Page 48 - IRS Individual Tax Forms

P. 48

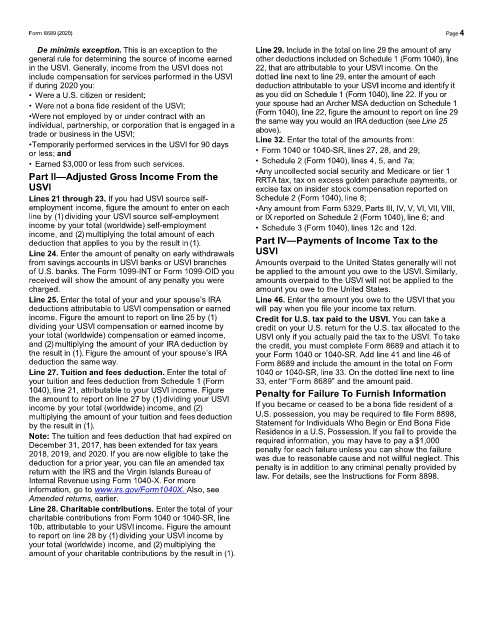

Form 8689 (2020) Page4

De minimis exception. This is an exception to the Line 29. Include in the total on line 29 the amount of any

general rule for determining the source of income earned other deductions included on Schedule 1 (Form 1040), line

in the USVI. Generally, income from the USVI does not 22, that are attributable to your USVI income. On the

include compensation for services performed in the USVI dotted line next to line 29, enter the amount of each

if during 2020 you: deduction attributable to your USVI income and identify it

• Were a U.S. citizen or resident; as you did on Schedule 1 (Form 1040), line 22. If you or

• Were not a bona fide resident of the USVI; your spouse had an Archer MSA deduction on Schedule 1

•Were not employed by or under contract with an (Form 1040), line 22, figure the amount to report on line 29

individual, partnership, or corporation that is engaged in a the same way you would an IRA deduction (see Line 25

trade or business in the USVI; above).

•Temporarily performed services in the USVI for 90 days Line 32. Enter the total of the amounts from:

or less; and • Form 1040 or 1040-SR, lines 27, 28, and 29;

• Earned $3,000 or less from such services. • Schedule 2 (Form 1040), lines 4, 5, and 7a;

Part II—Adjusted Gross Income From the •Any uncollected social security and Medicare or tier 1

RRTA tax, tax on excess golden parachute payments, or

USVI excise tax on insider stock compensation reported on

Lines 21 through 23. If you had USVI source self- Schedule 2 (Form 1040), line 8;

employment income, figure the amount to enter on each •Any amount from Form 5329, Parts III, IV, V, VI, VII, VIII,

line by (1) dividing your USVI source self-employment or IX reported on Schedule 2 (Form 1040), line 6; and

income by your total (worldwide) self-employment • Schedule 3 (Form 1040), lines 12c and 12d.

income, and (2) multiplying the total amount of each

deduction that applies to you by the result in (1). Part IV—Payments of Income Tax to the

Line 24. Enter the amount of penalty on early withdrawals USVI

from savings accounts in USVI banks or USVI branches Amounts overpaid to the United States generally will not

of U.S. banks. The Form 1099-INT or Form 1099-OID you be applied to the amount you owe to the USVI. Similarly,

received will show the amount of any penalty you were amounts overpaid to the USVI will not be applied to the

charged. amount you owe to the United States.

Line 25. Enter the total of your and your spouse’s IRA Line 46. Enter the amount you owe to the USVI that you

deductions attributable to USVI compensation or earned will pay when you file your income tax return.

income. Figure the amount to report on line 25 by (1) Credit for U.S. tax paid to the USVI. You can take a

dividing your USVI compensation or earned income by credit on your U.S. return for the U.S. tax allocated to the

your total (worldwide) compensation or earned income, USVI only if you actually paid the tax to the USVI. To take

and (2) multiplying the amount of your IRA deduction by the credit, you must complete Form 8689 and attach it to

the result in (1). Figure the amount of your spouse’s IRA your Form 1040 or 1040-SR. Add line 41 and line 46 of

deduction the same way. Form 8689 and include the amount in the total on Form

Line 27. Tuition and fees deduction. Enter the total of 1040 or 1040-SR, line 33. On the dotted line next to line

your tuition and fees deduction from Schedule 1 (Form 33, enter “Form 8689” and the amount paid.

1040), line 21, attributable to your USVI income. Figure Penalty for Failure To Furnish Information

the amount to report on line 27 by (1) dividing your USVI

income by your total (worldwide) income, and (2) If you became or ceased to be a bona fide resident of a

multiplying the amount of your tuition and fees deduction U.S. possession, you may be required to file Form 8898,

by the result in (1). Statement for Individuals Who Begin or End Bona Fide

Note: The tuition and fees deduction that had expired on Residence in a U.S. Possession. If you fail to provide the

December 31, 2017, has been extended for tax years required information, you may have to pay a $1,000

2018, 2019, and 2020. If you are now eligible to take the penalty for each failure unless you can show the failure

deduction for a prior year, you can file an amended tax was due to reasonable cause and not willful neglect. This

return with the IRS and the Virgin Islands Bureau of penalty is in addition to any criminal penalty provided by

Internal Revenue using Form 1040-X. For more law. For details, see the Instructions for Form 8898.

information, go to www.irs.gov/Form1040X. Also, see

Amended returns, earlier.

Line 28. Charitable contributions. Enter the total of your

charitable contributions from Form 1040 or 1040-SR, line

10b, attributable to your USVI income. Figure the amount

to report on line 28 by (1) dividing your USVI income by

your total (worldwide) income, and (2) multiplying the

amount of your charitable contributions by the result in (1).