Page 46 - Tax Guide for Small Business

P. 46

Page 44 of 54

Fileid: … tions/P334/2019/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

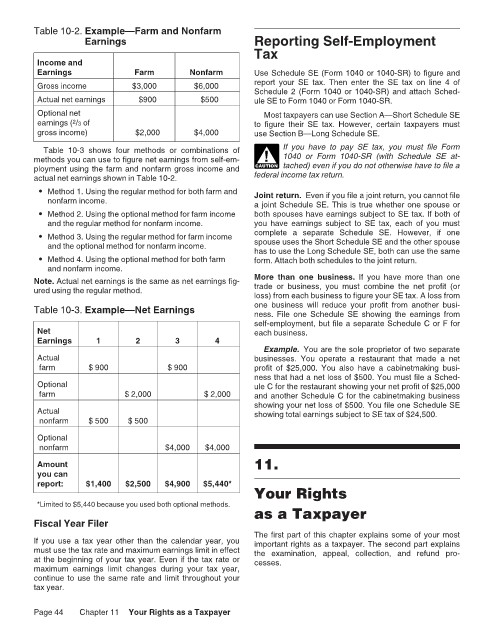

Table 10-2. Example—Farm and Nonfarm 12:18 - 30-Jan-2020

Earnings Reporting Self-Employment

Tax

Income and

Earnings Farm Nonfarm Use Schedule SE (Form 1040 or 1040-SR) to figure and

Gross income $3,000 $6,000 report your SE tax. Then enter the SE tax on line 4 of

Schedule 2 (Form 1040 or 1040-SR) and attach Sched-

Actual net earnings $900 $500 ule SE to Form 1040 or Form 1040-SR.

Optional net Most taxpayers can use Section A—Short Schedule SE

earnings ( /3 of to figure their SE tax. However, certain taxpayers must

2

gross income) $2,000 $4,000 use Section B—Long Schedule SE.

Table 10-3 shows four methods or combinations of If you have to pay SE tax, you must file Form

methods you can use to figure net earnings from self-em- ! 1040 or Form 1040-SR (with Schedule SE at-

ployment using the farm and nonfarm gross income and CAUTION tached) even if you do not otherwise have to file a

actual net earnings shown in Table 10-2. federal income tax return.

• Method 1. Using the regular method for both farm and Joint return. Even if you file a joint return, you cannot file

nonfarm income. a joint Schedule SE. This is true whether one spouse or

• Method 2. Using the optional method for farm income both spouses have earnings subject to SE tax. If both of

and the regular method for nonfarm income. you have earnings subject to SE tax, each of you must

• Method 3. Using the regular method for farm income complete a separate Schedule SE. However, if one

and the optional method for nonfarm income. spouse uses the Short Schedule SE and the other spouse

has to use the Long Schedule SE, both can use the same

• Method 4. Using the optional method for both farm form. Attach both schedules to the joint return.

and nonfarm income.

Note. Actual net earnings is the same as net earnings fig- More than one business. If you have more than one

ured using the regular method. trade or business, you must combine the net profit (or

loss) from each business to figure your SE tax. A loss from

Table 10-3. Example—Net Earnings one business will reduce your profit from another busi-

ness. File one Schedule SE showing the earnings from

self-employment, but file a separate Schedule C or F for

Net each business.

Earnings 1 2 3 4

Example. You are the sole proprietor of two separate

Actual businesses. You operate a restaurant that made a net

farm $ 900 $ 900 profit of $25,000. You also have a cabinetmaking busi-

ness that had a net loss of $500. You must file a Sched-

Optional ule C for the restaurant showing your net profit of $25,000

farm $ 2,000 $ 2,000 and another Schedule C for the cabinetmaking business

Actual showing your net loss of $500. You file one Schedule SE

showing total earnings subject to SE tax of $24,500.

nonfarm $ 500 $ 500

Optional

nonfarm $4,000 $4,000

Amount 11.

you can

report: $1,400 $2,500 $4,900 $5,440*

Your Rights

*Limited to $5,440 because you used both optional methods.

as a Taxpayer

Fiscal Year Filer

The first part of this chapter explains some of your most

If you use a tax year other than the calendar year, you important rights as a taxpayer. The second part explains

must use the tax rate and maximum earnings limit in effect the examination, appeal, collection, and refund pro-

at the beginning of your tax year. Even if the tax rate or cesses.

maximum earnings limit changes during your tax year,

continue to use the same rate and limit throughout your

tax year.

Page 44 Chapter 11 Your Rights as a Taxpayer