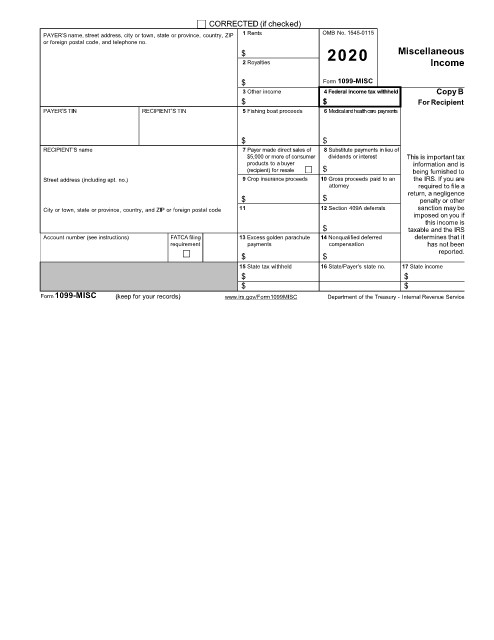

Page 31 - IRS Employer Tax Forms

P. 31

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, country, ZIP 1 Rents OMB No. 1545-0115

or foreign postal code, and telephone no.

$ 2020 Miscellaneous

2 Royalties Income

$ Form 1099-MISC

3 Other income 4 Federal income tax withheld Copy B

$ $ For Recipient

PAYER’S TIN RECIPIENT’S TIN 5 Fishing boat proceeds 6 Medical and health care payments

$ $

RECIPIENT’S name 7 Payer made direct sales of 8 Substitute payments in lieu of

$5,000 or more of consumer dividends or interest This is important tax

products to a buyer information and is

(recipient) for resale $ being furnished to

Street address (including apt. no.) 9 Crop insurance proceeds 10 Gross proceeds paid to an the IRS. If you are

attorney required to file a

$ $ return, a negligence

penalty or other

City or town, state or province, country, and ZIP or foreign postal code 11 12 Section 409A deferrals sanction may be

imposed on you if

this income is

$ taxable and the IRS

Account number (see instructions) FATCA filing 13 Excess golden parachute 14 Nonqualified deferred determines that it

requirement payments compensation has not been

reported.

$ $

15 State tax withheld 16 State/Payer’s state no. 17 State income

$ $

$ $

Form 1099-MISC (keep for your records) www.irs.gov/Form1099MISC Department of the Treasury - Internal Revenue Service