Page 462 - TaxAdviser_2022

P. 462

PROCEDURE & ADMINISTRATION

to file Form 8886. But given the large all named persons, including the busi-

There are penalties for failing to comply with ness owner, the insured, and the captive,

must meet the disclosure obligations for

Form 8886 filing requirements, taxpay-

indications from ers must carefully weigh the risks of not all years in which their respective tax

recent microcaptive reporting against the very burdensome returns reflect tax consequences or a tax

strategy.11 This results in an annual filing

disclosure requirements.

cases that the IRS Before highlighting the hefty requirement of multiple Forms 8886 for

may be reevaluating penalties that can be imposed for non- most microcaptives.

compliance, it is worth discussing the

The voluminous disclosure require-

its litigation efforts preparation time necessary to complete ments create a substantial time and

based on CIC Form 8886. reporting requirement for taxpayers. The

Services. Form 8886 disclosure table below, “Form 8886 Disclosures,”

outlines the basic Form 8886 disclosures

requirements and the disclosures specific to Sec.

to contest the issue in other jurisdic- For many material advisers, Forms 8886 831(b) microcaptive arrangements.

tions. Will the IRS try to relitigate the are filed for numerous — sometimes

case elsewhere, in other federal circuits? hundreds — of clients. The instructions Large penalties for

And what about taxpayers who are to Form 8886 suggest a total estimated noncompliance

subject to reporting obligations because preparation time of over 21 hours per Many taxpayers file Form 8886 because

of reportable transaction designations submission due to the lengthy requests they want to avoid the significant

made by different IRS notices that may for disclosure. penalties for noncompliance. Failure to

be similarly defective under the APA? For example, for Sec. 831(b) captive properly disclose reportable microcaptive

Taxpayers in these circumstances may transactions such as those at issue in transactions under Regs. Sec. 1.6011-4

wonder whether it is truly necessary CIC Services, Notice 2016-66 indicates can lead to a penalty under Sec. 6707A.

11. In relation to this, see Regs. Sec. 1.6011-4(c)(3)(i)(E).

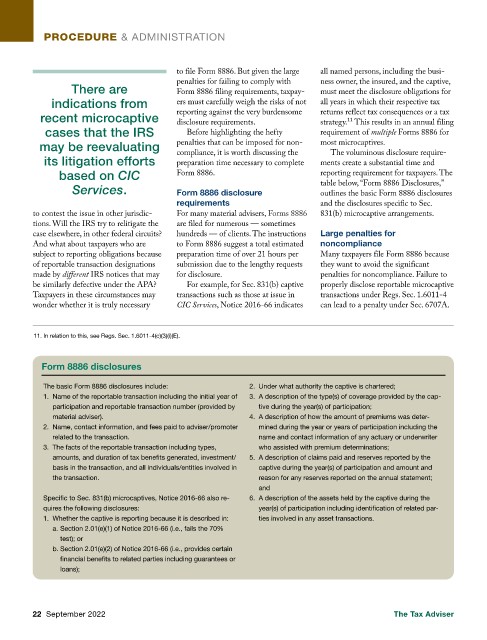

Form 8886 disclosures

The basic Form 8886 disclosures include: 2. Under what authority the captive is chartered;

1. Name of the reportable transaction including the initial year of 3. A description of the type(s) of coverage provided by the cap-

participation and reportable transaction number (provided by tive during the year(s) of participation;

material adviser). 4. A description of how the amount of premiums was deter-

2. Name, contact information, and fees paid to adviser/promoter mined during the year or years of participation including the

related to the transaction. name and contact information of any actuary or underwriter

3. The facts of the reportable transaction including types, who assisted with premium determinations;

amounts, and duration of tax benefits generated, investment/ 5. A description of claims paid and reserves reported by the

basis in the transaction, and all individuals/entities involved in captive during the year(s) of participation and amount and

the transaction. reason for any reserves reported on the annual statement;

and

Specific to Sec. 831(b) microcaptives, Notice 2016-66 also re- 6. A description of the assets held by the captive during the

quires the following disclosures: year(s) of participation including identification of related par-

1. Whether the captive is reporting because it is described in: ties involved in any asset transactions.

a. Section 2.01(e)(1) of Notice 2016-66 (i.e., fails the 70%

test); or

b. Section 2.01(e)(2) of Notice 2016-66 (i.e., provides certain

financial benefits to related parties including guarantees or

loans);

22 September 2022 The Tax Adviser