Page 7 - IRS Employer Tax Forms

P. 7

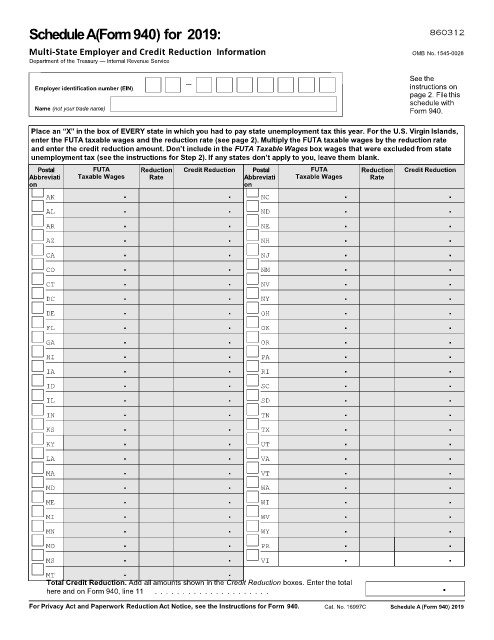

Schedule A (Form 940) for 2019: 860312

Multi-State Employer and Credit Reduction Information OMB No. 1545-0028

Department of the Treasury — Internal Revenue Service

See the

— instructions on

Employer identification number (EIN)

page 2. File this

schedule with

Name (not your trade name) Form 940.

Place an “X” in the box of EVERY state in which you had to pay state unemployment tax this year. For the U.S. Virgin Islands,

enter the FUTA taxable wages and the reduction rate (see page 2). Multiply the FUTA taxable wages by the reduction rate

and enter the credit reduction amount. Don’t include in the FUTA Taxable Wages box wages that were excluded from state

unemployment tax (see the instructions for Step 2). If any states don’t apply to you, leave them blank.

Postal FUTA Reduction Credit Reduction Postal FUTA Reduction Credit Reduction

Abbreviati Taxable Wages Rate Abbreviati Taxable Wages Rate

on on

AK . . NC . .

. . . .

AL ND

. . . .

AR NE

. . . .

AZ NH

. . . .

CA NJ

. . . .

CO NM

. . . .

CT NV

. . . .

DC NY

. . . .

DE OH

. . . .

FL OK

. . . .

GA OR

. . . .

HI PA

. . . .

IA RI

. . . .

ID SC

. . . .

IL SD

. . . .

IN TN

. . . .

KS TX

. . . .

KY UT

. . . .

LA VA

. . . .

MA VT

. . . .

MD WA

. . . .

ME WI

. . . .

MI WV

. . . .

MN WY

. . . .

MO PR

. . . .

MS VI

. .

MT

Total Credit Reduction. Add all amounts shown in the Credit Reduction boxes. Enter the total .

here and on Form 940, line 11 . . . . . . . . . . . . . . . . . . . . .

For Privacy Act and Paperwork Reduction Act Notice, see the Instructions for Form 940. Cat. No. 16997C Schedule A (Form 940) 2019