Page 289 - BusinessStructures & Forms

P. 289

12:52 - 26-Jan-2023

Page 10 of 65

Fileid: … ions/i1065/2022/a/xml/cycle08/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

When a partnership's federal return is amended or changed • Apply for an online payment agreement (IRS.gov/OPA) to meet

TIP for any reason, it may affect the partnership's state tax your tax obligation in monthly installments if you can’t pay your taxes

return. For more information, contact the state tax agency in full today. Once you complete the online process, you will receive

for the state in which the partnership return was filed. immediate notification of whether your agreement has been

approved.

• Use the Offer in Compromise Pre-Qualifier to see if you can settle

What if You Can’t Pay Now? your tax debt for less than the full amount you owe.

Go to IRS.gov/Payments for more information about your options.

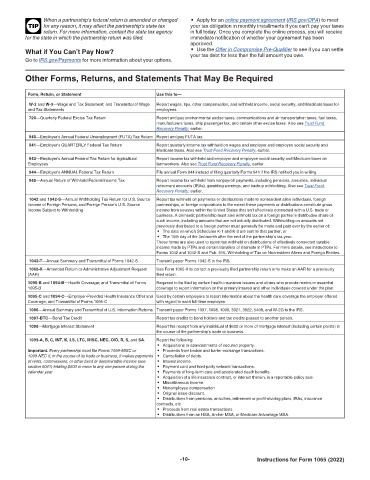

Other Forms, Returns, and Statements That May Be Required

Form, Return, or Statement Use this to—

W-2 and W-3—Wage and Tax Statement; and Transmittal of Wage Report wages, tips, other compensation, and withheld income, social security, and Medicare taxes for

and Tax Statements employees.

720—Quarterly Federal Excise Tax Return Report and pay environmental excise taxes, communications and air transportation taxes, fuel taxes,

manufacturers taxes, ship passenger tax, and certain other excise taxes. Also see Trust Fund

Recovery Penalty, earlier.

940—Employer's Annual Federal Unemployment (FUTA) Tax Return Report and pay FUTA tax.

941—Employer's QUARTERLY Federal Tax Return Report quarterly income tax withheld on wages and employer and employee social security and

Medicare taxes. Also see Trust Fund Recovery Penalty, earlier.

943—Employer's Annual Federal Tax Return for Agricultural Report income tax withheld and employer and employee social security and Medicare taxes on

Employees farmworkers. Also see Trust Fund Recovery Penalty, earlier.

944—Employer's ANNUAL Federal Tax Return File annual Form 944 instead of filing quarterly Forms 941 if the IRS notified you in writing.

945—Annual Return of Withheld Federal Income Tax Report income tax withheld from nonpayroll payments, including pensions, annuities, individual

retirement accounts (IRAs), gambling winnings, and backup withholding. Also see Trust Fund

Recovery Penalty, earlier.

1042 and 1042-S—Annual Withholding Tax Return for U.S. Source Report tax withheld on payments or distributions made to nonresident alien individuals, foreign

Income of Foreign Persons; and Foreign Person's U.S. Source partnerships, or foreign corporations to the extent these payments or distributions constitute gross

Income Subject to Withholding income from sources within the United States that isn't effectively connected with a U.S. trade or

business. A domestic partnership must also withhold tax on a foreign partner's distributive share of

such income, including amounts that are not actually distributed. Withholding on amounts not

previously distributed to a foreign partner must generally be made and paid over by the earlier of:

• The date on which Schedules K-1 and K-3 are sent to that partner, or

• The 15th day of the 3rd month after the end of the partnership's tax year.

These forms are also used to report tax withheld on distributions of effectively connected taxable

income made by PTPs and certain transfers of interests in PTPs. For more details, see instructions to

Forms 1042 and 1042-S and Pub. 515, Withholding of Tax on Nonresident Aliens and Foreign Entities.

1042-T—Annual Summary and Transmittal of Forms 1042-S Transmit paper Forms 1042-S to the IRS.

1065-X—Amended Return or Administrative Adjustment Request Use Form 1065-X to correct a previously filed partnership return or to make an AAR for a previously

(AAR) filed return.

1095-B and 1094-B—Health Coverage; and Transmittal of Forms Required to be filed by certain health insurance issuers and others who provide minimum essential

1095-B coverage to report information on the primary insured and other individuals covered under the plan.

1095-C and 1094-C—Employer-Provided Health Insurance Offer and Used by certain employers to report information about the health care coverage the employer offered

Coverage; and Transmittal of Forms 1095-C with regard to each full-time employee.

1096—Annual Summary and Transmittal of U.S. Information Returns Transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the IRS.

1097-BTC—Bond Tax Credit Report tax credits to bond holders and tax credits passed to another person.

1098—Mortgage Interest Statement Report the receipt from any individual of $600 or more of mortgage interest (including certain points) in

the course of the partnership's trade or business.

1099-A, B, C, INT, K, LS, LTC, MISC, NEC, OID, R, S, and SA. Report the following.

• Acquisitions or abandonments of secured property.

Important. Every partnership must file Forms 1099-MISC or • Proceeds from broker and barter exchange transactions.

1099-NEC if, in the course of its trade or business, it makes payments • Cancellation of debts.

of rents, commissions, or other fixed or determinable income (see • Interest income.

section 6041) totaling $600 or more to any one person during the • Payment card and third-party network transactions.

calendar year. • Payments of long-term care and accelerated death benefits.

• Acquisition of a life insurance contract, or interest therein, in a reportable policy sale.

• Miscellaneous income.

• Nonemployee compensation

• Original issue discount.

• Distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance

contracts, etc.

• Proceeds from real estate transactions.

• Distributions from an HSA, Archer MSA, or Medicare Advantage MSA.

-10- Instructions for Form 1065 (2022)