Page 64 - Inflation-Reduction-Act-Guidebook

P. 64

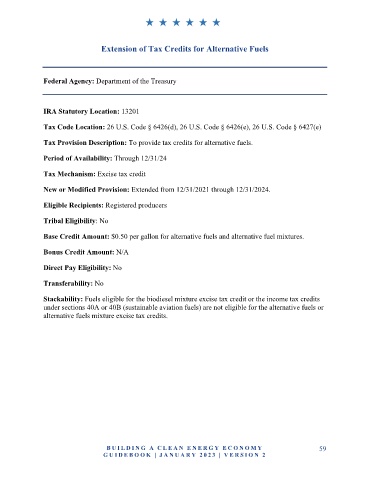

Extension of Tax Credits for Alternative Fuels

Federal Agency: Department of the Treasury

IRA Statutory Location: 13201

Tax Code Location: 26 U.S. Code § 6426(d), 26 U.S. Code § 6426(e), 26 U.S. Code § 6427(e)

Tax Provision Description: To provide tax credits for alternative fuels.

Period of Availability: Through 12/31/24

Tax Mechanism: Excise tax credit

New or Modified Provision: Extended from 12/31/2021 through 12/31/2024.

Eligible Recipients: Registered producers

Tribal Eligibility: No

Base Credit Amount: $0.50 per gallon for alternative fuels and alternative fuel mixtures.

Bonus Credit Amount: N/A

Direct Pay Eligibility: No

Transferability: No

Stackability: Fuels eligible for the biodiesel mixture excise tax credit or the income tax credits

under sections 40A or 40B (sustainable aviation fuels) are not eligible for the alternative fuels or

alternative fuels mixture excise tax credits.

B U IL D IN G A C L E A N E N E R G Y E C O N O MY 59

G U ID E B O O K | J AN UARY 20 2 3 | VE RS I O N 2