Page 96 - IRS Business Tax Credits Guide

P. 96

12:51 - 5-Jan-2023

Page 17 of 38

Fileid: … ns/i8933/202212/a/xml/cycle06/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Page 4

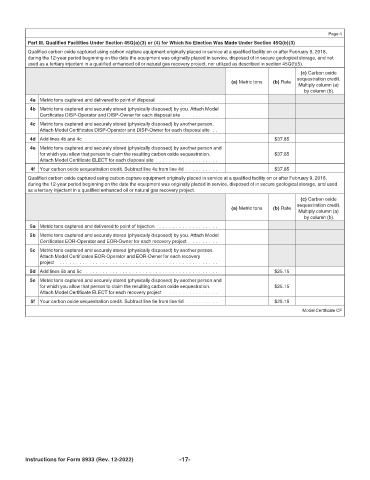

Part III. Qualified Facilities Under Section 45Q(a)(3) or (4) for Which No Election Was Made Under Section 45Q(b)(3)

Qualified carbon oxide captured using carbon capture equipment originally placed in service at a qualified facility on or after February 9, 2018,

during the 12-year period beginning on the date the equipment was originally placed in service, disposed of in secure geological storage, and not

used as a tertiary injectant in a qualified enhanced oil or natural gas recovery project, nor utilized as described in section 45Q(f)(5).

(c) Carbon oxide

(a) Metric tons (b) Rate sequestration credit.

Multiply column (a)

by column (b).

4a Metric tons captured and delivered to point of disposal . . . . . . . . . . . . . . . . . .

4b Metric tons captured and securely stored (physically disposed) by you. Attach Model

Certificates DISP-Operator and DISP-Owner for each disposal site . . . . . . . . . . .

4c Metric tons captured and securely stored (physically disposed) by another person.

Attach Model Certificates DISP-Operator and DISP-Owner for each disposal site . .

4d Add lines 4b and 4c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $37.85

4e Metric tons captured and securely stored (physically disposed) by another person and

for which you allow that person to claim the resulting carbon oxide sequestration. $37.85

Attach Model Certificate ELECT for each disposal site . . . . . . . . . . . . . . . . . . .

4f Your carbon oxide sequestration credit. Subtract line 4e from line 4d . . . . . . . . . . $37.85

Qualified carbon oxide captured using carbon capture equipment originally placed in service at a qualified facility on or after February 9, 2018,

during the 12-year period beginning on the date the equipment was originally placed in service, disposed of in secure geological storage, and used

as a tertiary injectant in a qualified enhanced oil or natural gas recovery project.

(c) Carbon oxide

sequestration credit.

(a) Metric tons (b) Rate

Multiply column (a)

by column (b).

5a Metric tons captured and delivered to point of injection . . . . . . . . . . . . . . . . . .

5b Metric tons captured and securely stored (physically disposed) by you. Attach Model

Certificates EOR-Operator and EOR-Owner for each recovery project . . . . . . . . .

5c Metric tons captured and securely stored (physically disposed) by another person.

Attach Model Certificates EOR-Operator and EOR-Owner for each recovery

project . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5d Add lines 5b and 5c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $25.15

5e Metric tons captured and securely stored (physically disposed) by another person and

for which you allow that person to claim the resulting carbon oxide sequestration. $25.15

Attach Model Certificate ELECT for each recovery project . . . . . . . . . . . . . . . .

5f Your carbon oxide sequestration credit. Subtract line 5e from line 5d . . . . . . . . . . $25.15

Model Certificate CF

Instructions for Form 8933 (Rev. 12-2022) -17-