Page 4 - Tax Guide for Small Business

P. 4

12:18 - 30-Jan-2020

Page 2 of 54

Fileid: … tions/P334/2019/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

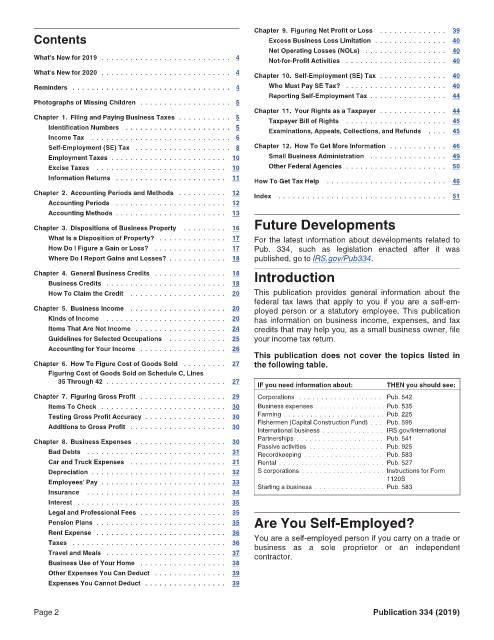

Chapter 9. Figuring Net Profit or Loss . . . . . . . . . . . . . . 39

Contents Excess Business Loss Limitation . . . . . . . . . . . . . . . 40

Net Operating Losses (NOLs) . . . . . . . . . . . . . . . . . 40

What's New for 2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 Not-for-Profit Activities . . . . . . . . . . . . . . . . . . . . . 40

What's New for 2020 . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 Chapter 10. Self-Employment (SE) Tax . . . . . . . . . . . . . . 40

Reminders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 Who Must Pay SE Tax? . . . . . . . . . . . . . . . . . . . . . 40

Reporting Self-Employment Tax . . . . . . . . . . . . . . . . 44

Photographs of Missing Children . . . . . . . . . . . . . . . . . . . 5

Chapter 11. Your Rights as a Taxpayer . . . . . . . . . . . . . . 44

Chapter 1. Filing and Paying Business Taxes . . . . . . . . . . . 5 Taxpayer Bill of Rights . . . . . . . . . . . . . . . . . . . . . 45

Identification Numbers . . . . . . . . . . . . . . . . . . . . . . 5 Examinations, Appeals, Collections, and Refunds . . . . 45

Income Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Self-Employment (SE) Tax . . . . . . . . . . . . . . . . . . . . 8 Chapter 12. How To Get More Information . . . . . . . . . . . . 46

Employment Taxes . . . . . . . . . . . . . . . . . . . . . . . . 10 Small Business Administration . . . . . . . . . . . . . . . . 49

Excise Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 Other Federal Agencies . . . . . . . . . . . . . . . . . . . . . 50

Information Returns . . . . . . . . . . . . . . . . . . . . . . . 11 How To Get Tax Help . . . . . . . . . . . . . . . . . . . . . . . . . 46

Chapter 2. Accounting Periods and Methods . . . . . . . . . . 12 Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

Accounting Periods . . . . . . . . . . . . . . . . . . . . . . . 12

Accounting Methods . . . . . . . . . . . . . . . . . . . . . . . 13

Chapter 3. Dispositions of Business Property . . . . . . . . . 16 Future Developments

What Is a Disposition of Property? . . . . . . . . . . . . . . 17 For the latest information about developments related to

How Do I Figure a Gain or Loss? . . . . . . . . . . . . . . . 17 Pub. 334, such as legislation enacted after it was

Where Do I Report Gains and Losses? . . . . . . . . . . . . 18 published, go to IRS.gov/Pub334.

Chapter 4. General Business Credits . . . . . . . . . . . . . . . 18 Introduction

Business Credits . . . . . . . . . . . . . . . . . . . . . . . . . 18

How To Claim the Credit . . . . . . . . . . . . . . . . . . . . 20 This publication provides general information about the

federal tax laws that apply to you if you are a self-em-

Chapter 5. Business Income . . . . . . . . . . . . . . . . . . . . 20 ployed person or a statutory employee. This publication

Kinds of Income . . . . . . . . . . . . . . . . . . . . . . . . . 20 has information on business income, expenses, and tax

Items That Are Not Income . . . . . . . . . . . . . . . . . . . 24 credits that may help you, as a small business owner, file

Guidelines for Selected Occupations . . . . . . . . . . . . 25 your income tax return.

Accounting for Your Income . . . . . . . . . . . . . . . . . . 26

This publication does not cover the topics listed in

Chapter 6. How To Figure Cost of Goods Sold . . . . . . . . . 27 the following table.

Figuring Cost of Goods Sold on Schedule C, Lines

35 Through 42 . . . . . . . . . . . . . . . . . . . . . . . . . 27 IF you need information about: THEN you should see:

Chapter 7. Figuring Gross Profit . . . . . . . . . . . . . . . . . . 29 Corporations . . . . . . . . . . . . . . . . . . . Pub. 542

Items To Check . . . . . . . . . . . . . . . . . . . . . . . . . . 30 Business expenses . . . . . . . . . . . . . . . . Pub. 535

Testing Gross Profit Accuracy . . . . . . . . . . . . . . . . . 30 Farming . . . . . . . . . . . . . . . . . . . . . . . Pub. 225

Additions to Gross Profit . . . . . . . . . . . . . . . . . . . . 30 Fishermen (Capital Construction Fund) . . . Pub. 595

International business . . . . . . . . . . . . . . IRS.gov/International

Chapter 8. Business Expenses . . . . . . . . . . . . . . . . . . . 30 Partnerships . . . . . . . . . . . . . . . . . . . . Pub. 541

Pub. 925

Bad Debts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31 Passive activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Pub. 583

Recordkeeping .

Car and Truck Expenses . . . . . . . . . . . . . . . . . . . . 31 Rental . . . . . . . . . . . . . . . . . . . . . . . . Pub. 527

Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32 S corporations . . . . . . . . . . . . . . . . . . . Instructions for Form

Employees' Pay . . . . . . . . . . . . . . . . . . . . . . . . . . 33 1120S

Pub. 583

Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34 Starting a business . . . . . . . . . . . . . . . .

Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

Legal and Professional Fees . . . . . . . . . . . . . . . . . . 35

Pension Plans . . . . . . . . . . . . . . . . . . . . . . . . . . . 35 Are You Self-Employed?

Rent Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36 You are a self-employed person if you carry on a trade or

business as a sole proprietor or an independent

Travel and Meals . . . . . . . . . . . . . . . . . . . . . . . . . 37 contractor.

Business Use of Your Home . . . . . . . . . . . . . . . . . . 38

Other Expenses You Can Deduct . . . . . . . . . . . . . . . 39

Expenses You Cannot Deduct . . . . . . . . . . . . . . . . . 39

Page 2 Publication 334 (2019)