Page 78 - Supplement to 2022 Income Tax

P. 78

11:14 - 16-Dec-2021

Page 15 of 26 Fileid: … -tax-table/2021/a/xml/cycle02/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2021 Tax Computation Worksheet

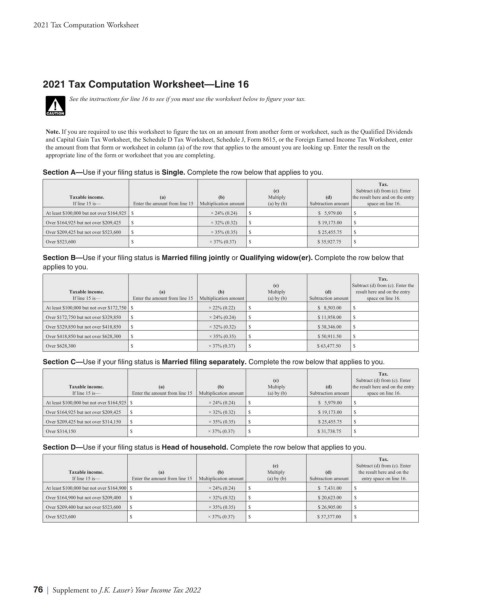

2021 Tax Computation Worksheet—Line 16

See the instructions for line 16 to see if you must use the worksheet below to figure your tax.

!

CAUTION

Note. If you are required to use this worksheet to figure the tax on an amount from another form or worksheet, such as the Qualified Dividends

and Capital Gain Tax Worksheet, the Schedule D Tax Worksheet, Schedule J, Form 8615, or the Foreign Earned Income Tax Worksheet, enter

the amount from that form or worksheet in column (a) of the row that applies to the amount you are looking up. Enter the result on the

appropriate line of the form or worksheet that you are completing.

Section A—Use if your filing status is Single. Complete the row below that applies to you.

Tax.

(c) Subtract (d) from (c). Enter

Taxable income. (a) (b) Multiply (d) the result here and on the entry

If line 15 is— Enter the amount from line 15 Multiplication amount (a) by (b) Subtraction amount space on line 16.

At least $100,000 but not over $164,925 $ × 24% (0.24) $ $ 5,979.00 $

Over $164,925 but not over $209,425 $ × 32% (0.32) $ $ 19,173.00 $

Over $209,425 but not over $523,600 $ × 35% (0.35) $ $ 25,455.75 $

Over $523,600 $ × 37% (0.37) $ $ 35,927.75 $

Section B—Use if your filing status is Married filing jointly or Qualifying widow(er). Complete the row below that

applies to you.

Tax.

(c) Subtract (d) from (c). Enter the

Taxable income. (a) (b) Multiply (d) result here and on the entry

If line 15 is— Enter the amount from line 15 Multiplication amount (a) by (b) Subtraction amount space on line 16.

At least $100,000 but not over $172,750 $ × 22% (0.22) $ $ 8,503.00 $

Over $172,750 but not over $329,850 $ × 24% (0.24) $ $ 11,958.00 $

Over $329,850 but not over $418,850 $ × 32% (0.32) $ $ 38,346.00 $

Over $418,850 but not over $628,300 $ × 35% (0.35) $ $ 50,911.50 $

Over $628,300 $ × 37% (0.37) $ $ 63,477.50 $

Section C—Use if your filing status is Married filing separately. Complete the row below that applies to you.

Tax.

(c) Subtract (d) from (c). Enter

Taxable income. (a) (b) Multiply (d) the result here and on the entry

If line 15 is— Enter the amount from line 15 Multiplication amount (a) by (b) Subtraction amount space on line 16.

At least $100,000 but not over $164,925 $ × 24% (0.24) $ $ 5,979.00 $

Over $164,925 but not over $209,425 $ × 32% (0.32) $ $ 19,173.00 $

Over $209,425 but not over $314,150 $ × 35% (0.35) $ $ 25,455.75 $

Over $314,150 $ × 37% (0.37) $ $ 31,738.75 $

Section D—Use if your filing status is Head of household. Complete the row below that applies to you.

Tax.

(c) Subtract (d) from (c). Enter

Taxable income. (a) (b) Multiply (d) the result here and on the

If line 15 is— Enter the amount from line 15 Multiplication amount (a) by (b) Subtraction amount entry space on line 16.

At least $100,000 but not over $164,900 $ × 24% (0.24) $ $ 7,431.00 $

Over $164,900 but not over $209,400 $ × 32% (0.32) $ $ 20,623.00 $

Over $209,400 but not over $523,600 $ × 35% (0.35) $ $ 26,905.00 $

Over $523,600 $ × 37% (0.37) $ $ 37,377.00 $

2021 Tax Computation Worksheet

76 | Supplement to J.K. Lasser’s Your Income Tax 2022