Page 299 - BusinessStructures & Forms

P. 299

Page 20 of 65

Fileid: … ions/i1065/2022/a/xml/cycle08/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

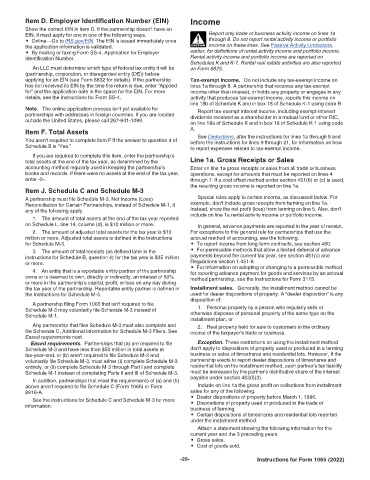

Item D. Employer Identification Number (EIN) Income 12:52 - 26-Jan-2023

Show the correct EIN in item D. If the partnership doesn't have an

EIN, it must apply for one in one of the following ways. Report only trade or business activity income on lines 1a

• Online—Go to IRS.gov/EIN. The EIN is issued immediately once ! through 8. Do not report rental activity income or portfolio

the application information is validated. CAUTION income on these lines. See Passive Activity Limitations,

• By mailing or faxing Form SS-4, Application for Employer earlier, for definitions of rental activity income and portfolio income.

Identification Number. Rental activity income and portfolio income are reported on

Schedules K and K-1. Rental real estate activities are also reported

An LLC must determine which type of federal tax entity it will be on Form 8825.

(partnership, corporation, or disregarded entity (DE)) before

applying for an EIN (see Form 8832 for details). If the partnership Tax-exempt income. Do not include any tax-exempt income on

has not received its EIN by the time the return is due, enter “Applied lines 1a through 8. A partnership that receives any tax-exempt

for” and the application date in the space for the EIN. For more income other than interest, or holds any property or engages in any

details, see the Instructions for Form SS-4. activity that produces tax-exempt income, reports this income on

line 18b of Schedule K and in box 18 of Schedule K-1 using code B.

Note. The online application process isn't yet available for Report tax-exempt interest income, including exempt-interest

partnerships with addresses in foreign countries. If you are located dividends received as a shareholder in a mutual fund or other RIC,

outside the United States, please call 267-941-1099. on line 18a of Schedule K and in box 18 of Schedule K-1 using code

Item F. Total Assets A.

See Deductions, after the instructions for lines 1a through 8 and

You aren't required to complete item F if the answer to question 4 of before the instructions for lines 9 through 21, for information on how

Schedule B is “Yes.” to report expenses related to tax-exempt income.

If you are required to complete this item, enter the partnership's

total assets at the end of the tax year, as determined by the Line 1a. Gross Receipts or Sales

accounting method regularly used in keeping the partnership's Enter on line 1a gross receipts or sales from all trade or business

books and records. If there were no assets at the end of the tax year, operations, except for amounts that must be reported on lines 4

enter -0-. through 7. If a cost offset method under section 451(b) or (c) is used,

Item J. Schedule C and Schedule M-3 the resulting gross income is reported on line 1a.

A partnership must file Schedule M-3, Net Income (Loss) Special rules apply to certain income, as discussed below. For

Reconciliation for Certain Partnerships, instead of Schedule M-1, if example, don't include gross receipts from farming on line 1a.

any of the following apply. Instead, show the net profit (loss) from farming on line 5. Also, don't

include on line 1a rental activity income or portfolio income.

1. The amount of total assets at the end of the tax year reported

on Schedule L, line 14, column (d), is $10 million or more. In general, advance payments are reported in the year of receipt.

2. The amount of adjusted total assets for the tax year is $10 For exceptions to this general rule for partnerships that use the

million or more. Adjusted total assets is defined in the Instructions accrual method of accounting, see the following.

for Schedule M-3. • To report income from long-term contracts, see section 460.

3. The amount of total receipts (as defined later in the • For permissible methods that allow a limited deferral of advance

instructions for Schedule B, question 4) for the tax year is $35 million payments beyond the current tax year, see section 451(c) and

or more. Regulations section 1.451-8.

• For information on adopting or changing to a permissible method

4. An entity that is a reportable entity partner of the partnership for reporting advance payment for goods and services by an accrual

owns or is deemed to own, directly or indirectly, an interest of 50% method partnership, see the Instructions for Form 3115.

or more in the partnership's capital, profit, or loss on any day during

the tax year of the partnership. Reportable entity partner is defined in Installment sales. Generally, the installment method cannot be

the Instructions for Schedule M-3. used for dealer dispositions of property. A “dealer disposition” is any

disposition of:

A partnership filing Form 1065 that isn't required to file

Schedule M-3 may voluntarily file Schedule M-3 instead of 1. Personal property by a person who regularly sells or

Schedule M-1. otherwise disposes of personal property of the same type on the

installment plan, or

Any partnership that files Schedule M-3 must also complete and 2. Real property held for sale to customers in the ordinary

file Schedule C, Additional Information for Schedule M-3 Filers. See course of the taxpayer's trade or business.

Eased requirements next.

Eased requirements. Partnerships that (a) are required to file Exception. These restrictions on using the installment method

Schedule M-3 and have less than $50 million in total assets at don't apply to dispositions of property used or produced in a farming

tax-year-end, or (b) aren't required to file Schedule M-3 and business or sales of timeshares and residential lots. However, if the

voluntarily file Schedule M-3, must either (i) complete Schedule M-3 partnership elects to report dealer dispositions of timeshares and

entirely, or (ii) complete Schedule M-3 through Part I and complete residential lots on the installment method, each partner's tax liability

Schedule M-1 instead of completing Parts II and III of Schedule M-3. must be increased by the partner's distributive share of the interest

In addition, partnerships that meet the requirements of (a) and (b) payable under section 453(l)(3).

above aren't required to file Schedule C (Form 1065) or Form Include on line 1a the gross profit on collections from installment

8916-A. sales for any of the following.

See the instructions for Schedule C and Schedule M-3 for more • Dealer dispositions of property before March 1, 1986.

• Dispositions of property used or produced in the trade or

information. business of farming.

• Certain dispositions of timeshares and residential lots reported

under the installment method.

Attach a statement showing the following information for the

current year and the 3 preceding years.

• Gross sales.

• Cost of goods sold.

-20- Instructions for Form 1065 (2022)