Page 165 - Individual Forms & Instructions Guide

P. 165

Page 7 of 6

Fileid: … ms/f1040es/2023/a/xml/cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2023 Tax Rate Schedules 11:55 - 30-Nov-2022

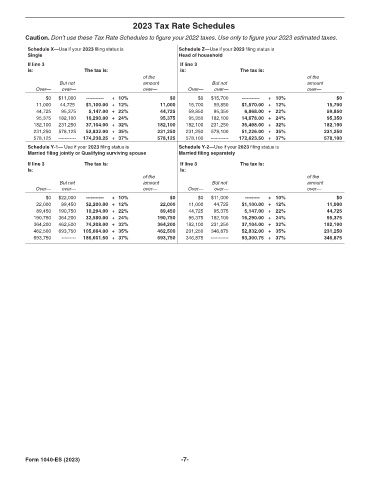

Caution. Don’t use these Tax Rate Schedules to figure your 2022 taxes. Use only to figure your 2023 estimated taxes.

Schedule X—Use if your 2023 filing status is Schedule Z—Use if your 2023 filing status is

Single Head of household

If line 3 If line 3

is: The tax is: is: The tax is:

of the of the

But not amount But not amount

Over— over— over— Over— over— over—

$0 $11,000 ----------- + 10% $0 $0 $15,700 ----------- + 10% $0

11,000 44,725 $1,100.00 + 12% 11,000 15,700 59,850 $1,570.00 + 12% 15,700

44,725 95,375 5,147.00 + 22% 44,725 59,850 95,350 6,868.00 + 22% 59,850

95,375 182,100 16,290.00 + 24% 95,375 95,350 182,100 14,678.00 + 24% 95,350

182,100 231,250 37,104.00 + 32% 182,100 182,100 231,250 35,498.00 + 32% 182,100

231,250 578,125 52,832.00 + 35% 231,250 231,250 578,100 51,226.00 + 35% 231,250

578,125 ----------- 174,238.25 + 37% 578,125 578,100 ----------- 172,623.50 + 37% 578,100

Schedule Y-1— Use if your 2023 filing status is Schedule Y-2—Use if your 2023 filing status is

Married filing jointly or Qualifying surviving spouse Married filing separately

If line 3 The tax is: If line 3 The tax is:

is: is:

of the of the

But not amount But not amount

Over— over— over— Over— over— over—

$0 $22,000 ----------- + 10% $0 $0 $11,000 --------- + 10% $0

22,000 89,450 $2,200.00 + 12% 22,000 11,000 44,725 $1,100.00 + 12% 11,000

89,450 190,750 10,294.00 + 22% 89,450 44,725 95,375 5,147.00 + 22% 44,725

190,750 364,200 32,580.00 + 24% 190,750 95,375 182,100 16,290.00 + 24% 95,375

364,200 462,500 74,208.00 + 32% 364,200 182,100 231,250 37,104.00 + 32% 182,100

462,500 693,750 105,664.00 + 35% 462,500 231,250 346,875 52,832.00 + 35% 231,250

693,750 --------- 186,601.50 + 37% 693,750 346,875 ----------- 93,300.75 + 37% 346,875

Form 1040-ES (2023) -7-