Page 40 - Tax withholding and Estimated Taxes

P. 40

Page 38 of 47

Fileid: … tions/P505/2020/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

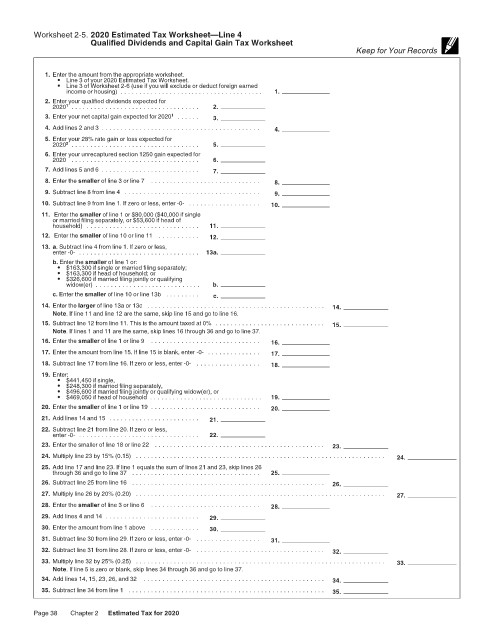

Worksheet 2-5. 2020 Estimated Tax Worksheet—Line 4 12:15 - 17-Jun-2020

Qualified Dividends and Capital Gain Tax Worksheet

Keep for Your Records

1. Enter the amount from the appropriate worksheet.

• Line 3 of your 2020 Estimated Tax Worksheet.

• Line 3 of Worksheet 2-6 (use if you will exclude or deduct foreign earned

income or housing) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Enter your qualified dividends expected for

2020 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

1

3. Enter your net capital gain expected for 2020 1 . . . . . . 3.

4. Add lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

5. Enter your 28% rate gain or loss expected for

2020 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

2

6. Enter your unrecaptured section 1250 gain expected for

2020 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

7. Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

8. Enter the smaller of line 3 or line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

9. Subtract line 8 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

10. Subtract line 9 from line 1. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . 10.

11. Enter the smaller of line 1 or $80,000 ($40,000 if single

or married filing separately, or $53,600 if head of

household) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

12. Enter the smaller of line 10 or line 11 . . . . . . . . . . . 12.

13. a. Subtract line 4 from line 1. If zero or less,

enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13a.

b. Enter the smaller of line 1 or:

• $163,300 if single or married filing separately;

• $163,300 if head of household; or

• $326,600 if married filing jointly or qualifying

widow(er) . . . . . . . . . . . . . . . . . . . . . . . . . . . . b.

c. Enter the smaller of line 10 or line 13b . . . . . . . . . c.

14. Enter the larger of line 13a or 13c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

Note. If line 11 and line 12 are the same, skip line 15 and go to line 16.

15. Subtract line 12 from line 11. This is the amount taxed at 0% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

Note. If lines 1 and 11 are the same, skip lines 16 through 36 and go to line 37.

16. Enter the smaller of line 1 or line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

17. Enter the amount from line 15. If line 15 is blank, enter -0- . . . . . . . . . . . . . . 17.

18. Subtract line 17 from line 16. If zero or less, enter -0- . . . . . . . . . . . . . . . . . 18.

19. Enter:

• $441,450 if single,

• $248,300 if married filing separately,

• $496,600 if married filing jointly or qualifying widow(er), or

• $469,050 if head of household . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19.

20. Enter the smaller of line 1 or line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20.

21. Add lines 14 and 15 . . . . . . . . . . . . . . . . . . . . . . . . 21.

22. Subtract line 21 from line 20. If zero or less,

enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22.

23. Enter the smaller of line 18 or line 22 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23.

24. Multiply line 23 by 15% (0.15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24.

25. Add line 17 and line 23. If line 1 equals the sum of lines 21 and 23, skip lines 26

through 36 and go to line 37 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25.

26. Subtract line 25 from line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26.

27. Multiply line 26 by 20% (0.20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27.

28. Enter the smaller of line 3 or line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28.

29. Add lines 4 and 14 . . . . . . . . . . . . . . . . . . . . . . . . . 29.

30. Enter the amount from line 1 above . . . . . . . . . . . . . 30.

31. Subtract line 30 from line 29. If zero or less, enter -0- . . . . . . . . . . . . . . . . . 31.

32. Subtract line 31 from line 28. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32.

33. Multiply line 32 by 25% (0.25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33.

Note. If line 5 is zero or blank, skip lines 34 through 36 and go to line 37.

34. Add lines 14, 15, 23, 26, and 32 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34.

35. Subtract line 34 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35.

Page 38 Chapter 2 Estimated Tax for 2020