified carbon oxide captured using carbon capture equipment originally placed in service at a qualified facility before February 9,

2018, and utilized as described in section 45Q(f)(5).

d Qualified carbon oxide captured using carbon capture equipment originally placed in service at a qualified facility on or after February 9,

2018, during the 12-year period beginning on the date the equipment was originally placed in service, disposed of in secure geological

storage, and not used as a tertiary injectant in a qualified enhanced oil or natural gas recovery project, nor utilized as described in

section 45Q(f)(5).

e Qualified carbon oxide captured using carbon capture equipment originally placed in service at a qualified facility on or after February 9,

2018, during the 12-year period beginning on the date the equipment was originally placed in service, disposed of in secure geological

storage, and used as a tertiary injectant in a qualified enhanced oil or natural gas recovery project.

f Qualified carbon oxide captured using carbon capture equipment originally placed in service at a qualified facility on or after February 9,

2018, during the 12-year period beginning on the date the equipment was originally placed in service, and utilized as described in

section 45Q(f)(5).

16 If box 15a, 15b, or 15c was checked, check here if you elect to claim the credit rates for equipment placed in service prior to the

enactment of the Bipartisan Budget Act of 2018.

17 Check the correct credit rate that applies for 2022 based on the boxes checked for lines 12, 15, and 16.

a $25.07 ($20 plus inflation for old equipment)

b $12.53 ($10 plus inflation for old equipment)

c $37.85 for new equipment and qualified carbon oxide disposed of in secure storage and not used in EOR

d $25.15 for new equipment and qualified carbon oxide disposed of in secure storage and used in EOR or utilized in a manner described

in section 45Q(f)(5)

* if available

Model Certificate ELECT

-32- Instructions for Form 8933 (Rev. 12-2022)