Page 19 - Tax Guide for Small Business

P. 19

12:18 - 30-Jan-2020

Page 17 of 54

Fileid: … tions/P334/2019/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Form (and Instructions) Sale of a business. The sale of a business usually is not

4797 4797 Sales of Business Property a sale of one asset. Instead, all the assets of the business

are sold. Generally, when this occurs, each asset is trea-

Sch D (Form 1040 or 1040-SR) Sch D (Form 1040 or 1040-SR) Capital Gains and ted as being sold separately for determining the treatment

Losses of gain or loss.

Both the buyer and seller involved in the sale of a busi-

See chapter 12 for information about getting publications ness must report to the IRS the allocation of the sales

and forms. price among the business assets. Use Form 8594, Asset

Acquisition Statement Under Section 1060, to provide this

What Is a Disposition information. The buyer and seller should each attach

Form 8594 to their federal income tax return for the year in

of Property? which the sale occurred.

For more information about the sale of a business, see

A disposition of property includes the following transac- chapter 2 in Pub. 544.

tions.

• You sell property for cash or other property. How Do I Figure

• You exchange property for other property. a Gain or Loss?

• You receive money as a tenant for the cancellation of

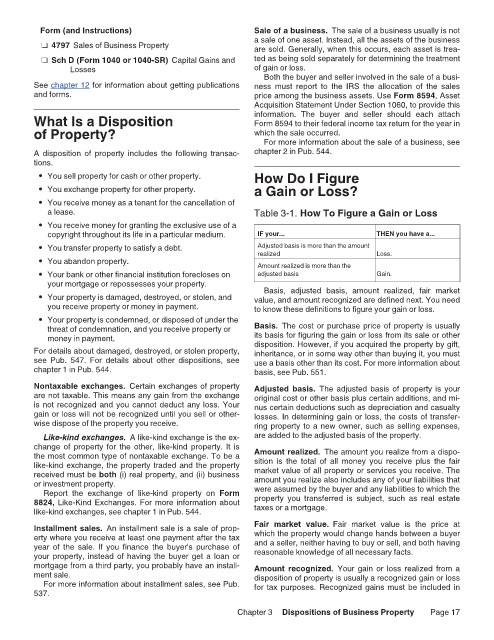

a lease. Table 3-1. How To Figure a Gain or Loss

• You receive money for granting the exclusive use of a

copyright throughout its life in a particular medium. IF your... THEN you have a...

• You transfer property to satisfy a debt. Adjusted basis is more than the amount Loss.

realized

• You abandon property. Amount realized is more than the

• Your bank or other financial institution forecloses on adjusted basis Gain.

your mortgage or repossesses your property.

Basis, adjusted basis, amount realized, fair market

• Your property is damaged, destroyed, or stolen, and value, and amount recognized are defined next. You need

you receive property or money in payment. to know these definitions to figure your gain or loss.

• Your property is condemned, or disposed of under the

threat of condemnation, and you receive property or Basis. The cost or purchase price of property is usually

money in payment. its basis for figuring the gain or loss from its sale or other

For details about damaged, destroyed, or stolen property, disposition. However, if you acquired the property by gift,

inheritance, or in some way other than buying it, you must

see Pub. 547. For details about other dispositions, see use a basis other than its cost. For more information about

chapter 1 in Pub. 544. basis, see Pub. 551.

Nontaxable exchanges. Certain exchanges of property Adjusted basis. The adjusted basis of property is your

are not taxable. This means any gain from the exchange original cost or other basis plus certain additions, and mi-

is not recognized and you cannot deduct any loss. Your nus certain deductions such as depreciation and casualty

gain or loss will not be recognized until you sell or other- losses. In determining gain or loss, the costs of transfer-

wise dispose of the property you receive. ring property to a new owner, such as selling expenses,

Like-kind exchanges. A like-kind exchange is the ex- are added to the adjusted basis of the property.

change of property for the other, like-kind property. It is

the most common type of nontaxable exchange. To be a Amount realized. The amount you realize from a dispo-

like-kind exchange, the property traded and the property sition is the total of all money you receive plus the fair

received must be both (i) real property, and (ii) business market value of all property or services you receive. The

or investment property. amount you realize also includes any of your liabilities that

Report the exchange of like-kind property on Form were assumed by the buyer and any liabilities to which the

8824, Like-Kind Exchanges. For more information about property you transferred is subject, such as real estate

like-kind exchanges, see chapter 1 in Pub. 544. taxes or a mortgage.

Installment sales. An installment sale is a sale of prop- Fair market value. Fair market value is the price at

erty where you receive at least one payment after the tax which the property would change hands between a buyer

year of the sale. If you finance the buyer's purchase of and a seller, neither having to buy or sell, and both having

your property, instead of having the buyer get a loan or reasonable knowledge of all necessary facts.

mortgage from a third party, you probably have an install- Amount recognized. Your gain or loss realized from a

ment sale. disposition of property is usually a recognized gain or loss

For more information about installment sales, see Pub. for tax purposes. Recognized gains must be included in

537.

Chapter 3 Dispositions of Business Property Page 17