Page 221 - Individual Forms & Instructions Guide

P. 221

Userid: CPM

Ok to Print

Draft

i1040x

AH XSL/XML Fileid: … /i1040schd/2022/a/xml/cycle02/source

22:40 - 25-Jul-2022

Page 1 of 17

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury Schema: Leadpct: 100% Pt. size: 10 (Init. & Date) _______

Internal Revenue Service

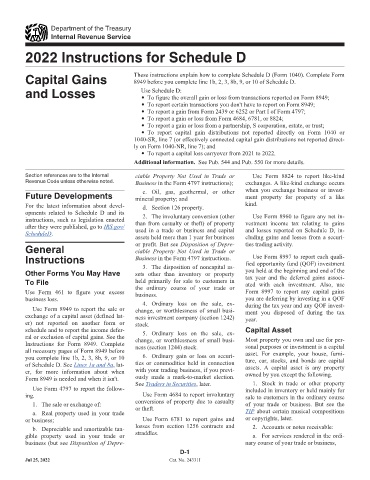

2022 Instructions for Schedule D

Capital Gains These instructions explain how to complete Schedule D (Form 1040). Complete Form

8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of Schedule D.

and Losses Use Schedule D:

• To figure the overall gain or loss from transactions reported on Form 8949;

• To report certain transactions you don't have to report on Form 8949;

• To report a gain from Form 2439 or 6252 or Part I of Form 4797;

• To report a gain or loss from Form 4684, 6781, or 8824;

• To report a gain or loss from a partnership, S corporation, estate, or trust;

• To report capital gain distributions not reported directly on Form 1040 or

1040-SR, line 7 (or effectively connected capital gain distributions not reported direct-

ly on Form 1040-NR, line 7); and

• To report a capital loss carryover from 2021 to 2022.

Additional information. See Pub. 544 and Pub. 550 for more details.

Section references are to the Internal ciable Property Not Used in Trade or Use Form 8824 to report like-kind

Revenue Code unless otherwise noted. Business in the Form 4797 instructions); exchanges. A like-kind exchange occurs

c. Oil, gas, geothermal, or other

Future Developments mineral property; and when you exchange business or invest-

ment property for property of a like

For the latest information about devel- d. Section 126 property. kind.

opments related to Schedule D and its 2. The involuntary conversion (other Use Form 8960 to figure any net in-

instructions, such as legislation enacted

after they were published, go to IRS.gov/ than from casualty or theft) of property vestment income tax relating to gains

used in a trade or business and capital

and losses reported on Schedule D, in-

ScheduleD.

assets held more than 1 year for business cluding gains and losses from a securi-

General or profit. But see Disposition of Depre- ties trading activity.

ciable Property Not Used in Trade or

Instructions Business in the Form 4797 instructions. Use Form 8997 to report each quali-

3. The disposition of noncapital as- fied opportunity fund (QOF) investment

Other Forms You May Have sets other than inventory or property you held at the beginning and end of the

To File held primarily for sale to customers in tax year and the deferred gains associ-

ated with each investment. Also, use

the ordinary course of your trade or

Use Form 461 to figure your excess business. Form 8997 to report any capital gains

business loss. you are deferring by investing in a QOF

4. Ordinary loss on the sale, ex- during the tax year and any QOF invest-

Use Form 8949 to report the sale or change, or worthlessness of small busi-

exchange of a capital asset (defined lat- ness investment company (section 1242) ment you disposed of during the tax

year.

er) not reported on another form or stock.

schedule and to report the income defer- 5. Ordinary loss on the sale, ex- Capital Asset

ral or exclusion of capital gains. See the change, or worthlessness of small busi- Most property you own and use for per-

Instructions for Form 8949. Complete ness (section 1244) stock. sonal purposes or investment is a capital

all necessary pages of Form 8949 before asset. For example, your house, furni-

you complete line 1b, 2, 3, 8b, 9, or 10 6. Ordinary gain or loss on securi- ture, car, stocks, and bonds are capital

of Schedule D. See Lines 1a and 8a, lat- ties or commodities held in connection assets. A capital asset is any property

er, for more information about when with your trading business, if you previ- owned by you except the following.

Form 8949 is needed and when it isn't. ously made a mark-to-market election.

See Traders in Securities, later. 1. Stock in trade or other property

Use Form 4797 to report the follow- included in inventory or held mainly for

ing. Use Form 4684 to report involuntary sale to customers in the ordinary course

conversions of property due to casualty

1. The sale or exchange of: or theft. of your trade or business. But see the

a. Real property used in your trade TIP about certain musical compositions

or business; Use Form 6781 to report gains and or copyrights, later.

b. Depreciable and amortizable tan- losses from section 1256 contracts and 2. Accounts or notes receivable:

gible property used in your trade or straddles. a. For services rendered in the ordi-

business (but see Disposition of Depre- nary course of your trade or business,

D-1

Jul 25, 2022 Cat. No. 24331I