Page 341 - TaxAdviser_2022

P. 341

TAX CLINIC

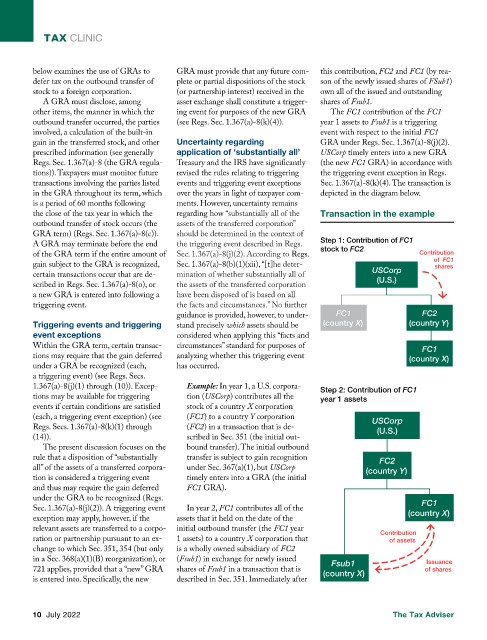

below examines the use of GRAs to GRA must provide that any future com- this contribution, FC2 and FC1 (by rea-

defer tax on the outbound transfer of plete or partial dispositions of the stock son of the newly issued shares of FSub1)

stock to a foreign corporation. (or partnership interest) received in the own all of the issued and outstanding

A GRA must disclose, among asset exchange shall constitute a trigger- shares of Fsub1.

other items, the manner in which the ing event for purposes of the new GRA The FC1 contribution of the FC1

outbound transfer occurred, the parties (see Regs. Sec. 1.367(a)-8(k)(4)). year 1 assets to Fsub1 is a triggering

involved, a calculation of the built-in event with respect to the initial FC1

gain in the transferred stock, and other Uncertainty regarding GRA under Regs. Sec. 1.367(a)-8(j)(2).

prescribed information (see generally application of ‘substantially all’ USCorp timely enters into a new GRA

Regs. Sec. 1.367(a)-8 (the GRA regula- Treasury and the IRS have significantly (the new FC1 GRA) in accordance with

tions)). Taxpayers must monitor future revised the rules relating to triggering the triggering event exception in Regs.

transactions involving the parties listed events and triggering event exceptions Sec. 1.367(a)-8(k)(4). The transaction is

in the GRA throughout its term, which over the years in light of taxpayer com- depicted in the diagram below.

is a period of 60 months following ments. However, uncertainty remains

the close of the tax year in which the regarding how “substantially all of the Transaction in the example

outbound transfer of stock occurs (the assets of the transferred corporation”

GRA term) (Regs. Sec. 1.367(a)-8(c)). should be determined in the context of

Step 1: Contribution of FC1

A GRA may terminate before the end the triggering event described in Regs.

stock to FC2

of the GRA term if the entire amount of Sec. 1.367(a)-8(j)(2). According to Regs. Contribution

of FC1

gain subject to the GRA is recognized, Sec. 1.367(a)-8(b)(1)(xii), “[t]he deter- shares

USCorp

certain transactions occur that are de- mination of whether substantially all of

(U.S.)

scribed in Regs. Sec. 1.367(a)-8(o), or the assets of the transferred corporation

a new GRA is entered into following a have been disposed of is based on all

triggering event. the facts and circumstances.” No further

FC1 FC2

guidance is provided, however, to under-

Triggering events and triggering stand precisely which assets should be (country X) (country Y)

event exceptions considered when applying this “facts and

Within the GRA term, certain transac- circumstances” standard for purposes of

FC1

tions may require that the gain deferred analyzing whether this triggering event (country X)

under a GRA be recognized (each, has occurred.

a triggering event) (see Regs. Secs.

1.367(a)-8(j)(1) through (10)). Excep- Example: In year 1, a U.S. corpora-

Step 2: Contribution of FC1

tions may be available for triggering tion (USCorp) contributes all the year 1 assets

events if certain conditions are satisfied stock of a country X corporation

(each, a triggering event exception) (see (FC1) to a country Y corporation

USCorp

Regs. Secs. 1.367(a)-8(k)(1) through (FC2) in a transaction that is de-

(U.S.)

(14)). scribed in Sec. 351 (the initial out-

The present discussion focuses on the bound transfer). The initial outbound

rule that a disposition of “substantially transfer is subject to gain recognition FC2

all” of the assets of a transferred corpora- under Sec. 367(a)(1), but USCorp (country Y)

tion is considered a triggering event timely enters into a GRA (the initial

and thus may require the gain deferred FC1 GRA).

under the GRA to be recognized (Regs. FC1

Sec. 1.367(a)-8(j)(2)). A triggering event In year 2, FC1 contributes all of the (country X)

exception may apply, however, if the assets that it held on the date of the

relevant assets are transferred to a corpo- initial outbound transfer (the FC1 year

Contribution

ration or partnership pursuant to an ex- 1 assets) to a country X corporation that of assets

change to which Sec. 351, 354 (but only is a wholly owned subsidiary of FC2

in a Sec. 368(a)(1)(B) reorganization), or (Fsub1) in exchange for newly issued Fsub1 Issuance

721 applies, provided that a “new” GRA shares of Fsub1 in a transaction that is (country X) of shares

is entered into. Specifically, the new described in Sec. 351. Immediately after

10 July 2022 The Tax Adviser