Page 102 - Large Business IRS Training Guides

P. 102

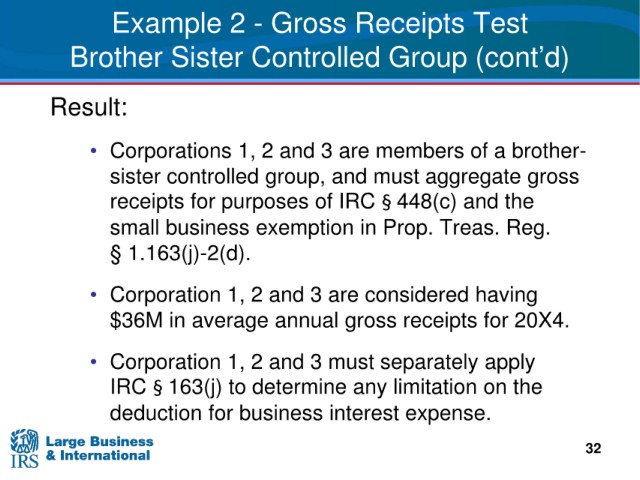

Example 2 - Gross Receipts Test

Brother Sister Controlled Group (cont’d)

Result:

• Corporations 1, 2 and 3 are members of a brother-

sister controlled group, and must aggregate gross

receipts for purposes of IRC § 448(c) and the

small business exemption in Prop. Treas. Reg.

§ 1.163(j)-2(d).

• Corporation 1, 2 and 3 are considered having

$36M in average annual gross receipts for 20X4.

• Corporation 1, 2 and 3 must separately apply

IRC § 163(j) to determine any limitation on the

deduction for business interest expense.

32