Page 499 - Auditing Standards

P. 499

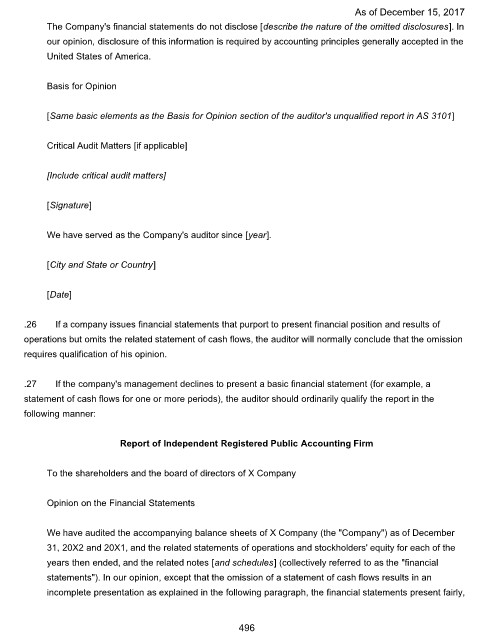

As of December 15, 2017

The Company's financial statements do not disclose [describe the nature of the omitted disclosures]. In

our opinion, disclosure of this information is required by accounting principles generally accepted in the

United States of America.

Basis for Opinion

[Same basic elements as the Basis for Opinion section of the auditor's unqualified report in AS 3101]

Critical Audit Matters [if applicable]

[Include critical audit matters]

[Signature]

We have served as the Company's auditor since [year].

[City and State or Country]

[Date]

.26 If a company issues financial statements that purport to present financial position and results of

operations but omits the related statement of cash flows, the auditor will normally conclude that the omission

requires qualification of his opinion.

.27 If the company's management declines to present a basic financial statement (for example, a

statement of cash flows for one or more periods), the auditor should ordinarily qualify the report in the

following manner:

Report of Independent Registered Public Accounting Firm

To the shareholders and the board of directors of X Company

Opinion on the Financial Statements

We have audited the accompanying balance sheets of X Company (the "Company") as of December

31, 20X2 and 20X1, and the related statements of operations and stockholders' equity for each of the

years then ended, and the related notes [and schedules] (collectively referred to as the "financial

statements"). In our opinion, except that the omission of a statement of cash flows results in an

incomplete presentation as explained in the following paragraph, the financial statements present fairly,

496