Page 298 - Individual Forms & Instructions Guide

P. 298

16:23 - 13-Oct-2022

Page 4 of 15

Fileid: … /i1040schj/2022/a/xml/cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Schedule D Tax Worksheet to figure the the Foreign Earned Income Tax Work- 2019. If for 2019 you had a capital loss

tax on the amount on line 7. However, if sheet. that resulted in a capital loss carryover

you filed Form 2555 for 2019, you must to 2020, don't reduce the elected farm

first complete the 2019 Foreign Earned When completing the Schedule D income allocated to 2019 by any part of

Income Tax Worksheet, and then use the Tax Worksheet, you must allocate 1/3 of the carryover.

2019 Schedule D Tax Worksheet to fig- the amount on Schedule J, line 2b (and

ure the tax on the amount on line 3 of 1/3 of the amount on line 2c, if any) to

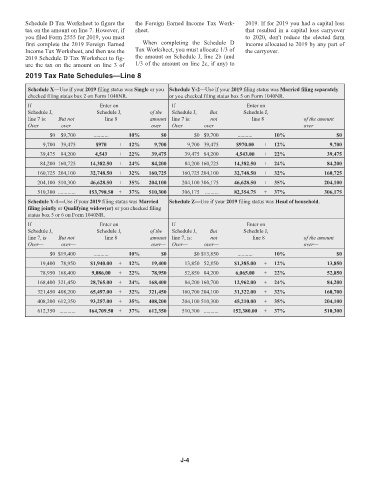

2019 Tax Rate Schedules—Line 8

Schedule X—Use if your 2019 filing status was Single or you Schedule Y-2—Use if your 2019 filing status was Married filing separately

checked filing status box 2 on Form 1040NR. or you checked filing status box 5 on Form 1040NR.

If Enter on If Enter on

Schedule J, Schedule J, of the Schedule J, But Schedule J,

line 7 is: But not line 8 amount line 7 is: not line 8 of the amount

Over— over— over— Over— over— over—

$0 $9,700 ........... 10% $0 $0 $9,700 ........... 10% $0

9,700 39,475 $970 + 12% 9,700 9,700 39,475 $970.00 + 12% 9,700

39,475 84,200 4,543 + 22% 39,475 39,475 84,200 4,543.00 + 22% 39,475

84,200 160,725 14,382.50 + 24% 84,200 84,200 160,725 14,382.50 + 24% 84,200

160,725 204,100 32,748.50 + 32% 160,725 160,725 204,100 32,748.50 + 32% 160,725

204,100 510,300 46,628.50 + 35% 204,100 204,100 306,175 46,628.50 + 35% 204,100

510,300 ............. 153,798.50 + 37% 510,300 306,175 .......... 82,354.75 + 37% 306,175

Schedule Y-1—Use if your 2019 filing status was Married Schedule Z—Use if your 2019 filing status was Head of household.

filing jointly or Qualifying widow(er) or you checked filing

status box 5 or 6 on Form 1040NR.

If Enter on If Enter on

Schedule J, Schedule J, of the Schedule J, But Schedule J,

line 7, is But not line 8 amount line 7, is: not line 8 of the amount

Over— over— over— Over— over— over—

$0 $19,400 ........... 10% $0 $0 $13,850 ........... 10% $0

19,400 78,950 $1,940.00 + 12% 19,400 13,850 52,850 $1,385.00 + 12% 13,850

78,950 168,400 9,086.00 + 22% 78,950 52,850 84,200 6,065.00 + 22% 52,850

168,400 321,450 28,765.00 + 24% 168,400 84,200 160,700 12,962.00 + 24% 84,200

321,450 408,200 65,497.00 + 32% 321,450 160,700 204,100 31,322.00 + 32% 160,700

408,200 612,350 93,257.00 + 35% 408,200 204,100 510,300 45,210.00 + 35% 204,100

612,350 ............ 164,709.50 + 37% 612,350 510,300 ........... 152,380.00 + 37% 510,300

J-4